The Barefoot Investor Book Summary

In 'The Barefoot Investor', Scott Pape unveils a transformative approach to personal finance that promises freedom from money stress. With relatable anecdotes and practical strategies, he guides readers on a journey to financial independence and peace of mind. This is not just another financial guide; it's a blueprint for a fulfilling life where money works for you, not the other way around. Pape’s engaging style makes complex concepts accessible, empowering even the most financially wary to take control of their destiny. Are you ready to ditch the stress and step into a life of financial savvy?

By Scott Pape

Published: 2017

"Financial freedom isn't just about having more money, it's about making smarter choices that lead to peace of mind and a life you love."

Book Review of The Barefoot Investor

** Reviewed and updated for the 2020-2021 financial year** This is the only money guide you'll ever need That's a bold claim, given there are already thousands of finance books on the shelves. So what makes this one different? Well, you won't be overwhelmed with a bunch of 'tips' … or a strict budget (that you won't follow). You'll get a step-by-step formula: open this account, then do this; call this person, and say this; invest money here, and not there. All with a glass of wine in your hand. This book will show you how to create an entire financial plan that is so simple you can sketch it on the back of a serviette … and you'll be able to manage your money in 10 minutes a week. You'll also get the skinny on: Saving up a six-figure house deposit in 20 months Doubling your income using the 'Trapeze Strategy' Saving $78,173 on your mortgage and wiping out 7 years of payments Finding a financial advisor who won't rip you off Handing your kids (or grandkids) a $140,000 cheque on their 21st birthday Why you don't need $1 million to retire … with the 'Donald Bradman Retirement Strategy' Sound too good to be true? It's not. This book is full of stories from everyday Aussies — single people, young families, empty nesters, retirees — who have applied the simple steps in this book and achieved amazing, life-changing results. And you're next.

Book Overview of The Barefoot Investor

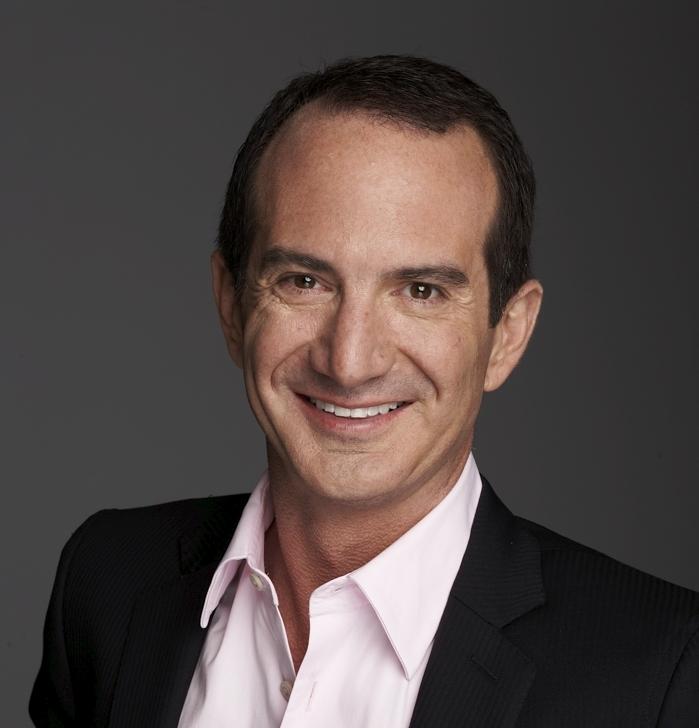

About the Book Author

Scott Pape

Scott Pape is an Australian author and financial educator, best known for his bestselling book "The Barefoot Investor". With a straightforward and accessible writing style, Pape demystifies personal finance, offering practical advice on budgeting, saving, and investing. His approachable demeanor and relatable anecdotes have made him a trusted voice in financial literacy, resonating with readers across various demographics. In addition to his acclaimed book, Pape is a regular contributor to various media outlets and hosts a podcast that further explores financial empowerment.

Book Details

Key information about the book.

- Authors

- Scott Pape

- Published

- April 2017

- Publisher

- John Wiley & Sons

- ISBN

- 0730324214

- Language

- English

- Pages

- 299

- Genres

- FinanceFinancial IndependenceFinancial Literacy for KidsPersonal Finance

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

The Millionaire Next Door Book Summary

In "The Millionaire Next Door," Thomas J. Stanley and William D. Danko reveal surprising truths about the habits and lifestyles of America's wealthy. Rather than flashy spending, these millionaires embody frugality, discipline, and the pursuit of financial independence. Uncover the principles that distinguish the affluent from those who merely appear wealthy, and learn how everyday choices shape true wealth. Through eye-opening statistics and relatable anecdotes, this book dismantles common misconceptions about wealth. Are you ready to discover the secrets of those living quietly among us who have amassed true fortunes?

The Richest Man In Babylon Book Summary

In "The Richest Man in Babylon," George S. Clason weaves captivating parables set in ancient Babylon, revealing timeless financial wisdom. Through the journey of its characters, readers uncover the secrets of wealth accumulation, including the power of saving, prudent investments, and living within one’s means. The narrative emphasizes that prosperity is attainable for anyone willing to learn and apply these fundamental principles. Each lesson is not only practical but also imbued with a sense of hope and empowerment. As you turn the pages, you’ll find yourself inspired to take control of your financial destiny and uncover the riches within your reach.

The Intelligent Investor Book Summary

In "The Intelligent Investor," Benjamin Graham unveils timeless strategies for navigating the volatile world of investing with wisdom and discipline. He introduces the concept of value investing, teaching readers to distinguish between price and intrinsic value, all while emphasizing the importance of a defensive investment strategy. Graham’s insightful principles empower investors to cultivate emotional resilience, protecting them from the relentless whims of the market. With real-world anecdotes and practical advice, this classic remains a cornerstone for anyone seeking financial success and peace of mind. Dive in to discover how patience, rationality, and a solid plan can transform your investment journey!

The Money Book for the Young, Fabulous & Broke Book Summary

The Money Book for the Young, Fabulous & Broke is your ultimate financial guide, tailored for those navigating the complexities of modern money management. With vibrant insights and relatable anecdotes, author Suze Orman empowers readers to take control of their finances while embracing their youthful exuberance. Discover essential tools for budgeting, saving, and investing, all designed to transform your financial future from daunting to dazzling. Orman’s candid advice challenges you to rethink your relationship with wealth and offers a blueprint for living fabulously, even on a budget. Are you ready to unlock the secrets to financial freedom and become fabulously secure?

Women & Money (Revised and Updated) Book Summary

In "Women & Money," Suze Orman empowers women to take control of their financial destinies with insightful advice and practical strategies. Through personal anecdotes and expert tips, she dismantles the societal myths that often hinder women's financial confidence. Orman explores the emotional connections to money, urging readers to embrace their worth and create a secure future. With a blend of tough love and encouragement, she offers a roadmap to financial independence that resonates deeply. Discover how understanding your relationship with money can transform not just your finances, but your entire life.

Nine Steps to Financial Freedom Book Summary

In "The 9 Steps to Financial Freedom," author Suze Orman unveils a transformative blueprint that empowers readers to take control of their financial lives. This compelling guide combines practical strategies with profound mindset shifts, encouraging individuals to confront their fears and embrace their worth. Each step is designed to dismantle barriers to wealth and instill lasting security, guiding readers from financial confusion to clarity. Through relatable anecdotes and actionable advice, Orman inspires a journey of self-discovery and financial empowerment. Are you ready to unlock the secrets to true financial freedom?

The Automatic Millionaire Book Summary

In "The Automatic Millionaire," David Bach unveils a powerful, no-nonsense financial strategy that promises to transform your wealth outlook without overwhelming effort. By advocating for automation in savings and investments, Bach highlights how small, consistent actions can lead to life-changing results. The book's engaging anecdotes and practical tips encourage readers to rethink their relationship with money. With an emphasis on establishing robust financial habits, it beckons you to discover the secrets of wealth-building while you sleep. Are you ready to unlock the door to financial freedom effortlessly?

The Real Book of Real Estate Book Summary

In "The Real Book of Real Estate," author Robert Kiyosaki unearths the hidden gems of wealth-building through property investment. With candid insights drawn from his own experiences, he dismantles common myths and reveals the strategies that can lead to financial freedom. This book isn’t just about numbers; it’s a masterclass in mindset, emphasizing the importance of surrounding yourself with the right team and resources. Kiyosaki’s engaging anecdotes and practical tips will inspire both novices and seasoned investors to reassess their approach to real estate. Prepare to unlock the secrets that could transform your financial future and discover the potential of becoming a savvy property mogul!

Showing 8 of 22 similar books

Similar Book Recommendations →

Bill Ackman's Book Recommendations

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

Andrew Lokenauth's Book Recommendations

Andrew Lokenauth is a distinguished author and financial expert known for his insightful contributions to personal finance and investment literature. With a career spanning over a decade, he has written extensively on topics such as wealth management, financial planning, and market analysis. Lokenauth's works are celebrated for their clarity and practical advice, making complex financial concepts accessible to a broad audience. He has been featured in numerous financial publications and has established himself as a trusted voice in the industry. Beyond his writing, Lokenauth is also a sought-after speaker, sharing his expertise at various seminars and workshops.

David Bach's Book Recommendations

David Bach is a financial expert and bestselling author known for his Finish Rich book series, including The Automatic Millionaire. He has made a career out of teaching people how to build wealth through small, manageable financial habits like “paying yourself first” and automating savings. His approach to personal finance is accessible and focuses on helping everyday individuals achieve long-term financial security. David has appeared on numerous media platforms, advocating for financial literacy and encouraging people to take control of their financial futures.

Anu Hariharan's Book Recommendations

Anu Hariharan is a distinguished partner at Y Combinator's Continuity Fund, where she has been instrumental in scaling numerous startups into successful enterprises. With a strong background in economics and technology, she has become a respected voice in the venture capital community. Hariharan has also made significant contributions through her writing on startup growth and investment strategies, offering insightful analyses and practical advice to entrepreneurs. Her work is frequently featured in leading business publications, showcasing her expertise in the tech industry. Beyond her professional accomplishments, Hariharan is committed to fostering diversity and inclusion within the startup ecosystem.

Morgan Housel's Book Recommendations

Morgan Housel is a financial writer and partner at The Collaborative Fund, best known for his book The Psychology of Money. His work explores the behavioral side of finance, emphasizing how emotions, history, and decision-making impact wealth-building. Housel’s writing is widely praised for being accessible, insightful, and engaging, making complex financial topics easier to understand. He contributes regularly to financial publications and speaks at conferences on the power of long-term thinking in finance. His book has become a modern classic in the personal finance genre.

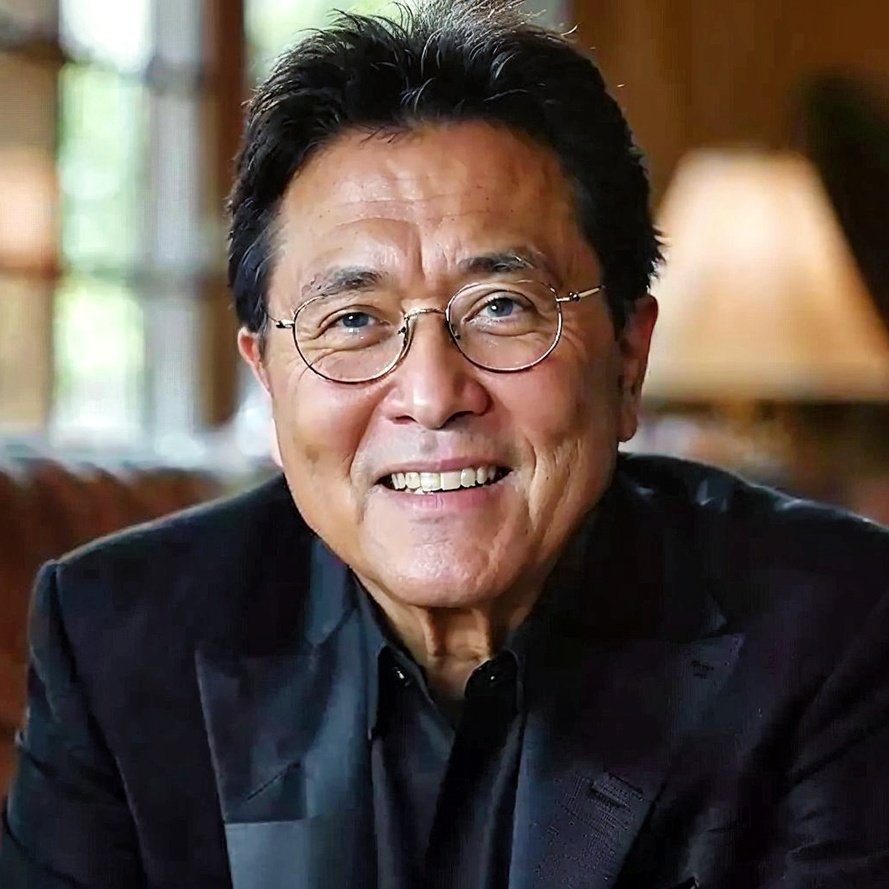

Robert Kiyosaki's Book Recommendations

Robert Kiyosaki is the author of the bestselling personal finance book Rich Dad Poor Dad, which challenges conventional wisdom on wealth building and financial literacy. He is a self-made entrepreneur and investor who emphasizes the importance of financial education and investing in assets that generate passive income. His Rich Dad brand has expanded to include books, seminars, and a board game that teaches financial principles. Kiyosaki advocates for self-reliance and encourages individuals to break free from the traditional “employee mindset.” He continues to teach people how to achieve financial independence.

Andrew Wilkinson's Book Recommendations

Andrew Wilkinson is a distinguished author and entrepreneur, best known for his insightful business writings and contributions to the tech industry. He co-founded MetaLab, a prominent design agency that has shaped the user experience of major platforms like Slack and Coinbase. Wilkinson's entrepreneurial journey and his publications provide valuable perspectives on startup culture, innovation, and leadership. His writing, often featured in leading business magazines and his personal blog, has garnered a wide readership for its practical advice and engaging storytelling. Andrew continues to influence both literature and the business world with his unique blend of creativity and strategic thinking.

Nathaniel Drew's Book Recommendations

Nathaniel Drew is a contemporary writer and digital content creator known for his insightful explorations of mindfulness, minimalism, and personal growth. Gaining popularity through his YouTube channel, Drew has inspired millions with his engaging videos that blend storytelling with practical advice. His work often emphasizes the importance of intentional living and self-awareness, resonating deeply with a global audience. In addition to his digital content, Drew has authored articles and essays that further delve into the themes of simplicity and introspection. His contributions have significantly impacted the modern discourse on how to lead a more meaningful and fulfilling life.

Showing 8 of 17 related collections

“Financial freedom isn't just about having more money, it's about making smarter choices that lead to peace of mind and a life you love.”

The Barefoot Investor

By Scott Pape

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy