Financial Peace Revisited Book Summary

In "Financial Peace Revisited," renowned financial guru Dave Ramsey lays out a transformative blueprint for achieving financial independence and peace of mind. Through compelling personal anecdotes and straightforward principles, he demystifies budgeting and debt management, empowering readers to take control of their finances. Ramsey's seven-step plan not only promises to eliminate debt but also encourages a mindset shift towards saving and giving. With a blend of practical advice and motivational insights, he confronts common financial fears and inspires readers to envision a life free from money stress. Dive into this engaging guide and discover the keys to unlocking your financial freedom!

By Dave Ramsey

Published: 2002

"“Debt is dumb. Cash is king.”"

Book Review of Financial Peace Revisited

With the help of a #1 New York Times bestselling author and finance expert, set your finances right with these updated tactics and practices Dave Ramsey knows what it's like to have it all. By age twenty-six, he had established a four-million-dollar real estate portfolio, only to lose it by age thirty. He has since rebuilt his financial life and, through his workshops and his New York Times business bestsellers Financial Peace and More than Enough, he has helped hundreds of thousands of people to understand the forces behind their financial distress and how to set things right-financially, emotionally, and spiritually. In this new edition of Financial Peace, Ramsey has updated his tactics and philosophy to show even more readers: • how to get out of debt and stay out • the KISS rule of investing—"Keep It Simple, Stupid" • how to use the principle of contentment to guide financial decision making • how the flow of money can revolutionize relationships With practical and easy to follow methods and personal anecdotes, Financial Peace is the road map to personal control, financial security, a new, vital family dynamic, and lifetime peace.

Book Overview of Financial Peace Revisited

About the Book Author

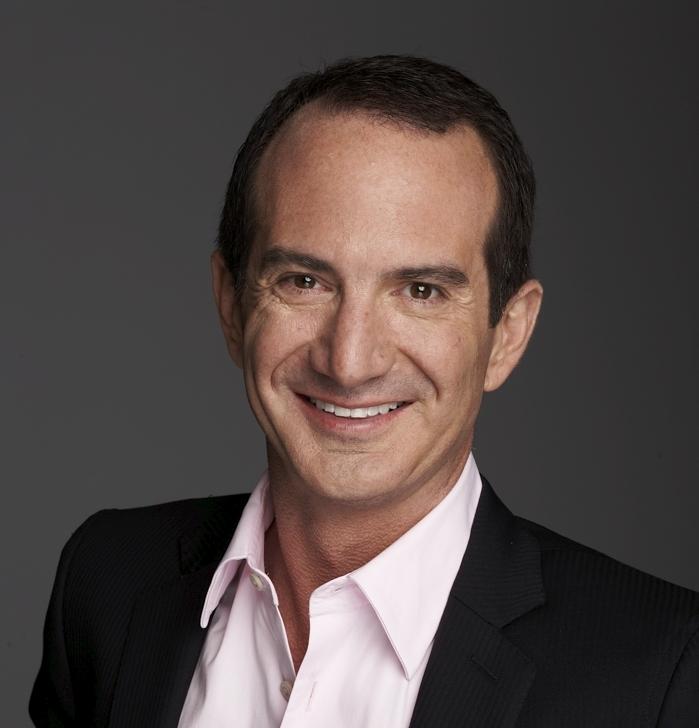

Dave Ramsey

Dave Ramsey is a well-known financial expert, author, and radio personality, famous for his straightforward approach to personal finance. He is best recognized for his bestselling books, including "The Total Money Makeover," which emphasizes debt elimination and financial independence. Through his popular radio show, "The Dave Ramsey Show," he offers advice to listeners on budgeting, saving, and investing. Ramsey also founded Financial Peace University, a program designed to help individuals and families take control of their financial futures. With millions of followers, his teachings promote a debt-free lifestyle and the importance of financial literacy.

Book Details

Key information about the book.

- Authors

- Dave Ramsey

- Published

- December 2002

- Publisher

- Penguin

- ISBN

- 0670032085

- Language

- English

- Pages

- 364

- Genres

- FinanceSelf-HelpFinancial IndependenceBudgetingDebt ManagementPersonal Finance

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

The Millionaire Next Door Book Summary

In "The Millionaire Next Door," Thomas J. Stanley and William D. Danko reveal surprising truths about the habits and lifestyles of America's wealthy. Rather than flashy spending, these millionaires embody frugality, discipline, and the pursuit of financial independence. Uncover the principles that distinguish the affluent from those who merely appear wealthy, and learn how everyday choices shape true wealth. Through eye-opening statistics and relatable anecdotes, this book dismantles common misconceptions about wealth. Are you ready to discover the secrets of those living quietly among us who have amassed true fortunes?

MONEY Master the Game Book Summary

In "Money: Master the Game," Tony Robbins unlocks the secrets to financial freedom through insights from legendary investors and his own transformative experiences. He presents a comprehensive blueprint that demystifies the world of finance, empowering readers to take control of their financial destinies. Packed with actionable strategies, Robbins reveals the psychological barriers that hold us back from wealth and how to overcome them. The book challenges conventional wisdom, urging readers to think differently about money and investing. Get ready to embark on an enlightening journey that could reshape your financial future forever!

The Money Book for the Young, Fabulous & Broke Book Summary

The Money Book for the Young, Fabulous & Broke is your ultimate financial guide, tailored for those navigating the complexities of modern money management. With vibrant insights and relatable anecdotes, author Suze Orman empowers readers to take control of their finances while embracing their youthful exuberance. Discover essential tools for budgeting, saving, and investing, all designed to transform your financial future from daunting to dazzling. Orman’s candid advice challenges you to rethink your relationship with wealth and offers a blueprint for living fabulously, even on a budget. Are you ready to unlock the secrets to financial freedom and become fabulously secure?

Women & Money (Revised and Updated) Book Summary

In "Women & Money," Suze Orman empowers women to take control of their financial destinies with insightful advice and practical strategies. Through personal anecdotes and expert tips, she dismantles the societal myths that often hinder women's financial confidence. Orman explores the emotional connections to money, urging readers to embrace their worth and create a secure future. With a blend of tough love and encouragement, she offers a roadmap to financial independence that resonates deeply. Discover how understanding your relationship with money can transform not just your finances, but your entire life.

The Latte Factor Book Summary

In "The Latte Factor," personal finance expert David Bach unveils a transformative story that intertwines the journey of a young woman discovering the power of financial freedom. Through the lens of a seemingly simple daily ritual—her coffee habit—she learns profound lessons about saving and investing. With relatable characters and an engaging narrative, Bach challenges readers to rethink their spending habits and recognize the true cost of indulgences. Could a small shift in perspective lead to monumental changes in your financial future? Dive into this inspiring tale and unlock the secrets to achieving your dreams, one latte at a time!

Save More Tomorrow Book Summary

In "Save More Tomorrow," behavioral finance pioneer Richard H. Thaler unveils a revolutionary approach to personal savings that empowers individuals to take control of their financial futures. By integrating the principles of human psychology with smart financial strategies, Thaler proposes a system where employees can commit to saving a portion of their future raises, making saving effortless and automatic. This innovative method not only combats the common barriers to saving but also transforms lifestyles and retirement outcomes. Through captivating anecdotes and research, Thaler illustrates how small behavioral tweaks can lead to monumental financial gains. Dive into this compelling narrative and discover how you can effortlessly boost your savings and secure a more prosperous future!

Automatic Wealth Book Summary

In "The Automatic Wealth," author Michael Masterson unveils the secrets to achieving financial independence through smart, strategic investments and income generation. With actionable advice and a no-nonsense approach, he demystifies the path to wealth, emphasizing the importance of mindset and disciplined financial habits. Masterson challenges readers to rethink their approach to money, transforming it from a source of stress into a tool for freedom. Packed with real-life examples and practical steps, this book equips you with the knowledge to build and sustain wealth effortlessly. Are you ready to unlock the doors to your financial future?

The Total Money Makeover Workbook Book Summary

In "The Total Money Makeover," financial guru Dave Ramsey unveils a transformative plan to overhaul your personal finances, empowering readers to break free from debt and build lasting wealth. Through practical steps and relatable success stories, he demystifies budgeting and saving, revealing the secrets to financial independence. Ramsey introduces his straightforward "Baby Steps" approach, guiding readers from caution to confidence on their journey to financial freedom. Packed with actionable advice and motivational insights, this book challenges conventional wisdom and inspires a total mindset shift. Are you ready to embark on a journey that could reshape your financial future?

Showing 8 of 30 similar books

Similar Book Recommendations →

Drew Houston's Book Recommendations

Drew Houston is an accomplished American entrepreneur best known for co-founding Dropbox, a widely-used cloud storage service, in 2007. As the CEO, he has led the company to serve millions of users worldwide and become a key player in the tech industry. Although not primarily known for literature, Houston has shared his entrepreneurial insights and experiences through various interviews and public speaking engagements, offering valuable lessons to aspiring business leaders. His work has significantly influenced the way people and organizations manage and share digital content. Houston's innovative vision continues to shape the future of cloud computing and digital collaboration.

David Bach's Book Recommendations

David Bach is a financial expert and bestselling author known for his Finish Rich book series, including The Automatic Millionaire. He has made a career out of teaching people how to build wealth through small, manageable financial habits like “paying yourself first” and automating savings. His approach to personal finance is accessible and focuses on helping everyday individuals achieve long-term financial security. David has appeared on numerous media platforms, advocating for financial literacy and encouraging people to take control of their financial futures.

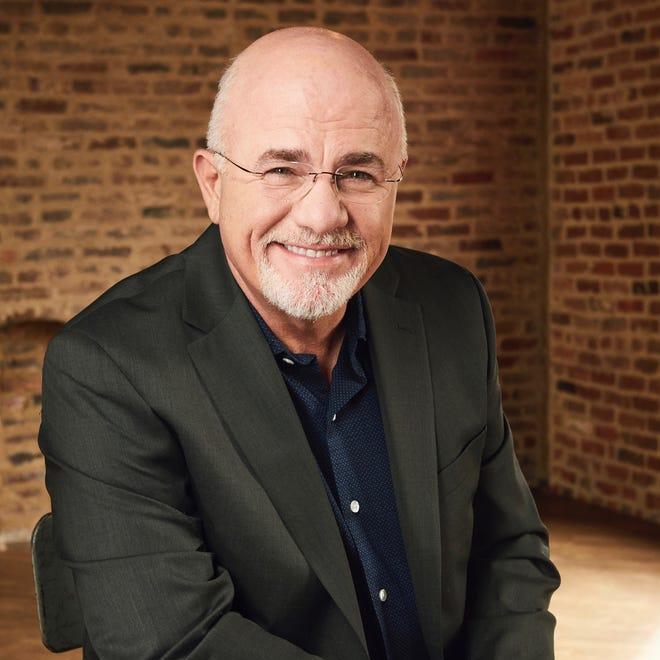

Ramsey Dave's Book Recommendations

Dave Ramsey is a personal finance expert, radio host, and bestselling author known for his book The Total Money Makeover. He advocates for debt-free living and offers practical advice on budgeting, saving, and investing. Ramsey’s popular radio show, The Dave Ramsey Show, has reached millions of listeners, where he provides real-world financial advice and helps individuals achieve financial peace. His Baby Steps method for eliminating debt and building wealth has become a cornerstone of his teachings. Ramsey’s work has made him one of the most well-known financial educators in the U.S.

Tony Robbins's Book Recommendations

Tony Robbins is a life coach, motivational speaker, and bestselling author known for his self-help books, including Awaken the Giant Within and Unlimited Power. He has worked with athletes, business leaders, and world figures to help them maximize their potential. Robbins is known for his dynamic seminars and workshops, where he teaches people strategies for achieving personal and professional success. His focus on emotional mastery, peak performance, and financial independence has made him a global leader in the self-improvement industry. Robbins has built a multi-million dollar business empire around his personal development programs.

Chip Conley's Book Recommendations

Chip Conley is a renowned American hotelier, author, and strategic advisor celebrated for his innovative approach to hospitality and leadership. He founded Joie de Vivre Hospitality, which became the second-largest boutique hotel company in the United States, and later served as the Head of Global Hospitality and Strategy at Airbnb. Conley has authored several influential books, including "Peak: How Great Companies Get Their Mojo from Maslow" and "Wisdom@Work: The Making of a Modern Elder," which explore themes of leadership, emotional intelligence, and the intergenerational workplace. His writings have inspired many to rethink business practices and the role of wisdom in professional environments. Conley's contributions extend beyond literature, as he is a sought-after speaker and thought leader in the realms of hospitality and personal development.

Eric Jorgenson's Book Recommendations

Eric Jorgenson is an author, investor, and product strategist best known for his book The Almanack of Naval Ravikant, which distills the wisdom of the entrepreneur and angel investor Naval Ravikant. Jorgenson's work focuses on personal development, wealth creation, and life philosophy. His ability to synthesize complex ideas into actionable insights has made his writing widely popular among entrepreneurs and tech enthusiasts. Beyond writing, Jorgenson has worked in product strategy at Zaarly, a marketplace for home services, and is involved in early-stage startup investing. He frequently speaks on the intersection of business, technology, and philosophy, and his blog covers topics ranging from mental models to entrepreneurship. Jorgenson's approach emphasizes learning from others' experiences and applying timeless principles to modern challenges. He continues to inspire a generation of readers with his clear, thoughtful reflections on how to live a more successful and fulfilling life.

Suze Orman's Book Recommendations

Suze Orman is a financial expert, television host, and author known for her straight-talking advice on personal finance. Her books, including The 9 Steps to Financial Freedom and Women & Money, have helped millions of people take control of their finances. Orman is a fierce advocate for financial empowerment, especially for women, and has appeared on numerous talk shows and news programs to share her advice. She emphasizes saving, investing, and avoiding debt to achieve long-term financial security. Suze continues to be a leading voice in personal finance education.

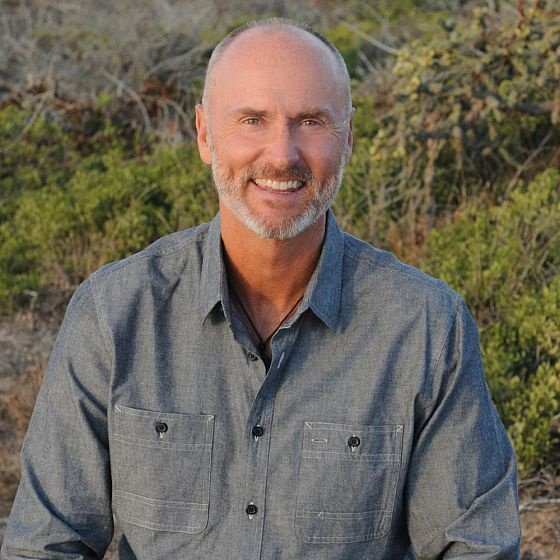

Brendon Burchard's Book Recommendations

Brendon Burchard is a high-performance coach, motivational speaker, and bestselling author, best known for his books High Performance Habits and The Motivation Manifesto. He helps individuals and organizations achieve peak performance through strategies focused on clarity, energy, and productivity. Brendon’s work emphasizes the importance of personal growth and developing habits that lead to sustained success. He has coached Fortune 500 CEOs, Olympians, and other high-achieving individuals. Brendon is also the founder of the High Performance Academy, where he trains people to lead more impactful and successful lives.

Showing 8 of 24 related collections

““Debt is dumb. Cash is king.””

Financial Peace Revisited

By Dave Ramsey

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy