Memoirs or Chronicle of The Fourth Crusade and The Conquest of Constantinople Book Summary

In 'Memoirs or Chronicle of The Fourth Crusade and The Conquest of Constantinople', Geoffrey de Villehardouin offers a gripping firsthand account of one of the most pivotal events in medieval history. Journey through the ambitions of the Crusaders as they venture beyond their holy mission into the heart of the Byzantine Empire. Witness the intrigue, battles, and betrayals that led to the dramatic fall of Constantinople. Villehardouin's vivid storytelling immerses readers in the chaos and fervor of the time. Uncover the complex motives behind the Crusade that changed the course of history and shaped the future of Europe.

By Geoffrey de Villehardouin

Published: 2018

"In the midst of chaos and conquest, the true essence of courage is not found in the sword's edge, but in the heart's resolve to forge a new destiny."

Book Review of Memoirs or Chronicle of The Fourth Crusade and The Conquest of Constantinople

Reproduction of the original.

Book Overview of Memoirs or Chronicle of The Fourth Crusade and The Conquest of Constantinople

About the Book Author

Geoffrey de Villehardouin

Geoffrey de Villehardouin was a 12th-century French nobleman and historian, best known for his work 'The Conquest of Constantinople' (c. 1207). A key figure in the Fourth Crusade, Villehardouin's writing is characterized by a clear, straightforward style, blending personal narrative with historical account. His firsthand experiences and observations provide invaluable insight into the events of the Crusade and the political complexities of the time. Today, he is regarded as one of the earliest practitioners of historical writing in France, with his works continuing to be studied for their contributions to medieval history.

Book Details

Key information about the book.

- Authors

- Geoffrey de Villehardouin

- Published

- January 2018

- Publisher

- BoD – Books on Demand

- ISBN

- 3732624552

- Language

- English

- Pages

- 126

- Genres

- Ancient HistoryHistoryHistory of TechnologyCultural HistoryMilitary History

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

Blitzscaling Book Summary

In 'Blitzscaling', Reid Hoffman and Chris Yeh dive into the high-octane world of rapid business growth, where traditional rules of scaling are thrown out the window. They introduce the concept of 'blitzscaling'—a strategy for rapidly growing a company to capture a market before competitors can catch up. The authors share insights from industry titans like Airbnb and LinkedIn, revealing the challenges and dynamics of pursuing hypergrowth. Packed with practical advice and real-world examples, this book unravels the complexities of navigating the entrepreneur's journey in an ever-evolving tech landscape. Are you ready to discover how to scale quickly and triumph in the startup arena?

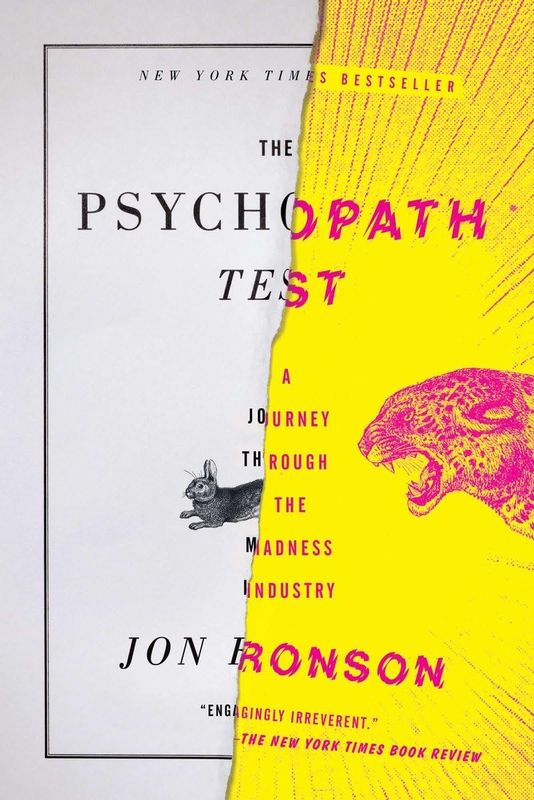

The Psychopath Test Book Summary

In 'The Psychopath Test,' Jon Ronson embarks on a mind-bending journey to decipher the complexities of the human mind and the psychopath diagnosis. He interviews individuals on both sides of the mental health spectrum, from charming con artists to distinguished psychologists. As he delves deeper, Ronson uncovers shocking truths about the thin line between sanity and madness. The book challenges readers to question who really qualifies as a 'psychopath' and whether we might all possess a hint of that darkness. With wit and insight, Ronson unveils a compelling exploration of morality, power, and the society's obsession with labeling minds.

The Success Equation Book Summary

In 'The Success Equation', Michael J. Mauboussin explores the intricate interplay between skill and luck in achieving success. He dismantles the myth of pure meritocracy, illustrating how randomness can shape outcomes in unexpected ways. Through engaging anecdotes and thought-provoking analysis, Mauboussin reveals insights on decision-making that challenge conventional wisdom. Readers will discover how to identify and cultivate true talent while understanding the limits of their control. This book invites you to rethink what it means to succeed—are you ready to redefine your own path?

The Shack Book Summary

In 'The Shack', William P. Young invites readers into a profound journey of faith, healing, and transformation. After suffering a devastating loss, Mackenzie Allen Phillips encounters a mysterious invitation to a remote shack, where he meets personifications of God that challenge his understanding of love and mercy. The narrative beautifully intertwines deep theological questions with a gripping story of grief and redemption. As Mack uncovers the truth of his pain, readers are compelled to reflect on their own beliefs and relationships with the divine. Will Mack find the answers he seeks, or will he emerge with even more questions about faith, hope, and the nature of God?

Green Hills of Africa Book Summary

In 'Green Hills of Africa,' Ernest Hemingway takes readers on a captivating adventure through the untamed landscapes of East Africa. This memoir intertwines vivid descriptions of the African plains with reflections on life, death, and the pursuit of authenticity. As Hemingway embarks on a hunting expedition, he grapples with his own literary ambitions and existential questions. The narrative is rich with insights on nature, culture, and the primal instincts that drive humanity. This journey not only showcases the beauty of the African wilderness but also reveals the complexities of the human spirit.

The Book of Jewish Food Book Summary

'The Book of Jewish Food' by Claudia Roden is a culinary journey that explores the rich tapestry of Jewish heritage through its diverse and captivating cuisine. With over 800 recipes, Roden unveils traditional dishes passed down through generations, reflecting the unique cultural influences from around the world. Each recipe is accompanied by personal anecdotes, revealing the significance of food in Jewish identity and celebration. This book is not just a collection of recipes; it is a heartfelt homage to the stories and history that shape Jewish life. Dive into the flavors and traditions that define Jewish culture and discover the secrets behind the dishes that bring families together.

Cooked Book Summary

In 'Cooked', Michael Pollan embarks on a captivating journey into the art of cooking, exploring the transformational power of food. He unpacks the four elemental cooking techniques: fire, water, air, and earth, revealing how they connect us to the world and ourselves. Each chapter immerses readers in the sensory delights and cultural significance of cooking, from barbecuing to baking. Pollan's exploration is not just about recipes, but about understanding food's role in our lives and health. Join him as he challenges you to reconsider what you eat and how it shapes your experience of the world.

The Memory of War and Children in Exile Book Summary

No summary available

Showing 8 of 13 similar books

Similar Book Recommendations →

Paul Graham's Book Recommendations

Paul Graham is a prominent programmer, venture capitalist, and essayist known for his influential work in the tech startup ecosystem. He co-founded Viaweb, one of the first web-based applications, which was later acquired by Yahoo! and became Yahoo! Store. As a co-founder of Y Combinator, Graham has been instrumental in funding and mentoring numerous successful startups, including Dropbox, Airbnb, and Reddit. His essays, collected in books such as "Hackers & Painters," offer profound insights into technology, entrepreneurship, and philosophy, making significant contributions to modern literature on these subjects. Graham's blend of technical expertise and thought leadership has made him a pivotal figure in both the tech and literary communities.

Barack Obama's Book Recommendations

Barack Obama is the 44th President of the United States, serving from 2009 to 2017. As the first African American president, Obama’s leadership marked a historic moment in American history. His administration focused on healthcare reform, economic recovery from the Great Recession, and environmental policies. He is best known for the Affordable Care Act, as well as his efforts to expand civil rights and restore diplomatic relations with Cuba. Since leaving office, Obama has continued to engage in public life through his foundation, focusing on leadership development, civic engagement, and global issues.

Elon Musk's Book Recommendations

Elon Musk is an influential entrepreneur and innovator known for founding and leading several groundbreaking companies, including Tesla, SpaceX, Neuralink, and The Boring Company. He has played a pivotal role in advancing electric vehicles, space exploration, and renewable energy. Musk's vision extends to colonizing Mars and reducing the risk of human extinction through space travel. In addition to his technological contributions, he has co-authored the book "Spacex: Making Commercial Spaceflight a Reality," providing insights into his ambitious projects and vision for the future. Musk's relentless pursuit of innovation continues to shape the trajectory of multiple industries.

Bill Gates's Book Recommendations

Bill Gates, co-founder of Microsoft Corporation, is a pioneering figure in the tech industry, having played a key role in the personal computer revolution. His work at Microsoft, particularly the development of Windows, transformed software and computing globally. Beyond his technology contributions, Gates is also a prolific author, with notable works such as "The Road Ahead" and "Business @ the Speed of Thought," which offer insights into the future of technology and business. Additionally, his philanthropic efforts through the Bill & Melinda Gates Foundation have had a profound impact on global health, education, and poverty. Gates continues to influence both technology and literature with his forward-thinking perspectives and innovative ideas.

Ta-Nehisi Coates's Book Recommendations

Ta-Nehisi Coates is an acclaimed American author and journalist known for his profound explorations of African American culture and history. His seminal work, "Between the World and Me," won the National Book Award for Nonfiction in 2015 and has been lauded for its poignant examination of race in America. Coates has also made significant contributions to comic books, notably writing for Marvel's "Black Panther" and "Captain America" series. He has been a national correspondent for The Atlantic, where his essays garnered widespread attention and accolades. Coates continues to influence contemporary thought on race, history, and politics through his powerful and evocative writing.

Noam Chomsky's Book Recommendations

Noam Chomsky, born December 7, 1928, is an influential American linguist, philosopher, cognitive scientist, historian, and social critic. He revolutionized the field of linguistics with his theory of generative grammar, particularly through his seminal work, "Syntactic Structures" (1957). Chomsky's contributions extend beyond linguistics to political activism, where he is known for his critiques of U.S. foreign policy and media, encapsulated in works like "Manufacturing Consent" (1988). As a professor emeritus at MIT, his interdisciplinary approach has significantly impacted cognitive science, philosophy of language, and political thought. Chomsky remains a prolific author and speaker, continuing to shape academic and public discourses.

Ryan Peterson's Book Recommendations

Ryan Peterson is an acclaimed author best known for his thought-provoking novels that delve into complex societal issues. His debut book, "Echoes of Silence," won the prestigious Man Booker Prize, establishing him as a formidable voice in contemporary fiction. Peterson's writing is celebrated for its lyrical prose and deep emotional resonance, drawing comparisons to literary giants like Toni Morrison and Gabriel García Márquez. Beyond fiction, he has contributed insightful essays to major publications, addressing topics such as social justice and mental health. With a growing body of work, Peterson continues to influence and inspire readers worldwide.

Austen Allred's Book Recommendations

Austen Allred is an influential entrepreneur and author, best known for his contributions to the education technology sector. He co-founded Lambda School, a groundbreaking online coding bootcamp that offers deferred tuition and has revolutionized access to tech education. In addition to his entrepreneurial ventures, Allred is the author of "The Grassfed Startup," which provides insights into building sustainable businesses. His innovative approach to education has earned him recognition as a thought leader in the tech industry. Allred continues to inspire with his commitment to making high-quality education accessible to all.

Showing 8 of 12 related collections

“In the midst of chaos and conquest, the true essence of courage is not found in the sword's edge, but in the heart's resolve to forge a new destiny.”

Memoirs or Chronicle of The Fourth Crusade and The Conquest of Constantinople

By Geoffrey de Villehardouin

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy