Fooling Some of the People All of the Time, A Long Short (and Now Complete) Story, Updated with New Epilogue Book Summary

In 'Fooling Some of the People All of the Time,' David Einhorn unveils the intricate web of lies and deception surrounding the financial world, particularly his infamous battle against a prominent company. This captivating narrative is not just a tale of investment loss but a profound examination of ethics, truth, and accountability. With detailed accounts and sharp analysis, Einhorn reveals the shocking lengths to which some will go to maintain their façade. Updated with a new epilogue, the story reflects on the aftermath of his struggles and the ongoing implications in today's financial landscape. Prepare to question everything you thought you knew about trust and transparency in the markets!

By David Einhorn

Published: 2010

"The truth, like a candle in the dark, can illuminate the darkest corners of the market, but only if someone is brave enough to light it."

Book Review of Fooling Some of the People All of the Time, A Long Short (and Now Complete) Story, Updated with New Epilogue

A revealing look at Wall Street, the financial media, and financial regulators by David Einhorn, the President of Greenlight Capital Could 2008's credit crisis have been minimized or even avoided? In 2002, David Einhorn-one of the country's top investors-was asked at a charity investment conference to share his best investment advice. Short sell Allied Capital. At the time, Allied was a leader in the private financing industry. Einhorn claimed Allied was using questionable accounting practices to prop itself up. Sound familiar? At the time of the original version of Fooling Some of the People All of the Time: A Long Short Story the outcome of his advice was unknown. Now, the story is complete and we know Einhorn was right. In 2008, Einhorn advised the same conference to short sell Lehman Brothers. And had the market been more open to his warnings, yes, the market meltdown might have been avoided, or at least minimized. Details the gripping battle between Allied Capital and Einhorn's Greenlight Capital Illuminates how questionable company practices are maintained and, at times, even protected by Wall Street Describes the failings of investment banks, analysts, journalists, and government regulators Describes how many parts of the Allied Capital story were replayed in the debate over Lehman Brothers Fooling Some of the People All of the Time is an important call for effective government regulation, free speech, and fair play.

Book Overview of Fooling Some of the People All of the Time, A Long Short (and Now Complete) Story, Updated with New Epilogue

About the Book Author

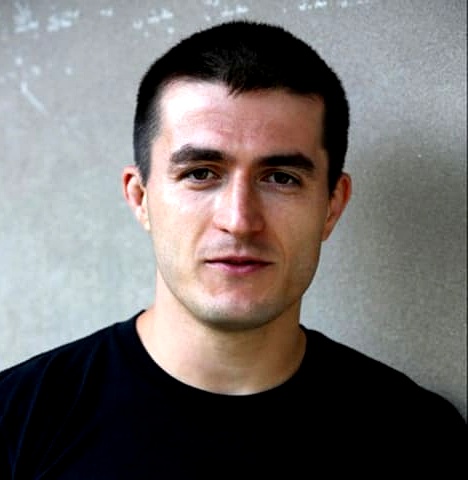

David Einhorn

David Einhorn is a renowned author and hedge fund manager, celebrated for his insightful analysis of financial markets and investment strategies. He is best known for his notable works, including 'Fooling Some of the People All of the Time: A Long Short Story' and 'The Little Book of Value Investing'. Einhorn's writing style combines a narrative approach with comprehensive financial analysis, making complex topics accessible to a broad audience. His expertise and critical perspective have established him as a thought leader in the finance community.

Book Details

Key information about the book.

- Authors

- David Einhorn

- Published

- December 2010

- Publisher

- John Wiley & Sons

- ISBN

- 0470481544

- Language

- English

- Pages

- 455

- Genres

- True CrimeFinanceBehavioral FinanceNon-FictionEthics and Morality

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

Fooled by Randomness Book Summary

In "Fooled by Randomness," Nassim Nicholas Taleb explores the hidden influence of chance in our lives, challenging our perceptions of luck, skill, and success. He argues that many people attribute their achievements to talent rather than the randomness that often underpins them. Through a blend of personal anecdotes and sharp wit, Taleb reveals how cognitive biases distort our understanding of risk and probability. He reminds us that, in the grand theater of life, we are often unwitting actors in a play scripted by randomness. Prepare to rethink your beliefs about fortune and failure as you uncover the profound truths lurking beneath the surface of chance.

Den of Thieves Book Summary

In "Den of Thieves," journalist James B. Stewart pulls back the curtain on the high-stakes world of corporate America during the 1980s. This riveting narrative chronicles the lives of power brokers and insider traders who bent the rules to accumulate unimaginable wealth. As greed intertwines with ambition, a thrilling tale of deception unfolds, leading to dramatic investigations and shocking convictions. Stewart masterfully blends real-life drama with insights into the financial markets, leaving readers on the edge of their seats. Dive into the labyrinth of moral ambiguity and see how far the quest for success can lead one astray!

Black Edge Book Summary

In "Black Edge," investigative journalist Sheelah Kolhatkar delves into the high-stakes world of hedge funds and the enigmatic figure of Steven A. Cohen. As she unravels the saga of insider trading, greed, and Wall Street's murky ethics, the book pulls readers into a gripping tale of ambition that spans decades. With intellectual prowess and audacious risk-taking, Cohen's rise to power raises questions about the moral compass of finance. Kolhatkar's penetrating analysis unveils the dark side of wealth and the relentless pursuit of success, leaving readers questioning the true cost of ambition. Will you dare to uncover the secrets of a financial titan and the shadowy underworld they inhabit?

Tap Dancing to Work Book Summary

In "Tap Dancing to Work," acclaimed investor and business magnate Warren Buffett offers an intimate glimpse into his extraordinary life and investment philosophy. Through a collection of articles, interviews, and letters, he reveals the secrets behind his unmatched success and unorthodox approach to investing. With wit and wisdom, Buffett explores the intersection of finance and personal values, all while sharing anecdotes that humanize his legendary persona. This treasure trove of insights not only showcases his brilliant strategies but also encourages readers to embrace their passions and pursue lifelong learning. Discover how the “Oracle of Omaha” has danced through challenges and opportunities alike—an inspiring journey that invites you to reflect on your own path to success.

Made in America Book Summary

In "Made in America," Sam Walton, the visionary founder of Walmart, shares his incredible journey from modest beginnings to building one of the world’s largest retail empires. Through candid anecdotes and insights, Walton reveals the secrets behind his revolutionary approach to customer service and efficiency. This compelling narrative not only chronicles the rise of a retail giant but also offers timeless lessons on entrepreneurship and innovation. As Walton reflects on the values that shaped his success, he challenges readers to rethink their own business strategies. Discover how grit, determination, and a touch of Southern charm transformed the American shopping experience forever!

Fiasco Book Summary

In 'Fiasco,' Frank Partnoy unveils the chaotic world of financial markets, where seemingly sound decisions can lead to catastrophic failures. He provides a gripping narrative of the 2008 financial crisis, dissecting the miscalculations and greed that fueled it. Through engaging anecdotes and sharp insights, Partnoy challenges readers to rethink risk and the nature of financial systems. This exploration serves as both a cautionary tale and a deep dive into the mechanisms that govern our economy. Prepare to question everything you thought you knew about finance and the true cost of ambition.

Why We Sleep Book Summary

In 'Why We Sleep,' neuroscientist Matthew Walker explores the vital role sleep plays in our lives, uncovering its impact on our health, cognition, and emotional well-being. He reveals that sleep is not just a passive state but a powerful tool for peak performance, creative problem-solving, and learning. Walker delves into the science of sleep cycles, debunking myths and highlighting the dangers of sleep deprivation. Through compelling research and insights, he urges readers to prioritize sleep for a healthier, happier life. Can you afford to lose a third of your life to sleepless nights?

Dawn of the New Everything Book Summary

In 'Dawn of the New Everything,' visionary thinker Jaron Lanier presents a provocative exploration of virtual reality and its implications for humanity. He intertwines personal anecdotes with thought-provoking insights about technology's role in shaping our perceptions and experiences. Lanier challenges readers to reconsider the essence of reality and the nature of human connection in an increasingly digital world. With his blend of optimism and caution, he invites us to envision a future where technology can enhance our existence rather than detract from it. This book compels us to rethink our relationship with virtual environments and the identities we forge within them.

Showing 8 of 27 similar books

Similar Book Recommendations →

Bill Ackman's Book Recommendations

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

Chris Dixon's Book Recommendations

Chris Dixon is a notable venture capitalist and technology entrepreneur, best known for his influential role as a general partner at Andreessen Horowitz, where he leads investments in cryptocurrency and blockchain technology. Before joining the firm, Dixon co-founded two startups: SiteAdvisor, a web security company acquired by McAfee, and Hunch, a recommendation engine acquired by eBay. In addition to his investment career, Dixon is a prolific writer and thought leader on technology and innovation, contributing insightful essays and articles to various platforms such as his personal blog and Medium. His writings often explore the future of technology, the internet, and the impact of blockchain, making significant contributions to contemporary tech literature. Dixon's work has earned him recognition as a visionary in both the tech and literary worlds.

Julian Shapiro's Book Recommendations

Julian Shapiro is a renowned writer and entrepreneur, acclaimed for his insightful essays on personal growth and marketing strategies. He is the author of "The Julian Shapiro Collection," a compilation of his most impactful writings that have garnered a wide readership online. Shapiro co-founded the growth marketing agency Bell Curve, where he has helped numerous startups achieve exponential growth. His work often blends practical advice with deep philosophical inquiries, making complex subjects accessible to a broad audience. Through his prolific writing and entrepreneurial ventures, Julian has become a key figure in the intersection of business and self-improvement literature.

Lex Fridman's Book Recommendations

Lex Fridman is an artificial intelligence researcher, podcaster, and MIT professor, known for his work in autonomous vehicles, robotics, and deep learning. Fridman has gained widespread popularity through his podcast, Lex Fridman Podcast, where he interviews leading thinkers in science, technology, and philosophy, exploring topics like AI, consciousness, and the future of humanity. His academic work focuses on human-centered AI, aiming to create machines that can better understand and interact with humans. Fridman’s ability to distill complex topics into accessible conversations has earned him a large following, and his podcast is known for its thoughtful, in-depth discussions with some of the brightest minds of our time. He is also an advocate for the responsible development of AI, emphasizing the ethical implications of this rapidly advancing technology. Outside of academia and podcasting, Fridman is a practitioner of jiu-jitsu and frequently speaks about the importance of discipline and continuous learning.

Naval Ravikant's Book Recommendations

Naval Ravikant is an entrepreneur, angel investor, and philosopher, best known as the co-founder of AngelList, a platform that connects startups with investors. Ravikant is a prolific thinker and writer on topics such as startups, investing, and personal well-being, sharing his wisdom through essays, podcasts, and social media. He has invested in over 100 companies, including Uber, Twitter, and Yammer, making him one of Silicon Valley’s most successful angel investors. Ravikant is also known for his philosophical musings on wealth, happiness, and the meaning of life, which have garnered him a large and dedicated following.

Marc Andreessen's Book Recommendations

Marc Andreessen is an American entrepreneur, software engineer, and venture capitalist, best known for co-creating the Mosaic web browser, the first widely-used web browser, and co-founding Netscape. Andreessen is also the co-founder of Andreessen Horowitz, one of Silicon Valley’s most prominent venture capital firms, where he invests in groundbreaking technology companies like Facebook, Airbnb, and Coinbase. He is a thought leader on the impact of technology and innovation, often sharing his views on the future of the internet and startups. His contributions to the development of the web and the tech ecosystem have made him one of the most influential figures in technology.

Ray Dalio's Book Recommendations

Ray Dalio is the founder of Bridgewater Associates, one of the largest and most successful hedge funds in the world. He is also the author of the bestselling book Principles, where he outlines his philosophy on life, leadership, and investing. Ray is renowned for his unique approach to transparency, radical truth, and thoughtful disagreement within organizations. His insights into economics and investing have made him one of the most influential figures in the financial world. Dalio continues to be a thought leader in business, economics, and philanthropy.

Andrew Lokenauth's Book Recommendations

Andrew Lokenauth is a distinguished author and financial expert known for his insightful contributions to personal finance and investment literature. With a career spanning over a decade, he has written extensively on topics such as wealth management, financial planning, and market analysis. Lokenauth's works are celebrated for their clarity and practical advice, making complex financial concepts accessible to a broad audience. He has been featured in numerous financial publications and has established himself as a trusted voice in the industry. Beyond his writing, Lokenauth is also a sought-after speaker, sharing his expertise at various seminars and workshops.

Showing 8 of 20 related collections

“The truth, like a candle in the dark, can illuminate the darkest corners of the market, but only if someone is brave enough to light it.”

Fooling Some of the People All of the Time, A Long Short (and Now Complete) Story, Updated with New Epilogue

By David Einhorn

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy