Rich Dad's Cashflow Quadrant Book Summary

In "Cashflow Quadrant," Robert Kiyosaki introduces a revolutionary framework for understanding how wealth is generated and sustained. He delineates four distinct categories—Employee, Self-Employed, Business Owner, and Investor—that illustrate the pathways individuals can take toward financial freedom. With insights drawn from his own journey, Kiyosaki challenges conventional beliefs about work and money, encouraging readers to shift their mindsets and explore new possibilities. This engaging guide empowers you to evaluate your current position and make strategic transitions to enhance your financial future. Are you ready to discover which quadrant you're in and unlock your potential for wealth?

By Robert T. Kiyosaki

Published: 2014

"Most people work for money. The rich have money work for them."

Book Review of Rich Dad's Cashflow Quadrant

This work will reveal why some people work less, earn more, pay less in taxes, and feel more financially secure than others.

Book Overview of Rich Dad's Cashflow Quadrant

About the Book Author

Robert T. Kiyosaki

Robert T. Kiyosaki is an American businessman, entrepreneur, and author best known for his influential personal finance book, "Rich Dad Poor Dad," which advocates for financial literacy and investment in assets. Born on April 8, 1947, in Hilo, Hawaii, Kiyosaki has leveraged his own experiences with wealth and financial struggles to teach others about achieving financial independence. He is the founder of the Rich Dad Company, which provides educational resources on finance and entrepreneurship. Kiyosaki is a sought-after speaker and has authored several books, expanding on concepts like cash flow, investing, and the importance of financial education. His straightforward approach has inspired millions to rethink their views on money and create paths toward wealth.

Book Details

Key information about the book.

- Authors

- Robert T. Kiyosaki

- Published

- January 2014

- Publisher

- N/A

- ISBN

- 0446589179

- Language

- English

- Pages

- N/A

- Genres

- FinanceFinancial IndependencePersonal Finance

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

The Millionaire Next Door Book Summary

In "The Millionaire Next Door," Thomas J. Stanley and William D. Danko reveal surprising truths about the habits and lifestyles of America's wealthy. Rather than flashy spending, these millionaires embody frugality, discipline, and the pursuit of financial independence. Uncover the principles that distinguish the affluent from those who merely appear wealthy, and learn how everyday choices shape true wealth. Through eye-opening statistics and relatable anecdotes, this book dismantles common misconceptions about wealth. Are you ready to discover the secrets of those living quietly among us who have amassed true fortunes?

MONEY Master the Game Book Summary

In "Money: Master the Game," Tony Robbins unlocks the secrets to financial freedom through insights from legendary investors and his own transformative experiences. He presents a comprehensive blueprint that demystifies the world of finance, empowering readers to take control of their financial destinies. Packed with actionable strategies, Robbins reveals the psychological barriers that hold us back from wealth and how to overcome them. The book challenges conventional wisdom, urging readers to think differently about money and investing. Get ready to embark on an enlightening journey that could reshape your financial future forever!

The Money Book for the Young, Fabulous & Broke Book Summary

The Money Book for the Young, Fabulous & Broke is your ultimate financial guide, tailored for those navigating the complexities of modern money management. With vibrant insights and relatable anecdotes, author Suze Orman empowers readers to take control of their finances while embracing their youthful exuberance. Discover essential tools for budgeting, saving, and investing, all designed to transform your financial future from daunting to dazzling. Orman’s candid advice challenges you to rethink your relationship with wealth and offers a blueprint for living fabulously, even on a budget. Are you ready to unlock the secrets to financial freedom and become fabulously secure?

The Automatic Millionaire Book Summary

In "The Automatic Millionaire," David Bach unveils a powerful, no-nonsense financial strategy that promises to transform your wealth outlook without overwhelming effort. By advocating for automation in savings and investments, Bach highlights how small, consistent actions can lead to life-changing results. The book's engaging anecdotes and practical tips encourage readers to rethink their relationship with money. With an emphasis on establishing robust financial habits, it beckons you to discover the secrets of wealth-building while you sleep. Are you ready to unlock the door to financial freedom effortlessly?

Start Late, Finish Rich Book Summary

In "Start Late, Finish Rich," financial expert David Bach unveils a transformative roadmap for those who feel it's too late to secure their financial future. Through captivating anecdotes and practical strategies, he encourages readers to seize the power of financial awareness and smart investing, regardless of age. Bach’s message is clear: it’s never too late to turn dreams into reality and build lasting wealth. With his unique blend of motivation and actionable advice, he empowers you to rethink your financial journey. Are you ready to embark on a path that could redefine your retirement?

Automatic Wealth Book Summary

In "The Automatic Wealth," author Michael Masterson unveils the secrets to achieving financial independence through smart, strategic investments and income generation. With actionable advice and a no-nonsense approach, he demystifies the path to wealth, emphasizing the importance of mindset and disciplined financial habits. Masterson challenges readers to rethink their approach to money, transforming it from a source of stress into a tool for freedom. Packed with real-life examples and practical steps, this book equips you with the knowledge to build and sustain wealth effortlessly. Are you ready to unlock the doors to your financial future?

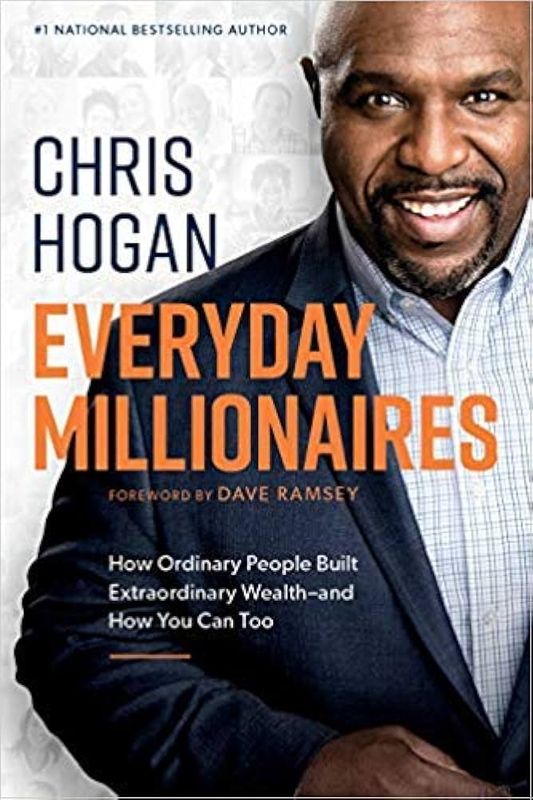

Everyday Millionaires Book Summary

In "Everyday Millionaires," authors Chris Hogan unravel the surprising truths behind the wealth of ordinary people who have achieved extraordinary financial success. Through compelling stories and real-life data, they challenge the myths of wealth, revealing that most millionaires live modestly and prioritize saving and investing over luxury. Hogan shares actionable insights on mindsets, financial habits, and the importance of perseverance, encouraging readers to rethink their own paths to wealth. The book empowers individuals to believe that anyone can attain financial independence with dedication and sensible strategies. Are you ready to unlock the secrets of everyday millionaires and transform your financial future?

Multiple Streams of Income Book Summary

In "Multiple Streams of Income," author Robert G. Allen unveils the secrets to financial freedom through diverse revenue sources. He challenges the conventional notion of a single paycheck, advocating for a multi-faceted approach to wealth generation. With engaging anecdotes and practical strategies, Allen guides readers on creating passive income streams—from real estate to online ventures. As he demystifies investment opportunities, he encourages a mindset shift towards entrepreneurial thinking. Dive in to discover how you can unlock financial security and live life on your terms!

Showing 8 of 23 similar books

Similar Book Recommendations →

Bill Ackman's Book Recommendations

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

Jan Losert's Book Recommendations

Jan Losert is a visionary author and digital design expert, renowned for his contributions to the intersection of technology and creativity. His most significant work includes co-authoring "Design Systems Handbook," which has become a seminal guide for creating cohesive and efficient design frameworks. Losert's expertise extends to his role as a speaker and educator, where he passionately shares his insights on user experience and interface design. In addition to his literary achievements, he co-founded several successful startups, leveraging his deep understanding of design to drive innovation. His work continues to influence and inspire both emerging and established designers worldwide.

Andrew Lokenauth's Book Recommendations

Andrew Lokenauth is a distinguished author and financial expert known for his insightful contributions to personal finance and investment literature. With a career spanning over a decade, he has written extensively on topics such as wealth management, financial planning, and market analysis. Lokenauth's works are celebrated for their clarity and practical advice, making complex financial concepts accessible to a broad audience. He has been featured in numerous financial publications and has established himself as a trusted voice in the industry. Beyond his writing, Lokenauth is also a sought-after speaker, sharing his expertise at various seminars and workshops.

Ana Fabrega's Book Recommendations

Ana Lorena Fabrega is an innovative educator and author passionate about reimagining education. Known as “Ms. Fab,” she is the Chief Evangelist at Synthesis, an education startup inspired by the problem-solving and collaboration model used at SpaceX. She advocates for alternative learning methods, encouraging curiosity and creativity in students. Ana's work emphasizes the importance of engaging young learners in real-world challenges and critical thinking. She also shares insights on education reform through her popular newsletter, Fab Fridays.

Morgan Housel's Book Recommendations

Morgan Housel is a financial writer and partner at The Collaborative Fund, best known for his book The Psychology of Money. His work explores the behavioral side of finance, emphasizing how emotions, history, and decision-making impact wealth-building. Housel’s writing is widely praised for being accessible, insightful, and engaging, making complex financial topics easier to understand. He contributes regularly to financial publications and speaks at conferences on the power of long-term thinking in finance. His book has become a modern classic in the personal finance genre.

Elizabeth Filips's Book Recommendations

Elizabeth Filips is a celebrated contemporary author known for her poignant and thought-provoking novels that explore the complexities of human emotions and relationships. Her debut novel, "The Silent Echo," garnered critical acclaim for its deep character development and lyrical prose, earning her a nomination for the prestigious Man Booker Prize. Filips' ability to weave intricate narratives has established her as a distinctive voice in modern literature. She is also an advocate for mental health awareness, often incorporating these themes into her writing to shed light on personal struggles and resilience. In addition to her novels, Filips has contributed essays and short stories to various literary magazines, further solidifying her reputation as a versatile and impactful writer.

Blake Mycoskie's Book Recommendations

Blake Mycoskie is an American entrepreneur, author, and philanthropist best known for founding TOMS Shoes, a company that pioneered the "One for One" business model, donating a pair of shoes for every pair sold. His significant literary contribution includes the bestselling book "Start Something That Matters," which offers insights into social entrepreneurship and encourages readers to pursue meaningful ventures. Mycoskie's innovative approach to business has inspired a global movement toward corporate social responsibility. He has received numerous accolades for his work, including the Secretary of State's Award for Corporate Excellence. Mycoskie continues to influence the business world with his emphasis on purpose-driven enterprises.

Robert Kiyosaki's Book Recommendations

Robert Kiyosaki is the author of the bestselling personal finance book Rich Dad Poor Dad, which challenges conventional wisdom on wealth building and financial literacy. He is a self-made entrepreneur and investor who emphasizes the importance of financial education and investing in assets that generate passive income. His Rich Dad brand has expanded to include books, seminars, and a board game that teaches financial principles. Kiyosaki advocates for self-reliance and encourages individuals to break free from the traditional “employee mindset.” He continues to teach people how to achieve financial independence.

Showing 8 of 22 related collections

“Most people work for money. The rich have money work for them.”

Rich Dad's Cashflow Quadrant

By Robert T. Kiyosaki

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy