Other People's Money Book Summary

In 'Other People's Money,' Charles V. Bagli unravels the high-stakes world of real estate financing in New York City. As he navigates through scandal and ambition, Bagli reveals how fortunes are made and lost on the backs of unsuspecting investors. The narrative is a gripping exploration of greed, power, and the complexities of ethical investment. With vivid character portraits and meticulous research, the book exposes the secretive dealings of industry moguls. This compelling read raises the question: what happens when the thirst for profit overshadows principles?

By Charles V. Bagli

Published: 2014

"In the world of finance, the true value of money lies not in its accumulation, but in its ability to shape destinies and transform landscapes."

Book Review of Other People's Money

A veteran New York Times reporter dissects the most spectacular failure in real estate history Real estate giant Tishman Speyer and its partner, BlackRock, lost billions of dollars when their much-vaunted purchase of Stuyvesant Town–Peter Cooper Village in New York City failed to deliver the expected profits. But how did Tishman Speyer walk away from the deal unscathed, while others took the financial hit—and MetLife scored a $3 billion profit? Illuminating the world of big real estate the way Too Big to Fail did for banks, Other People’s Money is a riveting account of politics, high finance, and the hubris that ultimately led to the nationwide real estate meltdown.

Book Overview of Other People's Money

About the Book Author

Charles V. Bagli

Charles V. Bagli is a distinguished author and journalist known for his incisive commentary on urban development and real estate in New York City. He has written extensively for The New York Times, where he has covered various aspects of city life, politics, and infrastructure. Among his notable works is 'Other People's Money: The Rise and Fall of the Great American Foreclosure Boom,' which explores the complexities of the foreclosure crisis and its impact on communities. Bagli's writing is characterized by its thorough research, compelling narratives, and a keen insight into the socio-economic factors shaping urban landscapes.

Book Details

Key information about the book.

- Authors

- Charles V. Bagli

- Published

- March 2014

- Publisher

- Penguin

- ISBN

- 0142180718

- Language

- English

- Pages

- 434

- Genres

- FinanceBusiness and EconomicsBehavioral Finance

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

MONEY Master the Game Book Summary

In "Money: Master the Game," Tony Robbins unlocks the secrets to financial freedom through insights from legendary investors and his own transformative experiences. He presents a comprehensive blueprint that demystifies the world of finance, empowering readers to take control of their financial destinies. Packed with actionable strategies, Robbins reveals the psychological barriers that hold us back from wealth and how to overcome them. The book challenges conventional wisdom, urging readers to think differently about money and investing. Get ready to embark on an enlightening journey that could reshape your financial future forever!

Save More Tomorrow Book Summary

In "Save More Tomorrow," behavioral finance pioneer Richard H. Thaler unveils a revolutionary approach to personal savings that empowers individuals to take control of their financial futures. By integrating the principles of human psychology with smart financial strategies, Thaler proposes a system where employees can commit to saving a portion of their future raises, making saving effortless and automatic. This innovative method not only combats the common barriers to saving but also transforms lifestyles and retirement outcomes. Through captivating anecdotes and research, Thaler illustrates how small behavioral tweaks can lead to monumental financial gains. Dive into this compelling narrative and discover how you can effortlessly boost your savings and secure a more prosperous future!

Nudge Book Summary

In "Nudge," behavioral economists Richard Thaler and Cass Sunstein unveil the subtle art of influencing choices and shaping outcomes without restricting freedom. They explore how small, seemingly insignificant changes in the way options are presented can lead to drastically improved decisions in health, finance, and overall happiness. With compelling real-world examples and engaging insights, the authors demonstrate how understanding human psychology can empower individuals and policymakers alike. Dive into a world where choice architecture transforms lives and reshapes society's approach to welfare. Discover the hidden nudges that could change everything about the way we choose!

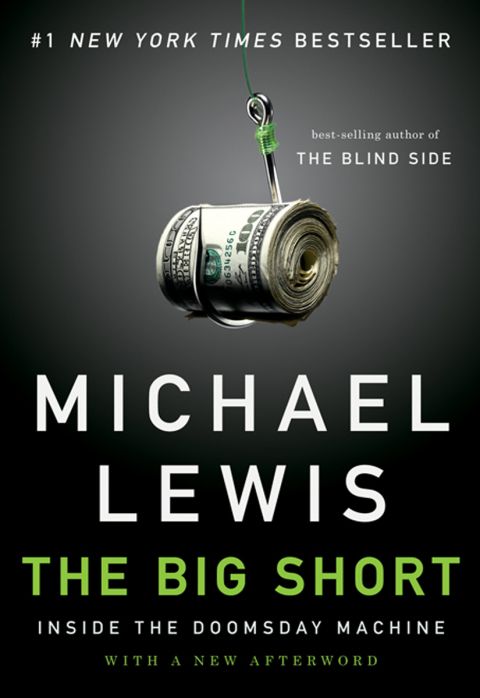

The Big Short: Inside the Doomsday Machine Book Summary

In "The Big Short," Michael Lewis unveils the hidden complexities of the 2008 financial crisis through the eyes of a few unconventional investors who saw disaster coming. As they bet against the housing market, these outsiders navigate Wall Street’s labyrinthine greed and negligence, exposing the flawed logic behind the crisis. With wit and suspense, Lewis reveals the shocking truth about the financial instruments that led to economic chaos. Readers will find themselves questioning the very foundations of finance while gripping the edge of their seats at the unfolding drama. Can a handful of mavericks really challenge the system, or are they just playing a dangerous game of chance?

Liar's Poker Book Summary

Liar's Poker takes you deep into the high-stakes world of Wall Street during the 1980s, where the line between truth and deception blurs in the cutthroat arena of finance. Author Michael Lewis pulls back the curtain on the chaotic life of bond traders, showcasing a ruthless culture driven by greed and bravado. Through vivid anecdotes and sharp insights, readers are thrust into the thrilling, sometimes absurd realm of investment banking. As Lewis navigates the intricacies of "big swinging d***s," he unveils the strategies and psychological games that define success in this high-pressure environment. Will you emerge with a new understanding of the financial world and its enigmatic players?

Black Edge Book Summary

In "Black Edge," investigative journalist Sheelah Kolhatkar delves into the high-stakes world of hedge funds and the enigmatic figure of Steven A. Cohen. As she unravels the saga of insider trading, greed, and Wall Street's murky ethics, the book pulls readers into a gripping tale of ambition that spans decades. With intellectual prowess and audacious risk-taking, Cohen's rise to power raises questions about the moral compass of finance. Kolhatkar's penetrating analysis unveils the dark side of wealth and the relentless pursuit of success, leaving readers questioning the true cost of ambition. Will you dare to uncover the secrets of a financial titan and the shadowy underworld they inhabit?

The Essays of Warren Buffett Book Summary

In "The Essays of Warren Buffett," the legendary investor distills decades of wisdom into a compelling collection of insights on investing, business, and life. Through a series of thought-provoking essays, Buffett shares his unique perspective on risk, value, and the importance of patience in the tumultuous world of finance. His distinctive voice combines humor with profound lessons, making complex concepts accessible to both novice investors and seasoned pros. As you delve into his reflections, you'll uncover the principles that have guided his success and how they can be applied to your own financial journey. Prepare to be inspired and challenged to rethink your approach to investing and wealth-building!

A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing (Ninth Edition) Book Summary

In "A Random Walk Down Wall Street," Burton Malkiel challenges the myth of market predictability and unveils the chaos underlying financial markets. Through engaging anecdotes and sharp insights, he demystifies complex investment strategies while advocating for the simplicity of index funds. Readers are taken on a journey through the history of financial theory and practical investing advice, revealing how randomness shapes market movements. Malkiel's compelling arguments will make you question conventional wisdom and reconsider your approach to investing. Are you ready to explore the unpredictable world of finance and learn how to navigate it wisely?

Showing 8 of 30 similar books

Similar Book Recommendations →

Niki Scevak's Book Recommendations

Niki Scevak is a distinguished entrepreneur and venture capitalist, widely recognized for his contributions to the startup ecosystem rather than traditional literature. As a co-founder and partner at Blackbird Ventures, he has played a pivotal role in funding and mentoring successful Australian tech startups. Scevak also co-founded Startmate, an influential accelerator program that has shaped numerous early-stage companies. His work has significantly impacted the Australian tech landscape, fostering innovation and entrepreneurial growth. Though not an author of traditional books, his insights and thought leadership are frequently shared through industry publications and speaking engagements.

Drew Houston's Book Recommendations

Drew Houston is an accomplished American entrepreneur best known for co-founding Dropbox, a widely-used cloud storage service, in 2007. As the CEO, he has led the company to serve millions of users worldwide and become a key player in the tech industry. Although not primarily known for literature, Houston has shared his entrepreneurial insights and experiences through various interviews and public speaking engagements, offering valuable lessons to aspiring business leaders. His work has significantly influenced the way people and organizations manage and share digital content. Houston's innovative vision continues to shape the future of cloud computing and digital collaboration.

David Bach's Book Recommendations

David Bach is a financial expert and bestselling author known for his Finish Rich book series, including The Automatic Millionaire. He has made a career out of teaching people how to build wealth through small, manageable financial habits like “paying yourself first” and automating savings. His approach to personal finance is accessible and focuses on helping everyday individuals achieve long-term financial security. David has appeared on numerous media platforms, advocating for financial literacy and encouraging people to take control of their financial futures.

Bernie Sanders's Book Recommendations

Bernie Sanders is an American politician and U.S. Senator from Vermont, known for his progressive policies and his advocacy for economic equality. Sanders ran for the Democratic presidential nomination in 2016 and 2020, inspiring a movement with his calls for Medicare for All, free college tuition, and a $15 minimum wage. He identifies as a democratic socialist and has been a long-standing advocate for labor rights, environmental justice, and social welfare programs. Sanders’ candidacy energized a new generation of activists and has had a lasting influence on the direction of the Democratic Party. His focus on income inequality and social justice continues to shape political discourse in the U.S.

Ana Fabrega's Book Recommendations

Ana Lorena Fabrega is an innovative educator and author passionate about reimagining education. Known as “Ms. Fab,” she is the Chief Evangelist at Synthesis, an education startup inspired by the problem-solving and collaboration model used at SpaceX. She advocates for alternative learning methods, encouraging curiosity and creativity in students. Ana's work emphasizes the importance of engaging young learners in real-world challenges and critical thinking. She also shares insights on education reform through her popular newsletter, Fab Fridays.

Charlie Munger's Book Recommendations

Charlie Munger is an American investor, businessman, and philanthropist, best known as the vice chairman of Berkshire Hathaway, where he partners with Warren Buffett. Renowned for his insights on investment strategies and mental models, Munger has significantly influenced the world of finance. His notable literary contributions include "Poor Charlie's Almanack," a compilation of his speeches and writings that distill his wisdom on decision-making and business principles. Munger's work emphasizes the importance of multidisciplinary thinking and continuous learning. Beyond his financial acumen, he is celebrated for his charitable efforts, particularly in education and healthcare.

Andrew Lokenauth's Book Recommendations

Andrew Lokenauth is a distinguished author and financial expert known for his insightful contributions to personal finance and investment literature. With a career spanning over a decade, he has written extensively on topics such as wealth management, financial planning, and market analysis. Lokenauth's works are celebrated for their clarity and practical advice, making complex financial concepts accessible to a broad audience. He has been featured in numerous financial publications and has established himself as a trusted voice in the industry. Beyond his writing, Lokenauth is also a sought-after speaker, sharing his expertise at various seminars and workshops.

Naval Ravikant's Book Recommendations

Naval Ravikant is an entrepreneur, angel investor, and philosopher, best known as the co-founder of AngelList, a platform that connects startups with investors. Ravikant is a prolific thinker and writer on topics such as startups, investing, and personal well-being, sharing his wisdom through essays, podcasts, and social media. He has invested in over 100 companies, including Uber, Twitter, and Yammer, making him one of Silicon Valley’s most successful angel investors. Ravikant is also known for his philosophical musings on wealth, happiness, and the meaning of life, which have garnered him a large and dedicated following.

Showing 8 of 12 related collections

“In the world of finance, the true value of money lies not in its accumulation, but in its ability to shape destinies and transform landscapes.”

Other People's Money

By Charles V. Bagli

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy