Portfolios of the Poor Book Summary

"Portfolios of the Poor" unveils the hidden financial lives of the impoverished, diving into their complex strategies for managing money in a world filled with instability and uncertainty. The authors, through in-depth interviews and case studies, reveal how the poor navigate financial challenges, using unique savings and credit methods that defy conventional wisdom. This eye-opening exploration challenges stereotypes and presents a surprising picture of resilience and resourcefulness. With poignant insights and compelling narratives, it invites readers to rethink the nature of poverty and the economic systems that surround it. Discover how the choices made by those at the bottom of the economic ladder can shed light on broader financial issues facing society today.

By Daryl Collins, Jonathan Morduch, Stuart Rutherford, Orlanda Ruthven

Published: 2009

""The financial lives of the poor are not a mystery; they are a complex tapestry woven from dreams, struggles, and resilient choices.""

Book Review of Portfolios of the Poor

In this work, the authors report on the yearlong 'financial diaries' of villagers and slum dwellers in Bangladesh, India, and South Africa. The stories of these families are often surprising and inspiring.

Book Overview of Portfolios of the Poor

About the Book Authors

Daryl Collins

Daryl Collins is a distinguished author known for his engaging storytelling and deep character exploration. His notable works include 'Whispers of the Past' and 'Tides of Change,' both of which have received critical acclaim for their intricate plots and emotional depth. Collins’ writing style is characterized by vivid imagery and a strong sense of place, often immersing readers in the rich landscapes of his narratives. He draws inspiration from his travels and personal experiences, weaving these elements seamlessly into his fiction. Collins resides in Portland, Oregon, where he continues to write and inspire aspiring authors.

Jonathan Morduch

Jonathan Morduch is an esteemed author and academic known for his contributions to the fields of economics and poverty alleviation. A professor at New York University's Wagner Graduate School of Public Service, he has conducted extensive research on microfinance, development economics, and the financial behaviors of low-income households. Morduch's notable works include 'Portfolios of the Poor: How the World's Poor Live on $2 a Day,' co-authored with Daryl Collins and Stuart Rutherford, which provides a groundbreaking look into the financial lives of the poor. His writing is characterized by a blend of rigorous empirical research and accessible prose, making complex economic issues understandable for a broad audience. Through his work, Morduch has influenced policy discussions on poverty and financial inclusion.

Stuart Rutherford

Stuart Rutherford is an acclaimed author known for his engaging storytelling and insightful exploration of human emotions. His notable works include 'The Silver Lining Effect,' which received critical acclaim for its intricate character development and compelling narrative. Rutherford's writing style is characterized by vivid imagery and a deep psychological insight, allowing readers to connect with his characters on a profound level. He has also contributed to various literary journals and has spoken at numerous literary events, further establishing his reputation as a significant voice in contemporary literature.

Orlanda Ruthven

Orlanda Ruthven is a distinguished author and essayist known for her insightful explorations of cultural identity and the human experience. Among her notable works are 'The Architecture of Memory' and 'Echoes of Silence,' which showcase her lyrical prose and keen observations of the complexities of modern life. Ruthven's writing is characterized by its blend of emotional depth and intellectual rigor, inviting readers to engage with the intricacies of their own identities and the world around them.

Book Details

Key information about the book.

- Authors

- Daryl Collins, Jonathan Morduch, Stuart Rutherford, Orlanda Ruthven

- Published

- January 2009

- Publisher

- Princeton University Press

- ISBN

- 0691148198

- Language

- English

- Pages

- 297

- Genres

- FinanceEconomic PolicyFinancial Literacy for KidsDebt Management

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

The Shadow and Bone Trilogy Book Summary

In the enchanting world of the Shadow and Bone Trilogy, Alina Starkov discovers her hidden powers while navigating a war-torn landscape overshadowed by a terrifying darkness known as the Fold. As she trains under the enigmatic Darkling, her loyalties are tested, revealing secrets that could alter the fate of her nation. With a fierce cast of characters—including loyal friends and formidable foes—Alina embarks on a perilous quest for self-discovery and redemption. Themes of love, betrayal, and the struggle between light and shadow intertwine to create a captivating narrative that keeps readers on the edge of their seats. Can Alina harness her powers to save her world, or will the darkness consume her?

Rich Dad Poor Dad - What the Rich Teach Their Kids About Money Book Summary

No summary available

The Richest Man In Babylon Book Summary

In "The Richest Man in Babylon," George S. Clason weaves captivating parables set in ancient Babylon, revealing timeless financial wisdom. Through the journey of its characters, readers uncover the secrets of wealth accumulation, including the power of saving, prudent investments, and living within one’s means. The narrative emphasizes that prosperity is attainable for anyone willing to learn and apply these fundamental principles. Each lesson is not only practical but also imbued with a sense of hope and empowerment. As you turn the pages, you’ll find yourself inspired to take control of your financial destiny and uncover the riches within your reach.

The Money Class Book Summary

In "The Money Class," Suze Orman redefines financial literacy in a world where traditional rules no longer apply. She reveals the secrets to navigating modern economic challenges, providing actionable advice on saving, investing, and building wealth. Orman emphasizes the importance of understanding your personal values and translating them into financial choices. With relatable stories and practical tips, she empowers readers to take control of their financial futures. Are you ready to transform your relationship with money and unlock the life you deserve?

Smart Money Smart Kids Book Summary

In "Smart Money Smart Kids," financial expert Dave Ramsey teams up with his daughter Rachel Cruze to tackle the crucial lessons of money management for a new generation. Through relatable anecdotes and practical strategies, they empower parents to teach their children about earning, saving, and investing wisely. The book challenges traditional views on money, emphasizing the importance of character and values in financial decision-making. With engaging activities and clear guidelines, readers are equipped to foster a healthy relationship with money early on. Dive in to discover how to raise financially savvy kids who are prepared for life’s economic challenges!

I Will Teach You to Be Rich, Second Edition Book Summary

In 'I Will Teach You to Be Rich, Second Edition,' Ramit Sethi provides a no-nonsense guide to mastering personal finance with a blend of humor and practicality. He challenges conventional money advice and introduces readers to a unique banking system for maximizing their savings. Through straightforward strategies, Sethi reveals how to automate finances and invest wisely for the long term. Each chapter brims with actionable tips that encourage readers to take control of their financial futures. With insights that delve deep into psychology and behavior, this book is a game-changer for anyone seeking to build real wealth.

The Simple Path to Wealth Book Summary

"In the dark, bewildering, trap-infested jungle of misinformation and opaque riddles that is the world of investment, JL Collins is the fatherly wizard on the side of the path, offering a simple map, warm words of encouragement and the tools to forge your way through with confidence. You'll never find a wiser advisor with a bigger heart." -- Malachi Rempen: Filmmaker, cartoonist, author and self-described ruffian This book grew out of a series of letters to my daughter concerning various things-mostly about money and investing-she was not yet quite ready to hear. Since money is the single most powerful tool we have for navigating this complex world we've created, understanding it is critical. "But Dad," she once said, "I know money is important. I just don't want to spend my life thinking about it." This was eye-opening. I love this stuff. But most people have better things to do with their precious time. Bridges to build, diseases to cure, treaties to negotiate, mountains to climb, technologies to create, children to teach, businesses to run. Unfortunately, benign neglect of things financial leaves you open to the charlatans of the financial world. The people who make investing endlessly complex, because if it can be made complex it becomes more profitable for them, more expensive for us, and we are forced into their waiting arms. Here's an important truth: Complex investments exist only to profit those who create and sell them. Not only are they more costly to the investor, they are less effective. The simple approach I created for her and present now to you, is not only easy to understand and implement, it is more powerful than any other. Together we'll explore: Debt: Why you must avoid it and what to do if you have it. The importance of having F-you Money. How to think about money, and the unique way understanding this is key to building your wealth. Where traditional investing advice goes wrong and what actually works. What the stock market really is and how it really works. Why the stock market always goes up and why most people still lose money investing in it. How to invest in a raging bull, or bear, market. Specific investments to implement these strategies. The Wealth Building and Wealth Preservation phases of your investing life and why they are not always tied to your age. How your asset allocation is tied to those phases and how to choose it. How to simplify the sometimes confusing world of 401(k), 403(b), TSP, IRA and Roth accounts. TRFs (Target Retirement Funds), HSAs (Health Savings Accounts) and RMDs (Required Minimum Distributions). What investment firm to use and why the one I recommend is so far superior to the competition. Why you should be very cautious when engaging an investment advisor and whether you need to at all. Why and how you can be conned, and how to avoid becoming prey. Why I don't recommend dollar cost averaging. What financial independence looks like and how to have your money support you. What the 4% rule is and how to use it to safely spend your wealth. The truth behind Social Security. A Case Study on how this all can be implemented in real life. Enjoy the read, and the journey!

Poor Charlie’s Almanack Book Summary

Poor Charlie’s Almanack is an enlightening compilation of wisdom from Charlie Munger, the renowned vice chairman of Berkshire Hathaway and lifelong partner of Warren Buffett. This thought-provoking collection delves into Munger's unique principles of investing, decision-making, and life philosophy, rich with wit and insight. Through anecdotes, illustrations, and a treasure trove of mental models, readers are inspired to think critically and embrace diverse perspectives. Munger’s emphasis on lifelong learning and rational thought challenges conventional thinking and encourages harnessing multidisciplinary knowledge for personal and professional success. Unlock the secrets of Munger’s remarkable intellect and discover how they can transform your approach to wealth and wisdom.

Showing 8 of 27 similar books

Similar Book Recommendations →

Marc Andreessen's Book Recommendations

Marc Andreessen is an American entrepreneur, software engineer, and venture capitalist, best known for co-creating the Mosaic web browser, the first widely-used web browser, and co-founding Netscape. Andreessen is also the co-founder of Andreessen Horowitz, one of Silicon Valley’s most prominent venture capital firms, where he invests in groundbreaking technology companies like Facebook, Airbnb, and Coinbase. He is a thought leader on the impact of technology and innovation, often sharing his views on the future of the internet and startups. His contributions to the development of the web and the tech ecosystem have made him one of the most influential figures in technology.

Alex Honnold's Book Recommendations

Alex Honnold is an American professional rock climber, best known for his free solo ascent of El Capitan in Yosemite National Park, a feat that was documented in the Oscar-winning film Free Solo. Honnold is renowned for his mental toughness, technical skill, and ability to climb without ropes or safety equipment. His accomplishments have made him a legend in the climbing world, and he continues to push the boundaries of the sport. Outside of climbing, Honnold is a philanthropist, founding the Honnold Foundation, which supports environmental sustainability projects, particularly in solar energy.

Anu Hariharan's Book Recommendations

Anu Hariharan is a distinguished partner at Y Combinator's Continuity Fund, where she has been instrumental in scaling numerous startups into successful enterprises. With a strong background in economics and technology, she has become a respected voice in the venture capital community. Hariharan has also made significant contributions through her writing on startup growth and investment strategies, offering insightful analyses and practical advice to entrepreneurs. Her work is frequently featured in leading business publications, showcasing her expertise in the tech industry. Beyond her professional accomplishments, Hariharan is committed to fostering diversity and inclusion within the startup ecosystem.

Morgan Housel's Book Recommendations

Morgan Housel is a financial writer and partner at The Collaborative Fund, best known for his book The Psychology of Money. His work explores the behavioral side of finance, emphasizing how emotions, history, and decision-making impact wealth-building. Housel’s writing is widely praised for being accessible, insightful, and engaging, making complex financial topics easier to understand. He contributes regularly to financial publications and speaks at conferences on the power of long-term thinking in finance. His book has become a modern classic in the personal finance genre.

Nassim Nicholas Taleb's Book Recommendations

Nassim Nicholas Taleb is a Lebanese-American author, scholar, and risk analyst, best known for his work on uncertainty, probability, and risk. His books, including The Black Swan and Antifragile, explore how rare and unpredictable events shape the world and how individuals and systems can become more resilient to shocks. Taleb’s insights on risk management have influenced fields ranging from finance to medicine, and he is known for his outspoken criticism of conventional wisdom. His ideas about randomness, decision-making, and the limitations of human knowledge have made him a leading thinker in modern economics and philosophy.

Blake Mycoskie's Book Recommendations

Blake Mycoskie is an American entrepreneur, author, and philanthropist best known for founding TOMS Shoes, a company that pioneered the "One for One" business model, donating a pair of shoes for every pair sold. His significant literary contribution includes the bestselling book "Start Something That Matters," which offers insights into social entrepreneurship and encourages readers to pursue meaningful ventures. Mycoskie's innovative approach to business has inspired a global movement toward corporate social responsibility. He has received numerous accolades for his work, including the Secretary of State's Award for Corporate Excellence. Mycoskie continues to influence the business world with his emphasis on purpose-driven enterprises.

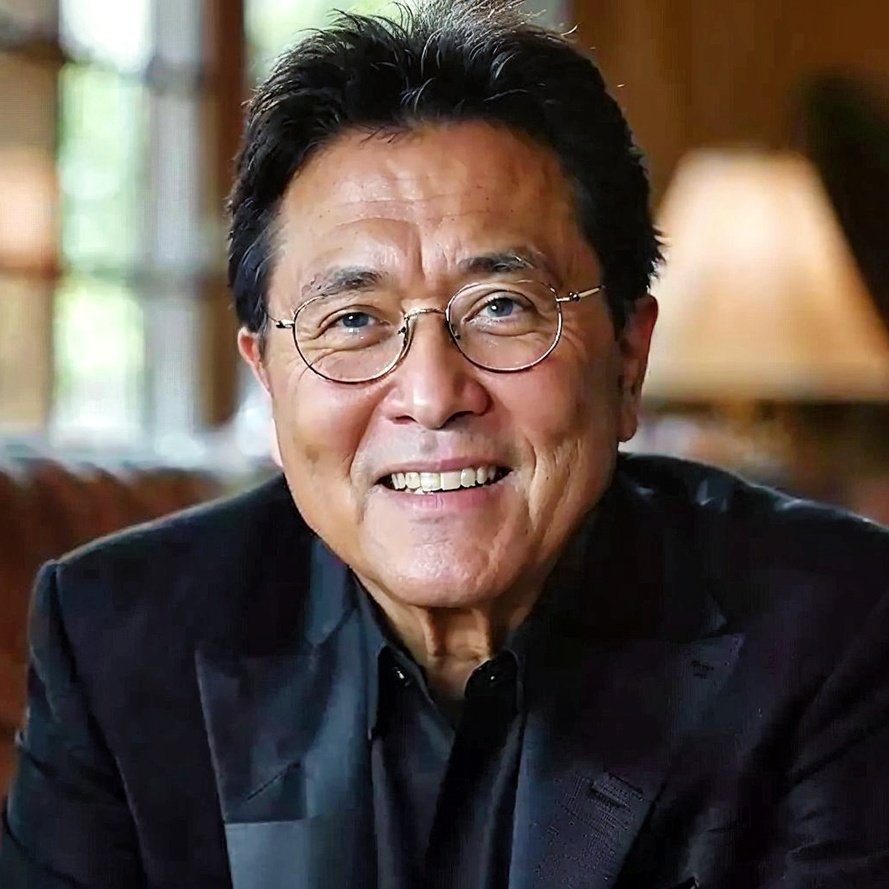

Robert Kiyosaki's Book Recommendations

Robert Kiyosaki is the author of the bestselling personal finance book Rich Dad Poor Dad, which challenges conventional wisdom on wealth building and financial literacy. He is a self-made entrepreneur and investor who emphasizes the importance of financial education and investing in assets that generate passive income. His Rich Dad brand has expanded to include books, seminars, and a board game that teaches financial principles. Kiyosaki advocates for self-reliance and encourages individuals to break free from the traditional “employee mindset.” He continues to teach people how to achieve financial independence.

Changpeng Zhao's Book Recommendations

Changpeng Zhao, commonly known as "CZ," is a prominent figure in the cryptocurrency world and the founder and CEO of Binance, the world's largest cryptocurrency exchange by trading volume. Although not a traditional literary figure, Zhao has significantly contributed to the understanding and proliferation of blockchain technology through numerous articles, interviews, and public speaking engagements. His insights and leadership have been instrumental in shaping modern digital finance. Zhao's journey from coding at Bloomberg to creating Binance has been documented in various publications, shedding light on the transformative potential of cryptocurrencies. Through his work, CZ continues to influence both the financial and technological landscapes globally.

Showing 8 of 15 related collections

“"The financial lives of the poor are not a mystery; they are a complex tapestry woven from dreams, struggles, and resilient choices."”

Portfolios of the Poor

By Daryl Collins, Jonathan Morduch, Stuart Rutherford, Orlanda Ruthven

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy