The Economics of Microfinance, second edition Book Summary

In 'The Economics of Microfinance', Beatriz Armendariz and Jonathan Morduch unveil the transformative power of small loans in underserved communities. The authors delve into the intricate interplay between microfinance and economic development, challenging conventional economic theories along the way. Through captivating case studies, they illustrate how microfinance institutions can empower individuals and foster entrepreneurship. As the second edition unfolds, it enriches the discourse with updated insights and broader implications for global poverty alleviation. This compelling exploration invites readers to reconsider the possibilities of financial inclusivity and its role in shaping a better future.

By Jonathan Morduch, Beatriz Armendariz

Published: 2010

"Microfinance isn't just about providing financial services; it's about empowering individuals to transform their own lives and communities, creating a ripple effect of growth and opportunity."

Book Review of The Economics of Microfinance, second edition

An accessible analysis of the global expansion of financial markets in poor communities, incorporating the latest thinking and evidence. The microfinance revolution has allowed more than 150 million poor people around the world to receive small loans without collateral, build up assets, and buy insurance. The idea that providing access to reliable and affordable financial services can have powerful economic and social effects has captured the imagination of policymakers, activists, bankers, and researchers around the world; the 2006 Nobel Peace Prize went to microfinance pioneer Muhammed Yunis and Grameen Bank of Bangladesh. This book offers an accessible and engaging analysis of the global expansion of financial markets in poor communities. It introduces readers to the key ideas driving microfinance, integrating theory with empirical data and addressing a range of issues, including savings and insurance, the role of women, impact measurement, and management incentives. This second edition has been updated throughout to reflect the latest data. A new chapter on commercialization describes the rapid growth in investment in microfinance institutions and the tensions inherent in the efforts to meet both social and financial objectives. The chapters on credit contracts, savings and insurance, and gender have been expanded substantially; a new section in the chapter on impact measurement describes the growing importance of randomized controlled trials; and the chapter on managing microfinance offers a new perspective on governance issues in transforming institutions. Appendixes and problem sets cover technical material.

Book Overview of The Economics of Microfinance, second edition

About the Book Authors

Jonathan Morduch

Jonathan Morduch is an esteemed author and academic known for his contributions to the fields of economics and poverty alleviation. A professor at New York University's Wagner Graduate School of Public Service, he has conducted extensive research on microfinance, development economics, and the financial behaviors of low-income households. Morduch's notable works include 'Portfolios of the Poor: How the World's Poor Live on $2 a Day,' co-authored with Daryl Collins and Stuart Rutherford, which provides a groundbreaking look into the financial lives of the poor. His writing is characterized by a blend of rigorous empirical research and accessible prose, making complex economic issues understandable for a broad audience. Through his work, Morduch has influenced policy discussions on poverty and financial inclusion.

Beatriz Armendariz

Beatriz Armendariz is a celebrated author known for her poignant storytelling and ability to weave rich narratives that explore themes of identity, culture, and resilience. With notable works such as 'The River Between Us' and 'Woven Threads,' she captivates readers with her lyrical prose and deep character development. Armendariz's writing style often draws on her own experiences and cultural heritage, allowing her to create authentic and relatable characters. She has received several accolades for her contributions to literature, making her a significant voice in contemporary fiction.

Book Details

Key information about the book.

- Authors

- Jonathan Morduch, Beatriz Armendariz

- Published

- April 2010

- Publisher

- MIT Press

- ISBN

- 0262513986

- Language

- English

- Pages

- 361

- Genres

- Global EconomicsBusiness and EconomicsFinancial Literacy for KidsPersonal Finance

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

The Latte Factor Book Summary

In "The Latte Factor," personal finance expert David Bach unveils a transformative story that intertwines the journey of a young woman discovering the power of financial freedom. Through the lens of a seemingly simple daily ritual—her coffee habit—she learns profound lessons about saving and investing. With relatable characters and an engaging narrative, Bach challenges readers to rethink their spending habits and recognize the true cost of indulgences. Could a small shift in perspective lead to monumental changes in your financial future? Dive into this inspiring tale and unlock the secrets to achieving your dreams, one latte at a time!

The Total Money Makeover Workbook Book Summary

In "The Total Money Makeover," financial guru Dave Ramsey unveils a transformative plan to overhaul your personal finances, empowering readers to break free from debt and build lasting wealth. Through practical steps and relatable success stories, he demystifies budgeting and saving, revealing the secrets to financial independence. Ramsey introduces his straightforward "Baby Steps" approach, guiding readers from caution to confidence on their journey to financial freedom. Packed with actionable advice and motivational insights, this book challenges conventional wisdom and inspires a total mindset shift. Are you ready to embark on a journey that could reshape your financial future?

Dave Ramsey's Complete Guide to Money Book Summary

Dive into "The Complete Guide to Money," where financial wisdom meets practical application. This comprehensive tome unravels the mysteries of personal finance, investment, and wealth-building strategies in an engaging manner. Discover transformative tips for budgeting that can reshape your spending habits and ignite your savings. With expert insights and real-world examples, you'll learn to navigate the complex world of money with confidence. Whether you're a novice or a seasoned investor, this guide promises to elevate your financial literacy and empower your economic decisions!

Antifragile Book Summary

In "Antifragile: Things That Gain from Disorder," Nassim Nicholas Taleb introduces a revolutionary concept that goes beyond resilience, presenting the idea of "antifragility"—the ability of systems to thrive and grow stronger in chaos and uncertainty. Taleb critiques conventional risk management and advocates for embracing volatility rather than fearing it. Through thought-provoking examples from various fields, he illustrates how unpredictability can be harnessed for personal and societal growth. Discover how to cultivate an antifragile mindset that empowers you to not only withstand life's challenges but to flourish because of them. Are you ready to rethink your relationship with chaos?

I Will Teach You to Be Rich, Second Edition Book Summary

In 'I Will Teach You to Be Rich, Second Edition,' Ramit Sethi provides a no-nonsense guide to mastering personal finance with a blend of humor and practicality. He challenges conventional money advice and introduces readers to a unique banking system for maximizing their savings. Through straightforward strategies, Sethi reveals how to automate finances and invest wisely for the long term. Each chapter brims with actionable tips that encourage readers to take control of their financial futures. With insights that delve deep into psychology and behavior, this book is a game-changer for anyone seeking to build real wealth.

Charlie Munger Book Summary

Dive into the extraordinary mind of Charlie Munger, Warren Buffett's right-hand man, in Tren Griffin's insightful exploration. This book reveals Munger's unique principles on investing, decision-making, and life philosophy that have shaped his legendary success. Griffin distills Munger's wisdom into practical lessons, illuminating the power of multidisciplinary thinking. Readers will uncover how Munger’s unconventional strategies challenge traditional approaches to business and investing. Prepare to be inspired and gain a fresh perspective on achieving greatness in your own endeavors.

Margin of Safety Book Summary

In 'Margin of Safety,' esteemed investor Seth A. Klarman presents a compelling treatise on value investing, emphasizing the importance of risk management and investment discipline. He challenges conventional wisdom and offers a treasure trove of insights on how to navigate the stock market's unpredictable nature. With intriguing case studies and a candid perspective, Klarman illustrates the pitfalls of speculative investing. This book is not just a guide for investors; it's a blueprint for achieving genuine financial security. Unlock the secrets of successful investing and discover why genius often lies in the margins.

More from Less Book Summary

In 'More from Less,' Andrew McAfee explores the paradox of how we can achieve greater prosperity while using fewer resources. He delves into the groundbreaking changes brought by technology that allow for sustainable growth and efficiency. Through compelling case studies and data-driven insights, McAfee challenges the notion of scarcity and presents a hopeful vision for the future. This book invites readers to rethink their assumptions about consumption and innovation. Can we truly do more with less, or is it just an illusion?

Showing 8 of 30 similar books

Similar Book Recommendations →

Bill Ackman's Book Recommendations

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

Ray Dalio's Book Recommendations

Ray Dalio is the founder of Bridgewater Associates, one of the largest and most successful hedge funds in the world. He is also the author of the bestselling book Principles, where he outlines his philosophy on life, leadership, and investing. Ray is renowned for his unique approach to transparency, radical truth, and thoughtful disagreement within organizations. His insights into economics and investing have made him one of the most influential figures in the financial world. Dalio continues to be a thought leader in business, economics, and philanthropy.

Graham Stephan's Book Recommendations

Graham Stephan is a prominent real estate investor, YouTuber, and personal finance guru known for his insightful content on financial independence and investment strategies. He began his career in real estate at the age of 18 and quickly rose to prominence, amassing a multi-million-dollar portfolio. Stephan's YouTube channel, which boasts millions of subscribers, offers accessible and practical advice on budgeting, saving, and investing, earning him widespread acclaim and a dedicated following. In addition to his online presence, he has been featured in numerous high-profile publications and media outlets, solidifying his status as an influential figure in personal finance education. Through his work, Stephan has empowered countless individuals to take control of their finances and pursue financial freedom.

Andrew Wilkinson's Book Recommendations

Andrew Wilkinson is a distinguished author and entrepreneur, best known for his insightful business writings and contributions to the tech industry. He co-founded MetaLab, a prominent design agency that has shaped the user experience of major platforms like Slack and Coinbase. Wilkinson's entrepreneurial journey and his publications provide valuable perspectives on startup culture, innovation, and leadership. His writing, often featured in leading business magazines and his personal blog, has garnered a wide readership for its practical advice and engaging storytelling. Andrew continues to influence both literature and the business world with his unique blend of creativity and strategic thinking.

Nick Huber's Book Recommendations

Nick Huber is a renowned entrepreneur and writer, best known for his insightful contributions to the business and self-improvement literary genres. He gained widespread recognition through his practical advice and motivational content, which has empowered countless individuals to pursue personal and professional growth. Huber's notable works include a series of bestselling books that combine his entrepreneurial experience with actionable strategies for success. In addition to his writing, he is a sought-after speaker, sharing his expertise at various conferences and events. Huber's influence extends beyond literature, as he continues to inspire a new generation of entrepreneurs and leaders.

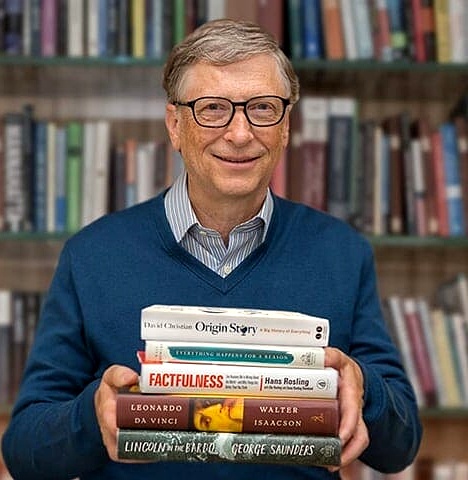

Bill Gates's Book Recommendations

Bill Gates, co-founder of Microsoft Corporation, is a pioneering figure in the tech industry, having played a key role in the personal computer revolution. His work at Microsoft, particularly the development of Windows, transformed software and computing globally. Beyond his technology contributions, Gates is also a prolific author, with notable works such as "The Road Ahead" and "Business @ the Speed of Thought," which offer insights into the future of technology and business. Additionally, his philanthropic efforts through the Bill & Melinda Gates Foundation have had a profound impact on global health, education, and poverty. Gates continues to influence both technology and literature with his forward-thinking perspectives and innovative ideas.

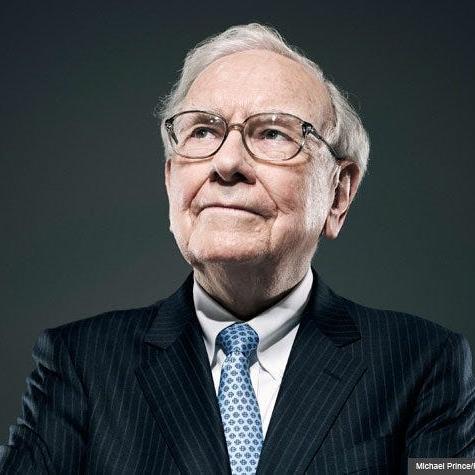

Warren Buffett's Book Recommendations

Warren Buffett, known as the “Oracle of Omaha,” is one of the most successful investors of all time and the chairman of Berkshire Hathaway. His investment philosophy, centered on value investing and long-term wealth creation, has made him one of the wealthiest people in the world. Buffett is also known for his philanthropic efforts, having pledged to donate a significant portion of his wealth to charitable causes. His annual letters to shareholders are highly anticipated for their financial wisdom. Buffett remains a revered figure in business and investing circles.

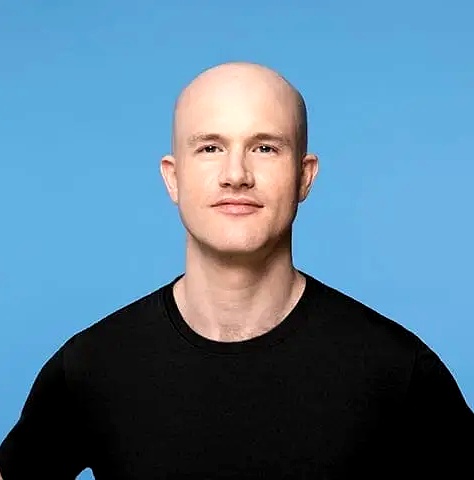

Brian Armstrong's Book Recommendations

Brian Armstrong is a renowned entrepreneur and author best known for co-founding and leading Coinbase, a major cryptocurrency exchange. His literary contributions include insightful writings on the future of digital currencies and blockchain technology. Armstrong's work has been pivotal in demystifying complex financial systems for a broader audience. Beyond his business acumen, his thought leadership in publications and public speaking engagements has cemented his status as a key voice in the fintech revolution. His dedication to innovation continues to influence the trajectory of global financial systems.

Showing 8 of 14 related collections

“Microfinance isn't just about providing financial services; it's about empowering individuals to transform their own lives and communities, creating a ripple effect of growth and opportunity.”

The Economics of Microfinance, second edition

By Jonathan Morduch, Beatriz Armendariz

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy