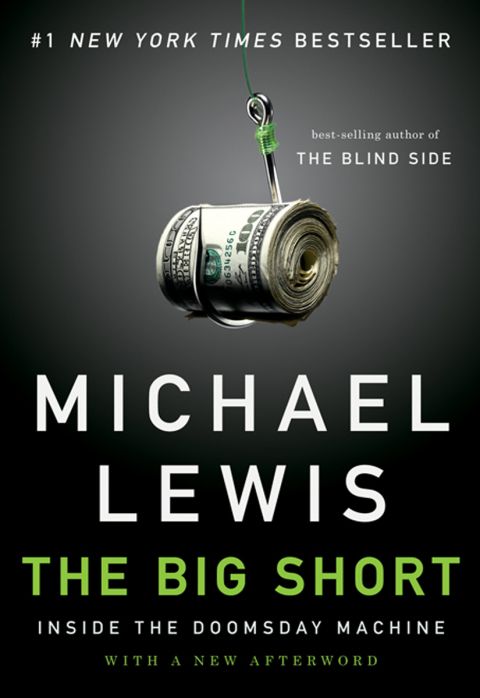

The Big Short Book Summary

In 'The Big Short,' Michael Lewis unveils the intricate web of deceit and risk that led to the 2008 financial crisis. Through a cast of eccentric and astute investors, he reveals how a handful of outsiders recognized the impending collapse of the housing market while most of Wall Street remained oblivious. As the narrative unfolds, readers are drawn into the thrilling world of finance, where fortunes are gained and lost in the blink of an eye. Lewis's sharp wit and keen insights slice through the complexities of the crisis, making it both accessible and compelling. This masterful tale challenges us to question the very foundations of the financial system and consider who truly holds the power.

By Michael Lewis

Published: 2010

""The truth is like poetry. And most people fucking hate poetry.""

Book Review of The Big Short

The #1 New York Times bestseller: a brilliant account—character-rich and darkly humorous—of how the U.S. economy was driven over the cliff. When the crash of the U. S. stock market became public knowledge in the fall of 2008, it was already old news. The real crash, the silent crash, had taken place over the previous year, in bizarre feeder markets where the sun doesn’t shine, and the SEC doesn’t dare, or bother, to tread: the bond and real estate derivative markets where geeks invent impenetrable securities to profit from the misery of lower- and middle-class Americans who can’t pay their debts. The smart people who understood what was or might be happening were paralyzed by hope and fear; in any case, they weren’t talking. The crucial question is this: Who understood the risk inherent in the assumption of ever-rising real estate prices, a risk compounded daily by the creation of those arcane, artificial securities loosely based on piles of doubtful mortgages? Michael Lewis turns the inquiry on its head to create a fresh, character-driven narrative brimming with indignation and dark humor, a fitting sequel to his #1 best-selling Liar’s Poker. Who got it right? he asks. Who saw the real estate market for the black hole it would become, and eventually made billions of dollars from that perception? And what qualities of character made those few persist when their peers and colleagues dismissed them as Chicken Littles? Out of this handful of unlikely—really unlikely—heroes, Lewis fashions a story as compelling and unusual as any of his earlier bestsellers, proving yet again that he is the finest and funniest chronicler of our times.

Book Overview of The Big Short

About the Book Author

Michael Lewis

Michael Lewis is an acclaimed American author and financial journalist known for his compelling narratives that explore the intricate worlds of finance and economics. He gained fame with his bestselling book "Liar's Poker," which offers a candid glimpse into the Wall Street culture of the 1980s. Lewis's other notable works, such as "Moneyball," "The Blind Side," and "The Big Short," have all been adapted into successful films, further cementing his influence on popular culture. His writing is characterized by its sharp wit, engaging storytelling, and deep insights into the human behavior behind economic phenomena. In addition to his books, Lewis is a contributing writer for publications like the New York Times and Vanity Fair, where he continues to analyze contemporary financial issues.

Book Details

Key information about the book.

- Authors

- Michael Lewis

- Published

- March 2010

- Publisher

- National Geographic Books

- ISBN

- 0393072231

- Language

- English

- Pages

- N/A

- Genres

- FinanceBusiness and EconomicsFinancial Literacy for KidsBehavioral Finance

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

The Money Book for the Young, Fabulous & Broke Book Summary

The Money Book for the Young, Fabulous & Broke is your ultimate financial guide, tailored for those navigating the complexities of modern money management. With vibrant insights and relatable anecdotes, author Suze Orman empowers readers to take control of their finances while embracing their youthful exuberance. Discover essential tools for budgeting, saving, and investing, all designed to transform your financial future from daunting to dazzling. Orman’s candid advice challenges you to rethink your relationship with wealth and offers a blueprint for living fabulously, even on a budget. Are you ready to unlock the secrets to financial freedom and become fabulously secure?

The Real Book of Real Estate Book Summary

In "The Real Book of Real Estate," author Robert Kiyosaki unearths the hidden gems of wealth-building through property investment. With candid insights drawn from his own experiences, he dismantles common myths and reveals the strategies that can lead to financial freedom. This book isn’t just about numbers; it’s a masterclass in mindset, emphasizing the importance of surrounding yourself with the right team and resources. Kiyosaki’s engaging anecdotes and practical tips will inspire both novices and seasoned investors to reassess their approach to real estate. Prepare to unlock the secrets that could transform your financial future and discover the potential of becoming a savvy property mogul!

Fooled by Randomness Book Summary

In "Fooled by Randomness," Nassim Nicholas Taleb explores the hidden influence of chance in our lives, challenging our perceptions of luck, skill, and success. He argues that many people attribute their achievements to talent rather than the randomness that often underpins them. Through a blend of personal anecdotes and sharp wit, Taleb reveals how cognitive biases distort our understanding of risk and probability. He reminds us that, in the grand theater of life, we are often unwitting actors in a play scripted by randomness. Prepare to rethink your beliefs about fortune and failure as you uncover the profound truths lurking beneath the surface of chance.

The Black Swan: Second Edition Book Summary

In "The Black Swan," Nassim Nicholas Taleb explores the profound impact of rare and unpredictable events—those seemingly impossible occurrences that shape our world in transformative ways. He challenges conventional thinking, revealing how humans consistently underestimate uncertainty and overvalue what we can predict. Through compelling anecdotes and thought-provoking insights, Taleb illustrates how we can prepare for the unexpected rather than just cling to past experiences. The book urges readers to embrace randomness and rethink the frameworks we use to navigate life’s complexities. Will you recognize your own blind spots before the next Black Swan strikes?

The Big Short: Inside the Doomsday Machine Book Summary

In "The Big Short," Michael Lewis unveils the hidden complexities of the 2008 financial crisis through the eyes of a few unconventional investors who saw disaster coming. As they bet against the housing market, these outsiders navigate Wall Street’s labyrinthine greed and negligence, exposing the flawed logic behind the crisis. With wit and suspense, Lewis reveals the shocking truth about the financial instruments that led to economic chaos. Readers will find themselves questioning the very foundations of finance while gripping the edge of their seats at the unfolding drama. Can a handful of mavericks really challenge the system, or are they just playing a dangerous game of chance?

Liar's Poker Book Summary

Liar's Poker takes you deep into the high-stakes world of Wall Street during the 1980s, where the line between truth and deception blurs in the cutthroat arena of finance. Author Michael Lewis pulls back the curtain on the chaotic life of bond traders, showcasing a ruthless culture driven by greed and bravado. Through vivid anecdotes and sharp insights, readers are thrust into the thrilling, sometimes absurd realm of investment banking. As Lewis navigates the intricacies of "big swinging d***s," he unveils the strategies and psychological games that define success in this high-pressure environment. Will you emerge with a new understanding of the financial world and its enigmatic players?

Black Edge Book Summary

In "Black Edge," investigative journalist Sheelah Kolhatkar delves into the high-stakes world of hedge funds and the enigmatic figure of Steven A. Cohen. As she unravels the saga of insider trading, greed, and Wall Street's murky ethics, the book pulls readers into a gripping tale of ambition that spans decades. With intellectual prowess and audacious risk-taking, Cohen's rise to power raises questions about the moral compass of finance. Kolhatkar's penetrating analysis unveils the dark side of wealth and the relentless pursuit of success, leaving readers questioning the true cost of ambition. Will you dare to uncover the secrets of a financial titan and the shadowy underworld they inhabit?

When Genius Failed Book Summary

When Genius Failed chronicles the dramatic rise and fall of Long-Term Capital Management, a hedge fund that boasted an elite team of financial wizards. As it navigates the complexities of high-stakes finance and groundbreaking quantitative models, the book unveils how overconfidence in genius can lead to catastrophic consequences. When the Asian financial crisis strikes, the fund’s intricate strategies unravel, threatening the global economy. Authors Roger Lowenstein masterfully intertwine personal narratives with economic theory, revealing the fragile balance between risk and reward. This gripping tale serves as a cautionary reminder that brilliance can blind us to the dangers lurking beneath the surface.

Showing 8 of 27 similar books

Similar Book Recommendations →

Bill Ackman's Book Recommendations

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

Andrew Lokenauth's Book Recommendations

Andrew Lokenauth is a distinguished author and financial expert known for his insightful contributions to personal finance and investment literature. With a career spanning over a decade, he has written extensively on topics such as wealth management, financial planning, and market analysis. Lokenauth's works are celebrated for their clarity and practical advice, making complex financial concepts accessible to a broad audience. He has been featured in numerous financial publications and has established himself as a trusted voice in the industry. Beyond his writing, Lokenauth is also a sought-after speaker, sharing his expertise at various seminars and workshops.

Ana Fabrega's Book Recommendations

Ana Lorena Fabrega is an innovative educator and author passionate about reimagining education. Known as “Ms. Fab,” she is the Chief Evangelist at Synthesis, an education startup inspired by the problem-solving and collaboration model used at SpaceX. She advocates for alternative learning methods, encouraging curiosity and creativity in students. Ana's work emphasizes the importance of engaging young learners in real-world challenges and critical thinking. She also shares insights on education reform through her popular newsletter, Fab Fridays.

Patrick Collison's Book Recommendations

Patrick Collison is an Irish entrepreneur and co-founder of Stripe, a global technology company that enables businesses to accept online payments. Along with his brother John, Patrick has transformed Stripe into one of the most valuable private tech companies in the world. Stripe’s innovative approach to online payments has made it a key player in the financial technology space. Collison is known for his deep interest in science, technology, and policy, often engaging in conversations about innovation, progress, and how to improve societal outcomes. He is an advocate for scientific advancement and the intersection of technology and public policy.

David Bach's Book Recommendations

David Bach is a financial expert and bestselling author known for his Finish Rich book series, including The Automatic Millionaire. He has made a career out of teaching people how to build wealth through small, manageable financial habits like “paying yourself first” and automating savings. His approach to personal finance is accessible and focuses on helping everyday individuals achieve long-term financial security. David has appeared on numerous media platforms, advocating for financial literacy and encouraging people to take control of their financial futures.

Morgan Housel's Book Recommendations

Morgan Housel is a financial writer and partner at The Collaborative Fund, best known for his book The Psychology of Money. His work explores the behavioral side of finance, emphasizing how emotions, history, and decision-making impact wealth-building. Housel’s writing is widely praised for being accessible, insightful, and engaging, making complex financial topics easier to understand. He contributes regularly to financial publications and speaks at conferences on the power of long-term thinking in finance. His book has become a modern classic in the personal finance genre.

Niki Scevak's Book Recommendations

Niki Scevak is a distinguished entrepreneur and venture capitalist, widely recognized for his contributions to the startup ecosystem rather than traditional literature. As a co-founder and partner at Blackbird Ventures, he has played a pivotal role in funding and mentoring successful Australian tech startups. Scevak also co-founded Startmate, an influential accelerator program that has shaped numerous early-stage companies. His work has significantly impacted the Australian tech landscape, fostering innovation and entrepreneurial growth. Though not an author of traditional books, his insights and thought leadership are frequently shared through industry publications and speaking engagements.

Robert Kiyosaki's Book Recommendations

Robert Kiyosaki is the author of the bestselling personal finance book Rich Dad Poor Dad, which challenges conventional wisdom on wealth building and financial literacy. He is a self-made entrepreneur and investor who emphasizes the importance of financial education and investing in assets that generate passive income. His Rich Dad brand has expanded to include books, seminars, and a board game that teaches financial principles. Kiyosaki advocates for self-reliance and encourages individuals to break free from the traditional “employee mindset.” He continues to teach people how to achieve financial independence.

Showing 8 of 18 related collections

“"The truth is like poetry. And most people fucking hate poetry."”

The Big Short

By Michael Lewis

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy