The Essays of Warren Buffett Book Summary

In "The Essays of Warren Buffett," the legendary investor distills decades of wisdom into a compelling collection of insights on investing, business, and life. Through a series of thought-provoking essays, Buffett shares his unique perspective on risk, value, and the importance of patience in the tumultuous world of finance. His distinctive voice combines humor with profound lessons, making complex concepts accessible to both novice investors and seasoned pros. As you delve into his reflections, you'll uncover the principles that have guided his success and how they can be applied to your own financial journey. Prepare to be inspired and challenged to rethink your approach to investing and wealth-building!

By Lawrence A. Cunningham, Warren E. Buffett

Published: 2013

"Risk arises from not knowing what you’re doing."

Book Review of The Essays of Warren Buffett

In the third edition of this international best seller, Lawrence Cunningham brings you the latest wisdom from Warren Buffett’s annual letters to Berkshire Hathaway shareholders. New material addresses: the financial crisis and its continuing implications for investors, managers and society; the housing bubble at the bottom of that crisis; the debt and derivatives excesses that fueled the crisis and how to deal with them; controlling risk and protecting reputation in corporate governance; Berkshire’s acquisition and operation of Burlington Northern Santa Fe; the role of oversight in heavily regulated industries; investment possibilities today; and weaknesses of popular option valuation models. Some other material has been rearranged to deepen the themes and lessons that the collection has always produced: Buffett’s “owner-related business principles” are in the prologue as a separate subject and valuation and accounting topics are spread over four instead of two sections and reordered to sharpen their payoff. Media coverage is available at the following links: Interviews/Podcasts: Motley Fool, click here. Money, Riches and Wealth, click here. Manual of Ideas, click here. Corporate Counsel, click here. Reviews: William J. Taylor, ABA Banking Journal, click here. Bob Morris, Blogging on Business, click here. Pamela Holmes, Saturday Evening Post, click here. Kevin M. LaCroix, D&O Diary, click here. Blog Posts: On Finance issues (Columbia University), click here. On Berkshire post-Buffett (Manual of Ideas), click here. On Publishing the book (Value Walk), click here. On Governance issues (Harvard University blog), click here. Featured Stories/Recommended Reading: Motley Fool, click here. Stock Market Blog, click here. Motley Fool Interviews with LAC at Berkshire's 2013 Annual Meeting Berkshire Businesses: Vastly Different, Same DNA, click here. Is Berkshire's Fat Wallet an Enemy to Its Success?, click here. Post-Buffett Berkshire: Same Question, Same Answer, click here. How a Disciplined Value Approach Works Across the Decades, click here. Through the Years: Constant Themes in Buffett's Letters, click here. Buffett's Single Greatest Accomplishment, click here. Where Buffett Is Finding Moats These Days, click here. How Buffett Has Changed Through the Years, click here. Speculating on Buffett's Next Acquisition, click here. Buffett Says “Chief Risk Officers” Are a Terrible Mistake, click here. Berkshire Without Buffett, click here.

Book Overview of The Essays of Warren Buffett

About the Book Authors

Lawrence A. Cunningham

Lawrence A. Cunningham is an acclaimed author and professor known for his expertise in finance, investment, and the intersection of literature and business. He is the author of several notable works, including "The Essays of Warren Buffett: Lessons for Corporate America," which has garnered widespread recognition for its insightful compilation of Buffett's thoughts on investing and corporate governance. Cunningham is also the author of "Value: The Four Cornerstones of Corporate Finance" and "The Intelligent Investor: A Guide to Value Investing," which reflects his commitment to making complex financial concepts accessible to a broader audience.

Cunningham’s writing style is characterized by clarity and pragmatism, blending analytical rigor with engaging narratives that appeal to both seasoned investors and novices alike. As a professor at George Washington University Law School and a sought-after speaker, he continues to influence the fields of finance and business through his compelling writing and teaching. His work not only educates but also inspires readers to think critically about investment strategies and corporate ethics in the modern economy.

Warren E. Buffett

Warren E. Buffett is a distinguished American investor, business tycoon, and philanthropist, widely regarded as one of the most successful investors in history. Born on August 30, 1930, in Omaha, Nebraska, Buffett is the chairman and CEO of Berkshire Hathaway, a multinational conglomerate holding company. He is known for his value investing philosophy, which emphasizes long-term investments in undervalued companies with strong fundamentals.

Buffett's notable works include his annual letters to Berkshire Hathaway shareholders, which have become essential reading for investors and provide insights into his investment strategies and economic outlook. These letters are characterized by their clarity, wit, and profound insights into market behavior and corporate governance. Additionally, his co-authored book, The Intelligent Investor (with Benjamin Graham), remains a classic in investment literature, promoting the principles of value investing.

With a writing style that is both accessible and engaging, Buffett speaks directly to his audience, breaking down complex financial concepts into understandable terms, making him a respected figure not just in finance but also in the realm of literature related to business and investing. His ability to distill wisdom from decades of market experience continues to inspire investors worldwide.

Book Details

Key information about the book.

- Authors

- Lawrence A. Cunningham, Warren E. Buffett

- Published

- March 2013

- Publisher

- Carolina Academic Press

- ISBN

- 1611634474

- Language

- English

- Pages

- 281

- Genres

- FinanceBusiness and EconomicsBehavioral FinanceSuccess StoriesPersonal FinanceInvesting Basics

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

I Will Teach You to Be Rich, Second Edition Book Summary

In 'I Will Teach You to Be Rich, Second Edition,' Ramit Sethi provides a no-nonsense guide to mastering personal finance with a blend of humor and practicality. He challenges conventional money advice and introduces readers to a unique banking system for maximizing their savings. Through straightforward strategies, Sethi reveals how to automate finances and invest wisely for the long term. Each chapter brims with actionable tips that encourage readers to take control of their financial futures. With insights that delve deep into psychology and behavior, this book is a game-changer for anyone seeking to build real wealth.

Your Money or Your Life Book Summary

In 'Your Money or Your Life', Vicki Robin and Joe Dominguez challenge you to redefine your relationship with money and reshape your life. They introduce a transformative program that combines financial independence with personal fulfillment, urging readers to evaluate what truly brings them happiness. With practical tools and real-life examples, the authors guide you through a holistic approach to budgeting and spending. The book encourages you to assess the true cost of your lifestyle choices and empowers you to reclaim your time and energy. Are you ready to discover the secret to living abundantly without being a slave to your income?

Liar's Poker Book Summary

Liar's Poker takes you deep into the high-stakes world of Wall Street during the 1980s, where the line between truth and deception blurs in the cutthroat arena of finance. Author Michael Lewis pulls back the curtain on the chaotic life of bond traders, showcasing a ruthless culture driven by greed and bravado. Through vivid anecdotes and sharp insights, readers are thrust into the thrilling, sometimes absurd realm of investment banking. As Lewis navigates the intricacies of "big swinging d***s," he unveils the strategies and psychological games that define success in this high-pressure environment. Will you emerge with a new understanding of the financial world and its enigmatic players?

Den of Thieves Book Summary

In "Den of Thieves," journalist James B. Stewart pulls back the curtain on the high-stakes world of corporate America during the 1980s. This riveting narrative chronicles the lives of power brokers and insider traders who bent the rules to accumulate unimaginable wealth. As greed intertwines with ambition, a thrilling tale of deception unfolds, leading to dramatic investigations and shocking convictions. Stewart masterfully blends real-life drama with insights into the financial markets, leaving readers on the edge of their seats. Dive into the labyrinth of moral ambiguity and see how far the quest for success can lead one astray!

Black Edge Book Summary

In "Black Edge," investigative journalist Sheelah Kolhatkar delves into the high-stakes world of hedge funds and the enigmatic figure of Steven A. Cohen. As she unravels the saga of insider trading, greed, and Wall Street's murky ethics, the book pulls readers into a gripping tale of ambition that spans decades. With intellectual prowess and audacious risk-taking, Cohen's rise to power raises questions about the moral compass of finance. Kolhatkar's penetrating analysis unveils the dark side of wealth and the relentless pursuit of success, leaving readers questioning the true cost of ambition. Will you dare to uncover the secrets of a financial titan and the shadowy underworld they inhabit?

When Genius Failed Book Summary

When Genius Failed chronicles the dramatic rise and fall of Long-Term Capital Management, a hedge fund that boasted an elite team of financial wizards. As it navigates the complexities of high-stakes finance and groundbreaking quantitative models, the book unveils how overconfidence in genius can lead to catastrophic consequences. When the Asian financial crisis strikes, the fund’s intricate strategies unravel, threatening the global economy. Authors Roger Lowenstein masterfully intertwine personal narratives with economic theory, revealing the fragile balance between risk and reward. This gripping tale serves as a cautionary reminder that brilliance can blind us to the dangers lurking beneath the surface.

Crushing It! Book Summary

In “Crush It!”, Gary Vaynerchuk ignites a passion for pursuing your dreams by harnessing the power of social media. He shares his own journey from a struggling wine retailer to a successful entrepreneur, demonstrating that authenticity and hard work can lead to incredible success. With practical advice and invigorating stories, Vaynerchuk inspires readers to turn their passions into profitable businesses. He emphasizes the importance of personal branding in today’s digital age, encouraging everyone to share their voices boldly. Ready to transform your passion into a thriving career? Dive in and discover how to “crush it!” today!

Stillness Is the Key Book Summary

In "Stillness Is the Key," Ryan Holiday unveils the transformative power of tranquility in a chaotic world. Drawing inspiration from philosophy, history, and modern examples, he reveals how stillness can unlock our potential and foster clarity in decision-making. Holiday guides readers through practical strategies for cultivating inner peace, helping them navigate life’s demands with resilience. He argues that true success lies not in relentless activity, but in finding moments of quiet reflection. Immerse yourself in this compelling read and discover how stillness can be the ultimate catalyst for a fulfilling life.

Showing 8 of 23 similar books

Similar Book Recommendations →

James Clear's Book Recommendations

James Clear is the author of the bestselling book Atomic Habits, which focuses on the power of small habits and incremental improvements to achieve significant personal and professional growth. Clear’s writing blends insights from psychology, neuroscience, and productivity to provide practical strategies for building better habits. His work has helped millions of people create positive changes in their lives by focusing on the process rather than the outcome. James’s clear, actionable advice has made him a sought-after speaker and thought leader in the field of personal development.

David Cancel's Book Recommendations

David Cancel is a prominent entrepreneur and author best known for his influential work in the tech and startup communities. As the CEO and co-founder of Drift, a leading conversational marketing platform, he has revolutionized how businesses engage with their customers online. Cancel has also authored insightful books such as "Hypergrowth," which offers valuable strategies for scaling startups rapidly. His contributions extend beyond literature as he frequently shares his expertise through speaking engagements and his popular podcast, "Seeking Wisdom." David Cancel's innovative ideas and practical advice continue to inspire and guide entrepreneurs worldwide.

Graham Stephan's Book Recommendations

Graham Stephan is a prominent real estate investor, YouTuber, and personal finance guru known for his insightful content on financial independence and investment strategies. He began his career in real estate at the age of 18 and quickly rose to prominence, amassing a multi-million-dollar portfolio. Stephan's YouTube channel, which boasts millions of subscribers, offers accessible and practical advice on budgeting, saving, and investing, earning him widespread acclaim and a dedicated following. In addition to his online presence, he has been featured in numerous high-profile publications and media outlets, solidifying his status as an influential figure in personal finance education. Through his work, Stephan has empowered countless individuals to take control of their finances and pursue financial freedom.

Rob Dyrdek's Book Recommendations

Rob Dyrdek is an American entrepreneur, actor, producer, and former professional skateboarder, best known for his influential role in popularizing skateboarding through his television shows on MTV. Although not primarily recognized for his contributions to literature, Dyrdek has authored the motivational book "The Dyrdek Machine: A Blueprint for Building Your Own Business," which provides insights into his entrepreneurial ventures and personal philosophy. His work has inspired many aspiring entrepreneurs and athletes by sharing his journey from skateboarding to business success. Dyrdek's impact extends beyond the written word, as he has founded multiple successful companies and created platforms that promote creativity and innovation. His multifaceted career serves as a testament to his ability to inspire and lead across various industries.

Howard Marks's Book Recommendations

Howard Marks was a renowned Welsh author and drug smuggler, best known for his bestselling autobiography, "Mr Nice," published in 1996. The book chronicles his complex life, from Oxford University graduate to one of the world's most infamous cannabis traffickers. Marks' candid storytelling and unique perspective earned him a cult following and critical acclaim, transforming him into a counterculture icon. He further contributed to literature with several other works, including "Señor Nice" and "Sympathy for the Devil." Marks' legacy continues to influence discussions on drug policy and the criminal justice system.

David Heinemeier Hansson's Book Recommendations

David Heinemeier Hansson, also known as DHH, is a Danish programmer, entrepreneur, and author, best known as the creator of Ruby on Rails, a popular web application framework. Heinemeier Hansson is also a partner at Basecamp, a project management and collaboration software company he co-founded. His contributions to software development have earned him widespread recognition, with Ruby on Rails being used by thousands of developers and companies worldwide. Heinemeier Hansson is also a vocal advocate for remote work, simplicity in business, and sustainable work practices, ideas he explores in his bestselling books Rework and It Doesn’t Have to Be Crazy at Work. In addition to his work in tech, he is an accomplished race car driver, having competed in the 24 Hours of Le Mans. Heinemeier Hansson’s approach to work-life balance and entrepreneurship has made him a thought leader in the tech community, where he continues to challenge traditional business practices and advocate for more human-centered approaches to work

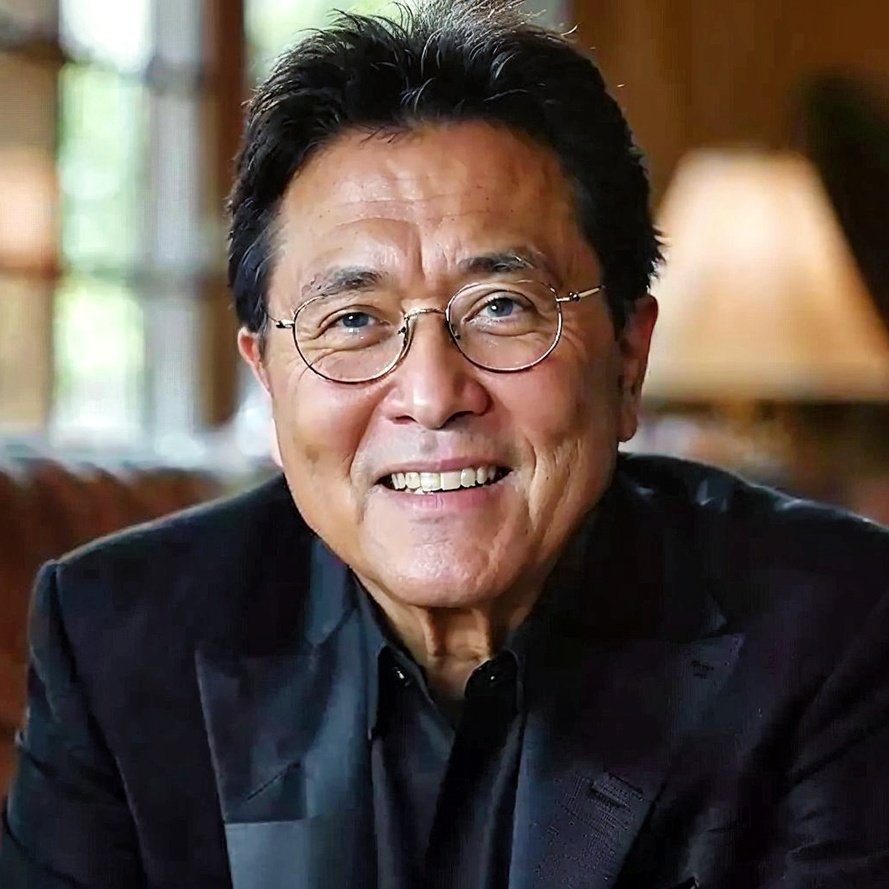

Robert Kiyosaki's Book Recommendations

Robert Kiyosaki is the author of the bestselling personal finance book Rich Dad Poor Dad, which challenges conventional wisdom on wealth building and financial literacy. He is a self-made entrepreneur and investor who emphasizes the importance of financial education and investing in assets that generate passive income. His Rich Dad brand has expanded to include books, seminars, and a board game that teaches financial principles. Kiyosaki advocates for self-reliance and encourages individuals to break free from the traditional “employee mindset.” He continues to teach people how to achieve financial independence.

Morgan Housel's Book Recommendations

Morgan Housel is a financial writer and partner at The Collaborative Fund, best known for his book The Psychology of Money. His work explores the behavioral side of finance, emphasizing how emotions, history, and decision-making impact wealth-building. Housel’s writing is widely praised for being accessible, insightful, and engaging, making complex financial topics easier to understand. He contributes regularly to financial publications and speaks at conferences on the power of long-term thinking in finance. His book has become a modern classic in the personal finance genre.

Showing 8 of 16 related collections

“Risk arises from not knowing what you’re doing.”

The Essays of Warren Buffett

By Lawrence A. Cunningham, Warren E. Buffett

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy