The Most Important Thing Book Summary

In 'The Most Important Thing', renowned investor Howard Marks shares his insights on the philosophy of investing and the art of risk management. He emphasizes the importance of understanding market cycles and the psychology behind investment decisions. Through anecdotes and analysis, Marks reveals the critical elements that separate successful investors from the rest. Readers will discover the power of value investing and the need for a disciplined approach in uncertain times. This book is not just a guide for investors, but a thought-provoking exploration of how to think about risk and opportunity in any financial endeavor.

By Howard Marks

Published: 2011

"The most important thing is not how much you know, but how well you can apply that knowledge in the real world."

Book Review of The Most Important Thing

This book explains the keys to successful investment and the pitfalls that can destroy capital or ruin a career. Utilizing passages from his memos to illustrate his ideas, Marks teaches by example, detailing the development of an investment philosophy that fully acknowledges the complexities of investing and the perils of the financial world. Brilliantly applying insight to today's volatile markets, Marks offers a volume that is part memoir, part creed, with a number of broad takeaways.

Book Overview of The Most Important Thing

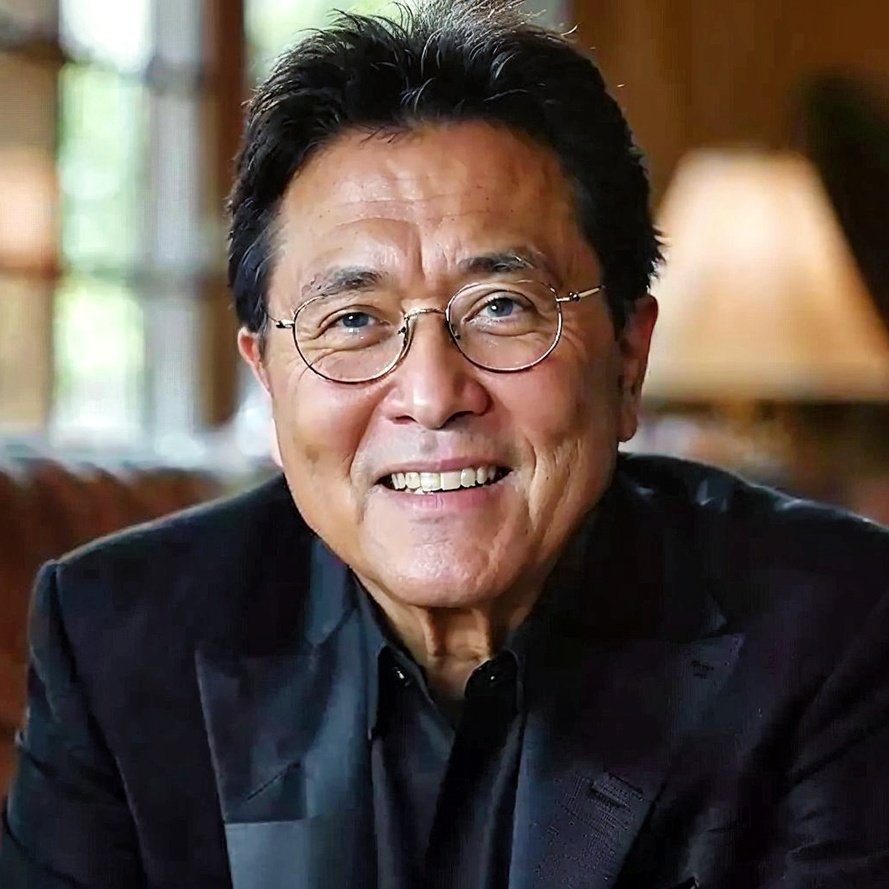

About the Book Author

Howard Marks

Howard Marks was a renowned writer and investor, best known for his impactful works in finance and memoirs that reflect his life experiences. His notable books include "The Most Important Thing: Uncommon Sense for the Thoughtful Investor," where he shares his insights on investment philosophy and market behavior. Marks is celebrated for his clear, engaging writing style that resonates with both novice and experienced investors. He combines profound market wisdom with personal anecdotes, making complex financial concepts accessible to a broader audience. His candid reflections on risk and opportunity have earned him a respected place in the financial literature realm.

Book Details

Key information about the book.

- Authors

- Howard Marks

- Published

- January 2011

- Publisher

- Columbia Business School Publishing

- ISBN

- 0231153686

- Language

- English

- Pages

- 180

- Genres

- InvestingFinanceBehavioral Finance

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

The Intelligent Investor Book Summary

In "The Intelligent Investor," Benjamin Graham unveils timeless strategies for navigating the volatile world of investing with wisdom and discipline. He introduces the concept of value investing, teaching readers to distinguish between price and intrinsic value, all while emphasizing the importance of a defensive investment strategy. Graham’s insightful principles empower investors to cultivate emotional resilience, protecting them from the relentless whims of the market. With real-world anecdotes and practical advice, this classic remains a cornerstone for anyone seeking financial success and peace of mind. Dive in to discover how patience, rationality, and a solid plan can transform your investment journey!

The Wealthy Gardener Book Summary

In "The Wealthy Gardener," author John Soforic reveals the transformative journey of a father teaching his son the intricate balance between wealth and wisdom. Through a series of poignant parables, readers explore the seeds of financial success that sprout from patience, dedication, and the right mindset. The book intertwines personal anecdotes with practical advice, challenging conventional notions of prosperity and fulfillment. As the characters navigate the gardens of their lives, they uncover profound truths about happiness, legacy, and the true meaning of wealth. Prepare to dig deep into a narrative that cultivates both inspiration and actionable insights for your own growth.

The Money Class Book Summary

In "The Money Class," Suze Orman redefines financial literacy in a world where traditional rules no longer apply. She reveals the secrets to navigating modern economic challenges, providing actionable advice on saving, investing, and building wealth. Orman emphasizes the importance of understanding your personal values and translating them into financial choices. With relatable stories and practical tips, she empowers readers to take control of their financial futures. Are you ready to transform your relationship with money and unlock the life you deserve?

The Real Book of Real Estate Book Summary

In "The Real Book of Real Estate," author Robert Kiyosaki unearths the hidden gems of wealth-building through property investment. With candid insights drawn from his own experiences, he dismantles common myths and reveals the strategies that can lead to financial freedom. This book isn’t just about numbers; it’s a masterclass in mindset, emphasizing the importance of surrounding yourself with the right team and resources. Kiyosaki’s engaging anecdotes and practical tips will inspire both novices and seasoned investors to reassess their approach to real estate. Prepare to unlock the secrets that could transform your financial future and discover the potential of becoming a savvy property mogul!

Save More Tomorrow Book Summary

In "Save More Tomorrow," behavioral finance pioneer Richard H. Thaler unveils a revolutionary approach to personal savings that empowers individuals to take control of their financial futures. By integrating the principles of human psychology with smart financial strategies, Thaler proposes a system where employees can commit to saving a portion of their future raises, making saving effortless and automatic. This innovative method not only combats the common barriers to saving but also transforms lifestyles and retirement outcomes. Through captivating anecdotes and research, Thaler illustrates how small behavioral tweaks can lead to monumental financial gains. Dive into this compelling narrative and discover how you can effortlessly boost your savings and secure a more prosperous future!

The Total Money Makeover Workbook Book Summary

In "The Total Money Makeover," financial guru Dave Ramsey unveils a transformative plan to overhaul your personal finances, empowering readers to break free from debt and build lasting wealth. Through practical steps and relatable success stories, he demystifies budgeting and saving, revealing the secrets to financial independence. Ramsey introduces his straightforward "Baby Steps" approach, guiding readers from caution to confidence on their journey to financial freedom. Packed with actionable advice and motivational insights, this book challenges conventional wisdom and inspires a total mindset shift. Are you ready to embark on a journey that could reshape your financial future?

Fooled by Randomness Book Summary

In "Fooled by Randomness," Nassim Nicholas Taleb explores the hidden influence of chance in our lives, challenging our perceptions of luck, skill, and success. He argues that many people attribute their achievements to talent rather than the randomness that often underpins them. Through a blend of personal anecdotes and sharp wit, Taleb reveals how cognitive biases distort our understanding of risk and probability. He reminds us that, in the grand theater of life, we are often unwitting actors in a play scripted by randomness. Prepare to rethink your beliefs about fortune and failure as you uncover the profound truths lurking beneath the surface of chance.

The Little Book of Behavioral Investing Book Summary

**The Little Book of Behavioral Investing** uncovers the psychological traps that often lead investors astray. With a blend of insightful anecdotes and cutting-edge research, it reveals how emotions like fear and greed shape our decisions in the financial world. Readers will discover practical strategies to counteract these biases and improve their investment outcomes. By understanding the behavioral factors at play, you can transform your investment approach. Are you ready to challenge your thinking and elevate your financial game?

Showing 8 of 27 similar books

Similar Book Recommendations →

Bill Ackman's Book Recommendations

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

Charlie Munger's Book Recommendations

Charlie Munger is an American investor, businessman, and philanthropist, best known as the vice chairman of Berkshire Hathaway, where he partners with Warren Buffett. Renowned for his insights on investment strategies and mental models, Munger has significantly influenced the world of finance. His notable literary contributions include "Poor Charlie's Almanack," a compilation of his speeches and writings that distill his wisdom on decision-making and business principles. Munger's work emphasizes the importance of multidisciplinary thinking and continuous learning. Beyond his financial acumen, he is celebrated for his charitable efforts, particularly in education and healthcare.

Andrew Lokenauth's Book Recommendations

Andrew Lokenauth is a distinguished author and financial expert known for his insightful contributions to personal finance and investment literature. With a career spanning over a decade, he has written extensively on topics such as wealth management, financial planning, and market analysis. Lokenauth's works are celebrated for their clarity and practical advice, making complex financial concepts accessible to a broad audience. He has been featured in numerous financial publications and has established himself as a trusted voice in the industry. Beyond his writing, Lokenauth is also a sought-after speaker, sharing his expertise at various seminars and workshops.

Drew Houston's Book Recommendations

Drew Houston is an accomplished American entrepreneur best known for co-founding Dropbox, a widely-used cloud storage service, in 2007. As the CEO, he has led the company to serve millions of users worldwide and become a key player in the tech industry. Although not primarily known for literature, Houston has shared his entrepreneurial insights and experiences through various interviews and public speaking engagements, offering valuable lessons to aspiring business leaders. His work has significantly influenced the way people and organizations manage and share digital content. Houston's innovative vision continues to shape the future of cloud computing and digital collaboration.

Niki Scevak's Book Recommendations

Niki Scevak is a distinguished entrepreneur and venture capitalist, widely recognized for his contributions to the startup ecosystem rather than traditional literature. As a co-founder and partner at Blackbird Ventures, he has played a pivotal role in funding and mentoring successful Australian tech startups. Scevak also co-founded Startmate, an influential accelerator program that has shaped numerous early-stage companies. His work has significantly impacted the Australian tech landscape, fostering innovation and entrepreneurial growth. Though not an author of traditional books, his insights and thought leadership are frequently shared through industry publications and speaking engagements.

Robert Kiyosaki's Book Recommendations

Robert Kiyosaki is the author of the bestselling personal finance book Rich Dad Poor Dad, which challenges conventional wisdom on wealth building and financial literacy. He is a self-made entrepreneur and investor who emphasizes the importance of financial education and investing in assets that generate passive income. His Rich Dad brand has expanded to include books, seminars, and a board game that teaches financial principles. Kiyosaki advocates for self-reliance and encourages individuals to break free from the traditional “employee mindset.” He continues to teach people how to achieve financial independence.

Andrew Wilkinson's Book Recommendations

Andrew Wilkinson is a distinguished author and entrepreneur, best known for his insightful business writings and contributions to the tech industry. He co-founded MetaLab, a prominent design agency that has shaped the user experience of major platforms like Slack and Coinbase. Wilkinson's entrepreneurial journey and his publications provide valuable perspectives on startup culture, innovation, and leadership. His writing, often featured in leading business magazines and his personal blog, has garnered a wide readership for its practical advice and engaging storytelling. Andrew continues to influence both literature and the business world with his unique blend of creativity and strategic thinking.

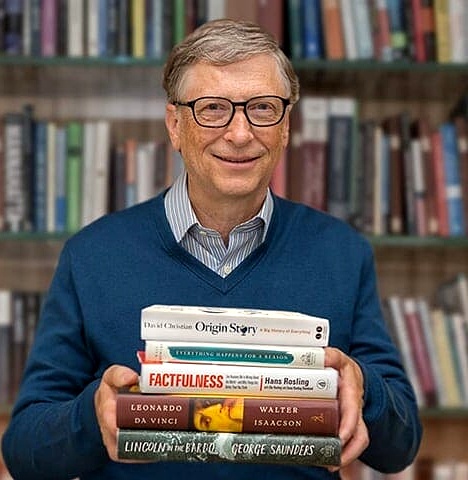

Bill Gates's Book Recommendations

Bill Gates, co-founder of Microsoft Corporation, is a pioneering figure in the tech industry, having played a key role in the personal computer revolution. His work at Microsoft, particularly the development of Windows, transformed software and computing globally. Beyond his technology contributions, Gates is also a prolific author, with notable works such as "The Road Ahead" and "Business @ the Speed of Thought," which offer insights into the future of technology and business. Additionally, his philanthropic efforts through the Bill & Melinda Gates Foundation have had a profound impact on global health, education, and poverty. Gates continues to influence both technology and literature with his forward-thinking perspectives and innovative ideas.

Showing 8 of 10 related collections

“The most important thing is not how much you know, but how well you can apply that knowledge in the real world.”

The Most Important Thing

By Howard Marks

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy