Fiasco Book Summary

In 'Fiasco,' Frank Partnoy unveils the chaotic world of financial markets, where seemingly sound decisions can lead to catastrophic failures. He provides a gripping narrative of the 2008 financial crisis, dissecting the miscalculations and greed that fueled it. Through engaging anecdotes and sharp insights, Partnoy challenges readers to rethink risk and the nature of financial systems. This exploration serves as both a cautionary tale and a deep dive into the mechanisms that govern our economy. Prepare to question everything you thought you knew about finance and the true cost of ambition.

By Frank Partnoy

Published: 1999

"In the chaos of financial markets, where certainty is an illusion and calculated risks can lead to disaster, the true battle lies not in numbers but in understanding the unpredictable nature of human greed and ambition."

Book Review of Fiasco

FIASCO is the shocking story of one man's education in the jungles of Wall Street. As a young derivatives salesman at Morgan Stanley, Frank Partnoy learned to buy and sell billions of dollars worth of securities that were so complex many traders themselves didn't understand them. In his behind-the-scenes look at the trading floor and the offices of one of the world's top investment firms, Partnoy recounts the macho attitudes and fiercely competitive ploys of his office mates. And he takes us to the annual drunken skeet-shooting competition, FIASCO, where he and his colleagues sharpen the killer instincts they are encouraged to use against their competitiors, their clients, and each other. FIASCO is the first book to take on the derivatves trading industry, the most highly charged and risky sector of the stock market. More importantly, it is a blistering indictment of the largely unregulated market in derivatives and serves as a warning to unwary investors about real fiascos, which have cost billions of dollars.

Book Overview of Fiasco

About the Book Author

Frank Partnoy

Frank Partnoy is a respected author and legal scholar known for his insightful explorations of finance, law, and behavioral economics. His notable works include 'Fools Rush In: Investors Learn to Live with Volatility' and 'Wait: The Useful Art of Procrastination,' where he blends engaging storytelling with rigorous research. Partnoy's writing style is characterized by its accessibility and wit, making complex topics understandable to a broad audience. He is a professor at the University of San Diego School of Law and frequently writes on the intersections of finance and human behavior.

Book Details

Key information about the book.

- Authors

- Frank Partnoy

- Published

- February 1999

- Publisher

- Penguin

- ISBN

- 0140278796

- Language

- English

- Pages

- 289

- Genres

- True CrimeFinanceEconomic PolicyBehavioral Finance

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

The Real Book of Real Estate Book Summary

In "The Real Book of Real Estate," author Robert Kiyosaki unearths the hidden gems of wealth-building through property investment. With candid insights drawn from his own experiences, he dismantles common myths and reveals the strategies that can lead to financial freedom. This book isn’t just about numbers; it’s a masterclass in mindset, emphasizing the importance of surrounding yourself with the right team and resources. Kiyosaki’s engaging anecdotes and practical tips will inspire both novices and seasoned investors to reassess their approach to real estate. Prepare to unlock the secrets that could transform your financial future and discover the potential of becoming a savvy property mogul!

Save More Tomorrow Book Summary

In "Save More Tomorrow," behavioral finance pioneer Richard H. Thaler unveils a revolutionary approach to personal savings that empowers individuals to take control of their financial futures. By integrating the principles of human psychology with smart financial strategies, Thaler proposes a system where employees can commit to saving a portion of their future raises, making saving effortless and automatic. This innovative method not only combats the common barriers to saving but also transforms lifestyles and retirement outcomes. Through captivating anecdotes and research, Thaler illustrates how small behavioral tweaks can lead to monumental financial gains. Dive into this compelling narrative and discover how you can effortlessly boost your savings and secure a more prosperous future!

Fooled by Randomness Book Summary

In "Fooled by Randomness," Nassim Nicholas Taleb explores the hidden influence of chance in our lives, challenging our perceptions of luck, skill, and success. He argues that many people attribute their achievements to talent rather than the randomness that often underpins them. Through a blend of personal anecdotes and sharp wit, Taleb reveals how cognitive biases distort our understanding of risk and probability. He reminds us that, in the grand theater of life, we are often unwitting actors in a play scripted by randomness. Prepare to rethink your beliefs about fortune and failure as you uncover the profound truths lurking beneath the surface of chance.

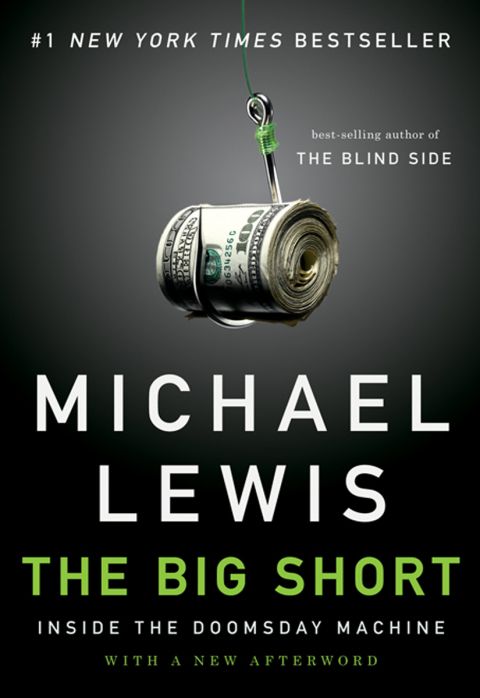

The Big Short: Inside the Doomsday Machine Book Summary

In "The Big Short," Michael Lewis unveils the hidden complexities of the 2008 financial crisis through the eyes of a few unconventional investors who saw disaster coming. As they bet against the housing market, these outsiders navigate Wall Street’s labyrinthine greed and negligence, exposing the flawed logic behind the crisis. With wit and suspense, Lewis reveals the shocking truth about the financial instruments that led to economic chaos. Readers will find themselves questioning the very foundations of finance while gripping the edge of their seats at the unfolding drama. Can a handful of mavericks really challenge the system, or are they just playing a dangerous game of chance?

Den of Thieves Book Summary

In "Den of Thieves," journalist James B. Stewart pulls back the curtain on the high-stakes world of corporate America during the 1980s. This riveting narrative chronicles the lives of power brokers and insider traders who bent the rules to accumulate unimaginable wealth. As greed intertwines with ambition, a thrilling tale of deception unfolds, leading to dramatic investigations and shocking convictions. Stewart masterfully blends real-life drama with insights into the financial markets, leaving readers on the edge of their seats. Dive into the labyrinth of moral ambiguity and see how far the quest for success can lead one astray!

Black Edge Book Summary

In "Black Edge," investigative journalist Sheelah Kolhatkar delves into the high-stakes world of hedge funds and the enigmatic figure of Steven A. Cohen. As she unravels the saga of insider trading, greed, and Wall Street's murky ethics, the book pulls readers into a gripping tale of ambition that spans decades. With intellectual prowess and audacious risk-taking, Cohen's rise to power raises questions about the moral compass of finance. Kolhatkar's penetrating analysis unveils the dark side of wealth and the relentless pursuit of success, leaving readers questioning the true cost of ambition. Will you dare to uncover the secrets of a financial titan and the shadowy underworld they inhabit?

When Genius Failed Book Summary

When Genius Failed chronicles the dramatic rise and fall of Long-Term Capital Management, a hedge fund that boasted an elite team of financial wizards. As it navigates the complexities of high-stakes finance and groundbreaking quantitative models, the book unveils how overconfidence in genius can lead to catastrophic consequences. When the Asian financial crisis strikes, the fund’s intricate strategies unravel, threatening the global economy. Authors Roger Lowenstein masterfully intertwine personal narratives with economic theory, revealing the fragile balance between risk and reward. This gripping tale serves as a cautionary reminder that brilliance can blind us to the dangers lurking beneath the surface.

Common Stocks and Uncommon Profits and Other Writings Book Summary

In "Common Stocks and Uncommon Profits," legendary investor Philip A. Fisher shares his groundbreaking approach to evaluating stocks, emphasizing the importance of understanding a company's long-term potential rather than just its current prices. Fisher introduces the "15 Points to Look for in a Common Stock," a comprehensive checklist that reveals the qualities of truly exceptional companies. With insightful anecdotes and practical wisdom, he challenges traditional investment strategies and highlights the significance of a strong management team. As readers delve into his meticulous analysis, they discover how to identify growth opportunities that others might overlook. This classic investment guide is not just a manual for profits; it's an invitation to think differently about wealth creation.

Showing 8 of 28 similar books

Similar Book Recommendations →

Shane Parrish's Book Recommendations

Shane Parrish is a renowned author and the founder of Farnam Street, a popular blog dedicated to personal development and decision-making. His insightful writings delve into mental models, critical thinking, and learning strategies, earning him a significant following among intellectuals and professionals alike. Parrish's work emphasizes the importance of continuous learning and thinking differently to achieve success. He is also the host of "The Knowledge Project" podcast, where he interviews leading thinkers to uncover their wisdom. His contributions have made a substantial impact on how readers approach problem-solving and personal growth.

Alexis Ohanian's Book Recommendations

Alexis Ohanian is an American entrepreneur, investor, and co-founder of Reddit, one of the world’s most popular social news and discussion platforms. Ohanian is also a prominent advocate for open internet and net neutrality, and he has invested in numerous startups through his venture capital firm, Initialized Capital. In addition to his work in tech, Ohanian is involved in philanthropy, supporting causes related to women’s rights, education, and social justice. He is married to tennis star Serena Williams, and together they advocate for gender equality and inclusive leadership. Ohanian’s influence in the tech world and his commitment to social impact have made him a respected figure in both business and activism.

Charlie Munger's Book Recommendations

Charlie Munger is an American investor, businessman, and philanthropist, best known as the vice chairman of Berkshire Hathaway, where he partners with Warren Buffett. Renowned for his insights on investment strategies and mental models, Munger has significantly influenced the world of finance. His notable literary contributions include "Poor Charlie's Almanack," a compilation of his speeches and writings that distill his wisdom on decision-making and business principles. Munger's work emphasizes the importance of multidisciplinary thinking and continuous learning. Beyond his financial acumen, he is celebrated for his charitable efforts, particularly in education and healthcare.

Patrick Collison's Book Recommendations

Patrick Collison is an Irish entrepreneur and co-founder of Stripe, a global technology company that enables businesses to accept online payments. Along with his brother John, Patrick has transformed Stripe into one of the most valuable private tech companies in the world. Stripe’s innovative approach to online payments has made it a key player in the financial technology space. Collison is known for his deep interest in science, technology, and policy, often engaging in conversations about innovation, progress, and how to improve societal outcomes. He is an advocate for scientific advancement and the intersection of technology and public policy.

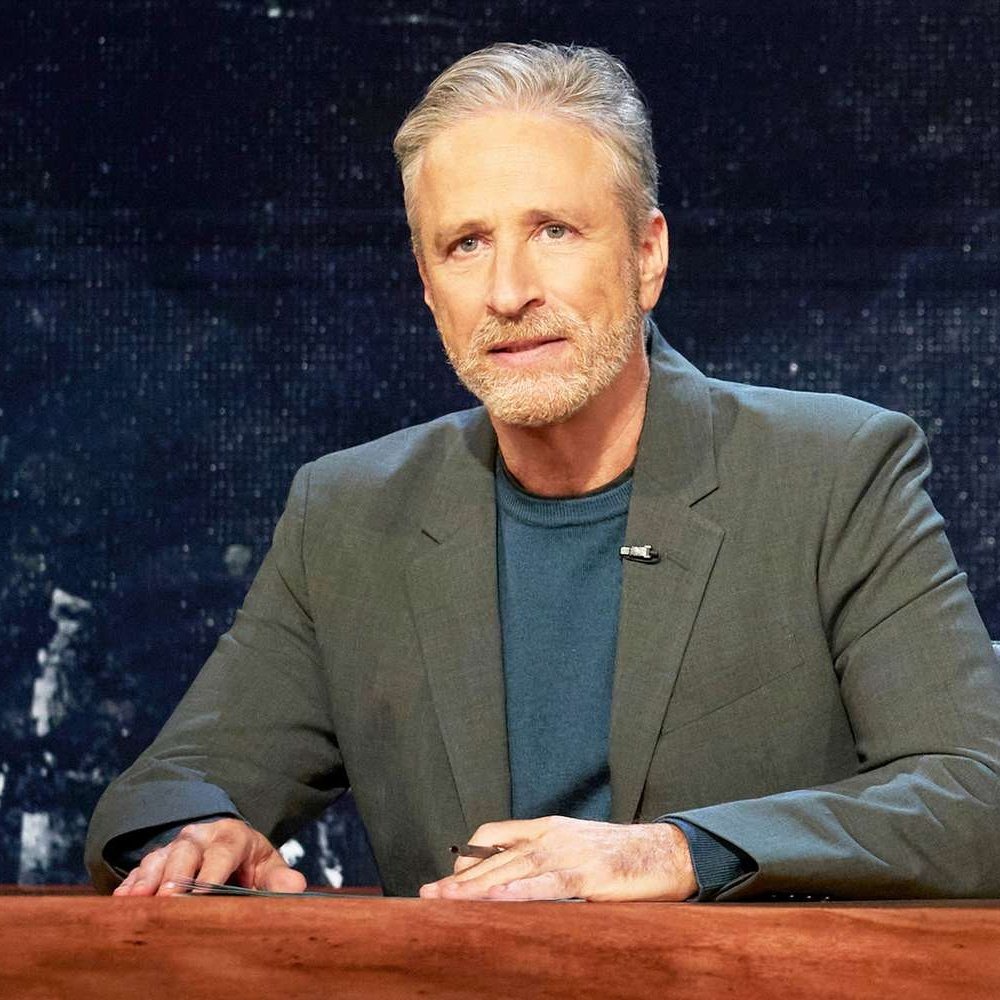

Jon Stewart's Book Recommendations

Jon Stewart is an American comedian, writer, and former host of The Daily Show, where he gained fame for his satirical take on news and politics. Stewart transformed The Daily Show into a critical voice in American media, blending humor with hard-hitting commentary on political and social issues. After stepping down from the show, Stewart has continued to advocate for causes like 9/11 first responders and veterans' rights. He is also a filmmaker, directing the political satire film Irresistible. Stewart remains a significant figure in American culture, known for his wit, activism, and influence on political discourse.

Bill Gurley's Book Recommendations

Bill Gurley is a prominent venture capitalist and general partner at Benchmark, a Silicon Valley venture capital firm. He is best known for his early investments in groundbreaking companies such as Uber, Zillow, and Grubhub, significantly shaping the tech industry's landscape. Gurley's insights into technology and business have been widely disseminated through his influential blog, "Above the Crowd," where he discusses market trends and investment strategies. His thought leadership extends beyond finance, offering valuable perspectives on innovation and entrepreneurship. Bill Gurley's contributions have earned him recognition as one of the most influential figures in venture capital today.

David Cancel's Book Recommendations

David Cancel is a prominent entrepreneur and author best known for his influential work in the tech and startup communities. As the CEO and co-founder of Drift, a leading conversational marketing platform, he has revolutionized how businesses engage with their customers online. Cancel has also authored insightful books such as "Hypergrowth," which offers valuable strategies for scaling startups rapidly. His contributions extend beyond literature as he frequently shares his expertise through speaking engagements and his popular podcast, "Seeking Wisdom." David Cancel's innovative ideas and practical advice continue to inspire and guide entrepreneurs worldwide.

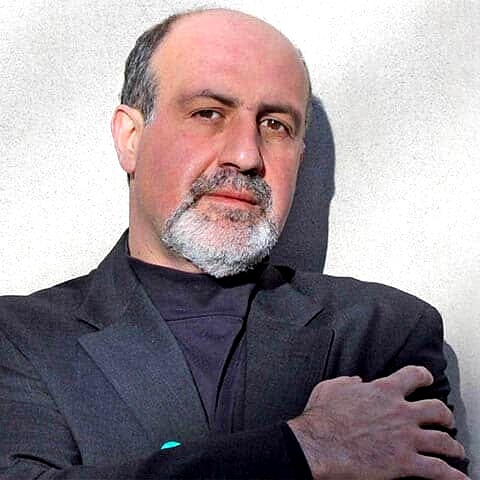

Nassim Nicholas Taleb's Book Recommendations

Nassim Nicholas Taleb is a Lebanese-American author, scholar, and risk analyst, best known for his work on uncertainty, probability, and risk. His books, including The Black Swan and Antifragile, explore how rare and unpredictable events shape the world and how individuals and systems can become more resilient to shocks. Taleb’s insights on risk management have influenced fields ranging from finance to medicine, and he is known for his outspoken criticism of conventional wisdom. His ideas about randomness, decision-making, and the limitations of human knowledge have made him a leading thinker in modern economics and philosophy.

Showing 8 of 14 related collections

“In the chaos of financial markets, where certainty is an illusion and calculated risks can lead to disaster, the true battle lies not in numbers but in understanding the unpredictable nature of human greed and ambition.”

Fiasco

By Frank Partnoy

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy