When Genius Failed Book Summary

When Genius Failed chronicles the dramatic rise and fall of Long-Term Capital Management, a hedge fund that boasted an elite team of financial wizards. As it navigates the complexities of high-stakes finance and groundbreaking quantitative models, the book unveils how overconfidence in genius can lead to catastrophic consequences. When the Asian financial crisis strikes, the fund’s intricate strategies unravel, threatening the global economy. Authors Roger Lowenstein masterfully intertwine personal narratives with economic theory, revealing the fragile balance between risk and reward. This gripping tale serves as a cautionary reminder that brilliance can blind us to the dangers lurking beneath the surface.

By Roger Lowenstein

Published: 2001

"When Genius Failed: The Rise and Fall of Long-Term Capital Management by Roger Lowenstein explores the complexities of finance and risk."

Book Review of When Genius Failed

“A riveting account that reaches beyond the market landscape to say something universal about risk and triumph, about hubris and failure.”—The New York Times NAMED ONE OF THE BEST BOOKS OF THE YEAR BY BUSINESSWEEK In this business classic—now with a new Afterword in which the author draws parallels to the recent financial crisis—Roger Lowenstein captures the gripping roller-coaster ride of Long-Term Capital Management. Drawing on confidential internal memos and interviews with dozens of key players, Lowenstein explains not just how the fund made and lost its money but also how the personalities of Long-Term’s partners, the arrogance of their mathematical certainties, and the culture of Wall Street itself contributed to both their rise and their fall. When it was founded in 1993, Long-Term was hailed as the most impressive hedge fund in history. But after four years in which the firm dazzled Wall Street as a $100 billion moneymaking juggernaut, it suddenly suffered catastrophic losses that jeopardized not only the biggest banks on Wall Street but the stability of the financial system itself. The dramatic story of Long-Term’s fall is now a chilling harbinger of the crisis that would strike all of Wall Street, from Lehman Brothers to AIG, a decade later. In his new Afterword, Lowenstein shows that LTCM’s implosion should be seen not as a one-off drama but as a template for market meltdowns in an age of instability—and as a wake-up call that Wall Street and government alike tragically ignored. Praise for When Genius Failed “[Roger] Lowenstein has written a squalid and fascinating tale of world-class greed and, above all, hubris.”—BusinessWeek “Compelling . . . The fund was long cloaked in secrecy, making the story of its rise . . . and its ultimate destruction that much more fascinating.”—The Washington Post “Story-telling journalism at its best.”—The Economist

Book Overview of When Genius Failed

About the Book Author

Roger Lowenstein

Roger Lowenstein is an acclaimed American financial journalist and author known for his insightful analysis of the stock market and investment strategies. He gained prominence with his best-selling books, including "When Genius Failed," which chronicles the rise and fall of Long-Term Capital Management, and "Buffett: The Making of an American Capitalist," a biography of famed investor Warren Buffett. Lowenstein has contributed to major publications such as The Wall Street Journal and The New York Times, showcasing his ability to distill complex financial concepts for a general audience. With a background in economics, he combines storytelling with rigorous research to illuminate the intricacies of financial markets. Through his writing, Lowenstein has not only informed readers but also shaped the discourse around investing and economic thought.

Book Details

Key information about the book.

- Authors

- Roger Lowenstein

- Published

- October 2001

- Publisher

- Random House Trade Paperbacks

- ISBN

- 0375758259

- Language

- English

- Pages

- 290

- Genres

- Behavioral FinanceFinancePersonal Finance

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

Save More Tomorrow Book Summary

In "Save More Tomorrow," behavioral finance pioneer Richard H. Thaler unveils a revolutionary approach to personal savings that empowers individuals to take control of their financial futures. By integrating the principles of human psychology with smart financial strategies, Thaler proposes a system where employees can commit to saving a portion of their future raises, making saving effortless and automatic. This innovative method not only combats the common barriers to saving but also transforms lifestyles and retirement outcomes. Through captivating anecdotes and research, Thaler illustrates how small behavioral tweaks can lead to monumental financial gains. Dive into this compelling narrative and discover how you can effortlessly boost your savings and secure a more prosperous future!

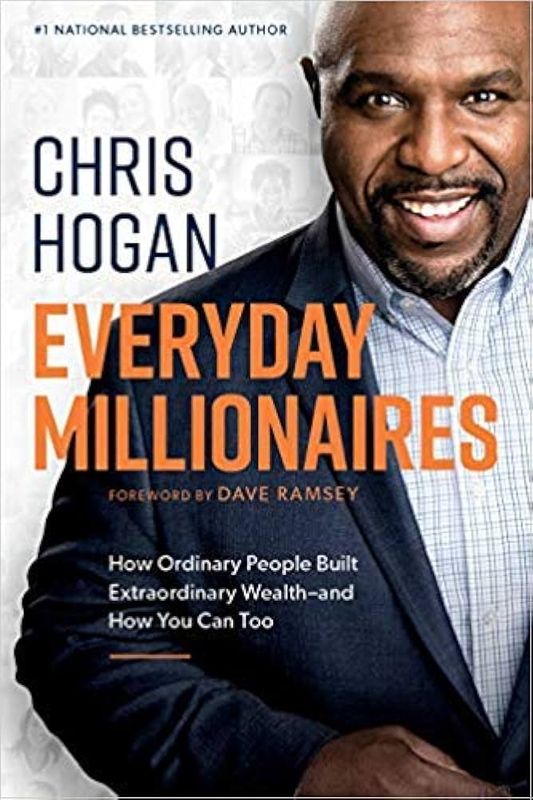

Everyday Millionaires Book Summary

In "Everyday Millionaires," authors Chris Hogan unravel the surprising truths behind the wealth of ordinary people who have achieved extraordinary financial success. Through compelling stories and real-life data, they challenge the myths of wealth, revealing that most millionaires live modestly and prioritize saving and investing over luxury. Hogan shares actionable insights on mindsets, financial habits, and the importance of perseverance, encouraging readers to rethink their own paths to wealth. The book empowers individuals to believe that anyone can attain financial independence with dedication and sensible strategies. Are you ready to unlock the secrets of everyday millionaires and transform your financial future?

Nudge Book Summary

In "Nudge," behavioral economists Richard Thaler and Cass Sunstein unveil the subtle art of influencing choices and shaping outcomes without restricting freedom. They explore how small, seemingly insignificant changes in the way options are presented can lead to drastically improved decisions in health, finance, and overall happiness. With compelling real-world examples and engaging insights, the authors demonstrate how understanding human psychology can empower individuals and policymakers alike. Dive into a world where choice architecture transforms lives and reshapes society's approach to welfare. Discover the hidden nudges that could change everything about the way we choose!

Fooled by Randomness Book Summary

In "Fooled by Randomness," Nassim Nicholas Taleb explores the hidden influence of chance in our lives, challenging our perceptions of luck, skill, and success. He argues that many people attribute their achievements to talent rather than the randomness that often underpins them. Through a blend of personal anecdotes and sharp wit, Taleb reveals how cognitive biases distort our understanding of risk and probability. He reminds us that, in the grand theater of life, we are often unwitting actors in a play scripted by randomness. Prepare to rethink your beliefs about fortune and failure as you uncover the profound truths lurking beneath the surface of chance.

I Will Teach You to Be Rich, Second Edition Book Summary

In 'I Will Teach You to Be Rich, Second Edition,' Ramit Sethi provides a no-nonsense guide to mastering personal finance with a blend of humor and practicality. He challenges conventional money advice and introduces readers to a unique banking system for maximizing their savings. Through straightforward strategies, Sethi reveals how to automate finances and invest wisely for the long term. Each chapter brims with actionable tips that encourage readers to take control of their financial futures. With insights that delve deep into psychology and behavior, this book is a game-changer for anyone seeking to build real wealth.

You Are a Badass® Book Summary

In "You Are a Badass," author Jen Sincero delivers a bold and empowering guide to unleashing your inner greatness. With humor and candor, she challenges readers to confront their self-doubt and embrace the power of positive thinking. Through relatable anecdotes and actionable advice, Sincero ignites a fire for self-improvement, urging you to take charge of your life. This book is not just a self-help manual; it's a call to action for anyone ready to break free from mediocrity. Are you ready to step into your badass self and transform your reality?

Financial Freedom Book Summary

In "Financial Freedom," Grant Sabatier unveils the transformative journey from scarcity to abundance, sharing his compelling story of achieving a million-dollar net worth in just five years. The book combines actionable strategies with powerful insights, challenging conventional beliefs about work, money, and happiness. Sabatier emphasizes the importance of redefining your relationship with wealth and creating multiple income streams to escape the rat race. With practical tips on budgeting, investing, and mindset shifts, readers are equipped to take bold steps toward their financial goals. Dive into this guide and discover the blueprint that could lead you to a life of true financial independence!

Black Edge Book Summary

In "Black Edge," investigative journalist Sheelah Kolhatkar delves into the high-stakes world of hedge funds and the enigmatic figure of Steven A. Cohen. As she unravels the saga of insider trading, greed, and Wall Street's murky ethics, the book pulls readers into a gripping tale of ambition that spans decades. With intellectual prowess and audacious risk-taking, Cohen's rise to power raises questions about the moral compass of finance. Kolhatkar's penetrating analysis unveils the dark side of wealth and the relentless pursuit of success, leaving readers questioning the true cost of ambition. Will you dare to uncover the secrets of a financial titan and the shadowy underworld they inhabit?

Showing 8 of 27 similar books

Similar Book Recommendations →

Bill Ackman's Book Recommendations

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

Andrew Lokenauth's Book Recommendations

Andrew Lokenauth is a distinguished author and financial expert known for his insightful contributions to personal finance and investment literature. With a career spanning over a decade, he has written extensively on topics such as wealth management, financial planning, and market analysis. Lokenauth's works are celebrated for their clarity and practical advice, making complex financial concepts accessible to a broad audience. He has been featured in numerous financial publications and has established himself as a trusted voice in the industry. Beyond his writing, Lokenauth is also a sought-after speaker, sharing his expertise at various seminars and workshops.

David Bach's Book Recommendations

David Bach is a financial expert and bestselling author known for his Finish Rich book series, including The Automatic Millionaire. He has made a career out of teaching people how to build wealth through small, manageable financial habits like “paying yourself first” and automating savings. His approach to personal finance is accessible and focuses on helping everyday individuals achieve long-term financial security. David has appeared on numerous media platforms, advocating for financial literacy and encouraging people to take control of their financial futures.

Nat Eliason's Book Recommendations

Nat Eliason is an influential writer, entrepreneur, and educator known for his insightful work on personal growth, productivity, and digital marketing. He founded Growth Machine, a successful SEO and content marketing agency that has helped numerous companies expand their online presence. Eliason's thought-provoking articles on his blog cover a wide range of topics, from philosophy to health, attracting a large and engaged audience. Additionally, he authored "Effortless Output with Roam," a comprehensive guide on using the Roam Research tool for knowledge management. Through his diverse contributions, Eliason has established himself as a significant voice in the realms of self-improvement and digital strategy.

Andrew Wilkinson's Book Recommendations

Andrew Wilkinson is a distinguished author and entrepreneur, best known for his insightful business writings and contributions to the tech industry. He co-founded MetaLab, a prominent design agency that has shaped the user experience of major platforms like Slack and Coinbase. Wilkinson's entrepreneurial journey and his publications provide valuable perspectives on startup culture, innovation, and leadership. His writing, often featured in leading business magazines and his personal blog, has garnered a wide readership for its practical advice and engaging storytelling. Andrew continues to influence both literature and the business world with his unique blend of creativity and strategic thinking.

Bill Gates's Book Recommendations

Bill Gates, co-founder of Microsoft Corporation, is a pioneering figure in the tech industry, having played a key role in the personal computer revolution. His work at Microsoft, particularly the development of Windows, transformed software and computing globally. Beyond his technology contributions, Gates is also a prolific author, with notable works such as "The Road Ahead" and "Business @ the Speed of Thought," which offer insights into the future of technology and business. Additionally, his philanthropic efforts through the Bill & Melinda Gates Foundation have had a profound impact on global health, education, and poverty. Gates continues to influence both technology and literature with his forward-thinking perspectives and innovative ideas.

James Clear's Book Recommendations

James Clear is the author of the bestselling book Atomic Habits, which focuses on the power of small habits and incremental improvements to achieve significant personal and professional growth. Clear’s writing blends insights from psychology, neuroscience, and productivity to provide practical strategies for building better habits. His work has helped millions of people create positive changes in their lives by focusing on the process rather than the outcome. James’s clear, actionable advice has made him a sought-after speaker and thought leader in the field of personal development.

Guy Spier's Book Recommendations

Guy Spier is a renowned value investor and author, best known for his influential book "The Education of a Value Investor," which offers deep insights into the principles of value investing and personal development. An alumnus of Harvard Business School and Oxford University, Spier has carved a niche in the financial world with his disciplined investment philosophy. He is the managing partner of the Aquamarine Fund, an investment partnership inspired by the principles of Warren Buffett. Spier gained widespread recognition for his charitable winning bid to have lunch with Buffett, a move that significantly bolstered his reputation in the investment community. Through his writing and public speaking, Spier continues to inspire both novice and seasoned investors with his ethical approach to investing and life.

Showing 8 of 10 related collections

“When Genius Failed: The Rise and Fall of Long-Term Capital Management by Roger Lowenstein explores the complexities of finance and risk.”

When Genius Failed

By Roger Lowenstein

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy