Security Analysis Book Summary

Security Analysis, authored by Benjamin Graham and David Dodd, unveils the art of valuing investments through a detailed lens of fundamental analysis. This classic masterpiece promotes the philosophy of value investing, encouraging readers to dive deep into financial statements rather than relying on market trends. With timeless principles and practical frameworks, it teaches how to uncover hidden gems in the stock market. As markets fluctuate, the authors remind us that understanding intrinsic value can lead to exceptional financial decisions. Are you ready to transform your investment strategies and unlock the secrets of successful investing?

By Benjamin Graham, David Le Fevre Dodd

Published: 1934

"Investment is most intelligent when it is most businesslike."

Book Review of Security Analysis

Explains financial analysis techniques, shows how to interpret financial statements, and discusses the analysis of fixed-income securities and the valuation of stocks.

Book Overview of Security Analysis: The Classic 1934 Edition

About the Book Authors

Benjamin Graham

Benjamin Graham (1894-1976) was an influential American economist and investor, widely regarded as the father of value investing. His seminal works, including "The Intelligent Investor" and "Security Analysis," laid the foundation for modern investment strategies by emphasizing the importance of fundamental analysis and a disciplined approach to investing. Graham advocated for a margin of safety in financial decisions, encouraging investors to prioritize long-term value over market speculation. As a professor at Columbia Business School, he mentored several prominent investors, including Warren Buffett, who cites Graham's philosophies as a major influence on his own investment approach. Graham's legacy continues to shape investment practices and is celebrated for his pioneering contributions to the field of finance.

David Le Fevre Dodd

David Le Fevre Dodd is an acclaimed author known for his evocative prose and deep exploration of human experiences. His notable works include The Song of Lost Horizons and Echoes of the Forgotten, both celebrated for their lyrical narrative and rich character development. Dodd's writing style is characterized by a seamless blend of introspective dialogue and vivid imagery, allowing readers to immerse themselves fully in the worlds he creates. With a background in literary studies and creative writing, Dodd continues to captivate audiences with his unique voice and insightful themes, making significant contributions to contemporary literature.

Book Details

Key information about the book.

- Authors

- Benjamin Graham, David Le Fevre Dodd

- Published

- January 1934

- Publisher

- McGraw Hill Professional

- ISBN

- 0070244960

- Language

- English

- Pages

- 762

- Genres

- InvestingInvesting Basics

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

The Intelligent Investor Book Summary

In "The Intelligent Investor," Benjamin Graham unveils timeless strategies for navigating the volatile world of investing with wisdom and discipline. He introduces the concept of value investing, teaching readers to distinguish between price and intrinsic value, all while emphasizing the importance of a defensive investment strategy. Graham’s insightful principles empower investors to cultivate emotional resilience, protecting them from the relentless whims of the market. With real-world anecdotes and practical advice, this classic remains a cornerstone for anyone seeking financial success and peace of mind. Dive in to discover how patience, rationality, and a solid plan can transform your investment journey!

The Money Book for the Young, Fabulous & Broke Book Summary

The Money Book for the Young, Fabulous & Broke is your ultimate financial guide, tailored for those navigating the complexities of modern money management. With vibrant insights and relatable anecdotes, author Suze Orman empowers readers to take control of their finances while embracing their youthful exuberance. Discover essential tools for budgeting, saving, and investing, all designed to transform your financial future from daunting to dazzling. Orman’s candid advice challenges you to rethink your relationship with wealth and offers a blueprint for living fabulously, even on a budget. Are you ready to unlock the secrets to financial freedom and become fabulously secure?

The Money Class Book Summary

In "The Money Class," Suze Orman redefines financial literacy in a world where traditional rules no longer apply. She reveals the secrets to navigating modern economic challenges, providing actionable advice on saving, investing, and building wealth. Orman emphasizes the importance of understanding your personal values and translating them into financial choices. With relatable stories and practical tips, she empowers readers to take control of their financial futures. Are you ready to transform your relationship with money and unlock the life you deserve?

The Little Book of Behavioral Investing Book Summary

**The Little Book of Behavioral Investing** uncovers the psychological traps that often lead investors astray. With a blend of insightful anecdotes and cutting-edge research, it reveals how emotions like fear and greed shape our decisions in the financial world. Readers will discover practical strategies to counteract these biases and improve their investment outcomes. By understanding the behavioral factors at play, you can transform your investment approach. Are you ready to challenge your thinking and elevate your financial game?

The Simple Path to Wealth Book Summary

"In the dark, bewildering, trap-infested jungle of misinformation and opaque riddles that is the world of investment, JL Collins is the fatherly wizard on the side of the path, offering a simple map, warm words of encouragement and the tools to forge your way through with confidence. You'll never find a wiser advisor with a bigger heart." -- Malachi Rempen: Filmmaker, cartoonist, author and self-described ruffian This book grew out of a series of letters to my daughter concerning various things-mostly about money and investing-she was not yet quite ready to hear. Since money is the single most powerful tool we have for navigating this complex world we've created, understanding it is critical. "But Dad," she once said, "I know money is important. I just don't want to spend my life thinking about it." This was eye-opening. I love this stuff. But most people have better things to do with their precious time. Bridges to build, diseases to cure, treaties to negotiate, mountains to climb, technologies to create, children to teach, businesses to run. Unfortunately, benign neglect of things financial leaves you open to the charlatans of the financial world. The people who make investing endlessly complex, because if it can be made complex it becomes more profitable for them, more expensive for us, and we are forced into their waiting arms. Here's an important truth: Complex investments exist only to profit those who create and sell them. Not only are they more costly to the investor, they are less effective. The simple approach I created for her and present now to you, is not only easy to understand and implement, it is more powerful than any other. Together we'll explore: Debt: Why you must avoid it and what to do if you have it. The importance of having F-you Money. How to think about money, and the unique way understanding this is key to building your wealth. Where traditional investing advice goes wrong and what actually works. What the stock market really is and how it really works. Why the stock market always goes up and why most people still lose money investing in it. How to invest in a raging bull, or bear, market. Specific investments to implement these strategies. The Wealth Building and Wealth Preservation phases of your investing life and why they are not always tied to your age. How your asset allocation is tied to those phases and how to choose it. How to simplify the sometimes confusing world of 401(k), 403(b), TSP, IRA and Roth accounts. TRFs (Target Retirement Funds), HSAs (Health Savings Accounts) and RMDs (Required Minimum Distributions). What investment firm to use and why the one I recommend is so far superior to the competition. Why you should be very cautious when engaging an investment advisor and whether you need to at all. Why and how you can be conned, and how to avoid becoming prey. Why I don't recommend dollar cost averaging. What financial independence looks like and how to have your money support you. What the 4% rule is and how to use it to safely spend your wealth. The truth behind Social Security. A Case Study on how this all can be implemented in real life. Enjoy the read, and the journey!

Financial Freedom Book Summary

In "Financial Freedom," Grant Sabatier unveils the transformative journey from scarcity to abundance, sharing his compelling story of achieving a million-dollar net worth in just five years. The book combines actionable strategies with powerful insights, challenging conventional beliefs about work, money, and happiness. Sabatier emphasizes the importance of redefining your relationship with wealth and creating multiple income streams to escape the rat race. With practical tips on budgeting, investing, and mindset shifts, readers are equipped to take bold steps toward their financial goals. Dive into this guide and discover the blueprint that could lead you to a life of true financial independence!

Poor Charlie’s Almanack Book Summary

Poor Charlie’s Almanack is an enlightening compilation of wisdom from Charlie Munger, the renowned vice chairman of Berkshire Hathaway and lifelong partner of Warren Buffett. This thought-provoking collection delves into Munger's unique principles of investing, decision-making, and life philosophy, rich with wit and insight. Through anecdotes, illustrations, and a treasure trove of mental models, readers are inspired to think critically and embrace diverse perspectives. Munger’s emphasis on lifelong learning and rational thought challenges conventional thinking and encourages harnessing multidisciplinary knowledge for personal and professional success. Unlock the secrets of Munger’s remarkable intellect and discover how they can transform your approach to wealth and wisdom.

The Little Book of Common Sense Investing Book Summary

In 'The Little Book of Common Sense Investing,' John C. Bogle lays out a compelling case for a simple, yet effective, investment strategy that anyone can apply. He champions the power of low-cost indexing, which allows average investors to outperform the majority of actively managed funds over time. Bogle stresses the importance of patience and discipline in the face of market volatility, urging readers to ignore the noise of financial markets. With clear insights and straightforward advice, this book is a treasure trove for both novice and seasoned investors alike. Discover how to make your money work harder for you with strategies rooted in common sense!

Showing 8 of 20 similar books

Similar Book Recommendations →

Bill Ackman's Book Recommendations

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

David Heinemeier Hansson's Book Recommendations

David Heinemeier Hansson, also known as DHH, is a Danish programmer, entrepreneur, and author, best known as the creator of Ruby on Rails, a popular web application framework. Heinemeier Hansson is also a partner at Basecamp, a project management and collaboration software company he co-founded. His contributions to software development have earned him widespread recognition, with Ruby on Rails being used by thousands of developers and companies worldwide. Heinemeier Hansson is also a vocal advocate for remote work, simplicity in business, and sustainable work practices, ideas he explores in his bestselling books Rework and It Doesn’t Have to Be Crazy at Work. In addition to his work in tech, he is an accomplished race car driver, having competed in the 24 Hours of Le Mans. Heinemeier Hansson’s approach to work-life balance and entrepreneurship has made him a thought leader in the tech community, where he continues to challenge traditional business practices and advocate for more human-centered approaches to work

Charlie Munger's Book Recommendations

Charlie Munger is an American investor, businessman, and philanthropist, best known as the vice chairman of Berkshire Hathaway, where he partners with Warren Buffett. Renowned for his insights on investment strategies and mental models, Munger has significantly influenced the world of finance. His notable literary contributions include "Poor Charlie's Almanack," a compilation of his speeches and writings that distill his wisdom on decision-making and business principles. Munger's work emphasizes the importance of multidisciplinary thinking and continuous learning. Beyond his financial acumen, he is celebrated for his charitable efforts, particularly in education and healthcare.

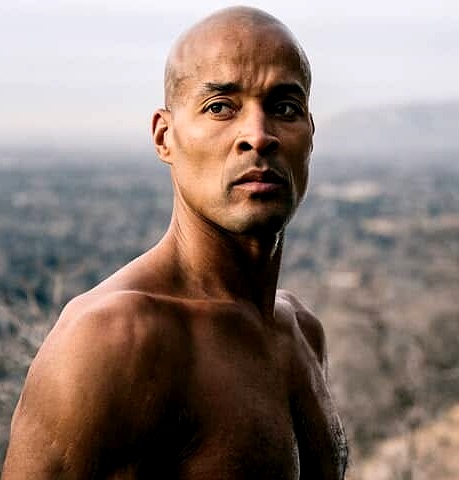

David Goggins's Book Recommendations

David Goggins is a retired Navy SEAL and former U.S. Air Force Tactical Air Control Party member who has gained widespread recognition for his extraordinary achievements in endurance sports and personal development. As an ultramarathon runner, triathlete, and world record holder for completing 4,030 pull-ups in 17 hours, Goggins exemplifies unparalleled mental and physical resilience. His memoir, "Can't Hurt Me: Master Your Mind and Defy the Odds," has become a bestseller, inspiring millions with its powerful messages of overcoming adversity and pushing beyond perceived limits. Goggins is also a sought-after motivational speaker, known for his no-excuses approach to self-improvement. His story continues to motivate individuals around the globe to embrace challenges and strive for excellence.

Drew Houston's Book Recommendations

Drew Houston is an accomplished American entrepreneur best known for co-founding Dropbox, a widely-used cloud storage service, in 2007. As the CEO, he has led the company to serve millions of users worldwide and become a key player in the tech industry. Although not primarily known for literature, Houston has shared his entrepreneurial insights and experiences through various interviews and public speaking engagements, offering valuable lessons to aspiring business leaders. His work has significantly influenced the way people and organizations manage and share digital content. Houston's innovative vision continues to shape the future of cloud computing and digital collaboration.

Niki Scevak's Book Recommendations

Niki Scevak is a distinguished entrepreneur and venture capitalist, widely recognized for his contributions to the startup ecosystem rather than traditional literature. As a co-founder and partner at Blackbird Ventures, he has played a pivotal role in funding and mentoring successful Australian tech startups. Scevak also co-founded Startmate, an influential accelerator program that has shaped numerous early-stage companies. His work has significantly impacted the Australian tech landscape, fostering innovation and entrepreneurial growth. Though not an author of traditional books, his insights and thought leadership are frequently shared through industry publications and speaking engagements.

Reid Hoffman's Book Recommendations

Reid Hoffman is an influential American entrepreneur, venture capitalist, and author, best known as the co-founder of LinkedIn, the professional networking platform that transformed online professional interactions. Hoffman has significantly impacted the business world through his investments in notable tech companies like Airbnb, Facebook, and Zynga. As an author, he has co-written several acclaimed books, including "The Start-Up of You" and "Blitzscaling," which provide strategic insights into career development and business growth. His works are celebrated for their practical advice and have become essential reading for aspiring entrepreneurs and business leaders. Hoffman's contributions extend beyond his literary efforts, as he remains a prominent figure in Silicon Valley, shaping the future of technology and innovation.

Nat Eliason's Book Recommendations

Nat Eliason is an influential writer, entrepreneur, and educator known for his insightful work on personal growth, productivity, and digital marketing. He founded Growth Machine, a successful SEO and content marketing agency that has helped numerous companies expand their online presence. Eliason's thought-provoking articles on his blog cover a wide range of topics, from philosophy to health, attracting a large and engaged audience. Additionally, he authored "Effortless Output with Roam," a comprehensive guide on using the Roam Research tool for knowledge management. Through his diverse contributions, Eliason has established himself as a significant voice in the realms of self-improvement and digital strategy.

Showing 8 of 10 related collections

“Investment is most intelligent when it is most businesslike.”

Security Analysis

By Benjamin Graham, David Le Fevre Dodd

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy