The Clash of the Cultures Book Summary

In 'The Clash of the Cultures,' John C. Bogle presents a compelling exploration of the fundamental battle between investment cultures: the short-term traders versus the long-term investors. Bogle, the founder of Vanguard, emphasizes the importance of a principled, patient approach to investing as a way to combat the rampant short-termism that has overtaken financial markets. Through insightful anecdotes and rigorous analysis, he challenges conventional wisdom and urges readers to reconsider their investment philosophies. Bogle's passionate advocacy for ethical investing resonates deeply, prompting a powerful reflection on the true purpose of capital markets. This thought-provoking read is not just for investors; it's a call to safeguard the integrity of capitalism itself.

By John C. Bogle

Published: 2012

"In a world where the pursuit of profit often overshadows the pursuit of purpose, we must remember that true value lies not just in wealth, but in the wisdom of our choices and the impact we have on the lives of others."

Book Review of The Clash of the Cultures

Examines the financial world's shift from healthy long-term investment to damaging speculation, and outlines helpful hints for investors to avoid common hazards.

Book Overview of The Clash of the Cultures

About the Book Author

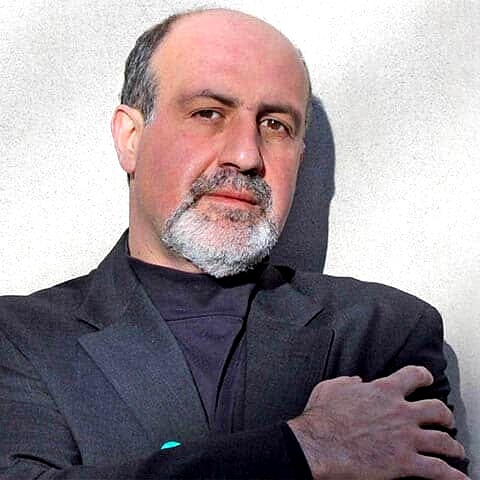

John C. Bogle

John C. Bogle was an influential American investor, philanthropist, and author, best known as the founder of the Vanguard Group and a pioneer of index investing. Born on May 8, 1929, he revolutionized the investment management industry by promoting low-cost, passive investment strategies that prioritized long-term wealth accumulation for individual investors. Bogle authored several books, including "The Little Book of Common Sense Investing," which advocates for the benefits of index funds over actively managed portfolios. His commitment to investor advocacy and ethical practices earned him a lasting legacy in finance and a dedicated following among both professionals and everyday investors. Bogle passed away on January 16, 2019, leaving behind a profound impact on how millions approach investing.

Book Details

Key information about the book.

- Authors

- John C. Bogle

- Published

- August 2012

- Publisher

- John Wiley & Sons

- ISBN

- 1118122771

- Language

- English

- Pages

- 353

- Genres

- FinanceBusiness and EconomicsBehavioral FinanceInvesting Basics

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

The Intelligent Investor Book Summary

In "The Intelligent Investor," Benjamin Graham unveils timeless strategies for navigating the volatile world of investing with wisdom and discipline. He introduces the concept of value investing, teaching readers to distinguish between price and intrinsic value, all while emphasizing the importance of a defensive investment strategy. Graham’s insightful principles empower investors to cultivate emotional resilience, protecting them from the relentless whims of the market. With real-world anecdotes and practical advice, this classic remains a cornerstone for anyone seeking financial success and peace of mind. Dive in to discover how patience, rationality, and a solid plan can transform your investment journey!

Financial Peace Revisited Book Summary

In "Financial Peace Revisited," renowned financial guru Dave Ramsey lays out a transformative blueprint for achieving financial independence and peace of mind. Through compelling personal anecdotes and straightforward principles, he demystifies budgeting and debt management, empowering readers to take control of their finances. Ramsey's seven-step plan not only promises to eliminate debt but also encourages a mindset shift towards saving and giving. With a blend of practical advice and motivational insights, he confronts common financial fears and inspires readers to envision a life free from money stress. Dive into this engaging guide and discover the keys to unlocking your financial freedom!

Smart Money Smart Kids Book Summary

In "Smart Money Smart Kids," financial expert Dave Ramsey teams up with his daughter Rachel Cruze to tackle the crucial lessons of money management for a new generation. Through relatable anecdotes and practical strategies, they empower parents to teach their children about earning, saving, and investing wisely. The book challenges traditional views on money, emphasizing the importance of character and values in financial decision-making. With engaging activities and clear guidelines, readers are equipped to foster a healthy relationship with money early on. Dive in to discover how to raise financially savvy kids who are prepared for life’s economic challenges!

Financial Freedom Book Summary

In "Financial Freedom," Grant Sabatier unveils the transformative journey from scarcity to abundance, sharing his compelling story of achieving a million-dollar net worth in just five years. The book combines actionable strategies with powerful insights, challenging conventional beliefs about work, money, and happiness. Sabatier emphasizes the importance of redefining your relationship with wealth and creating multiple income streams to escape the rat race. With practical tips on budgeting, investing, and mindset shifts, readers are equipped to take bold steps toward their financial goals. Dive into this guide and discover the blueprint that could lead you to a life of true financial independence!

Den of Thieves Book Summary

In "Den of Thieves," journalist James B. Stewart pulls back the curtain on the high-stakes world of corporate America during the 1980s. This riveting narrative chronicles the lives of power brokers and insider traders who bent the rules to accumulate unimaginable wealth. As greed intertwines with ambition, a thrilling tale of deception unfolds, leading to dramatic investigations and shocking convictions. Stewart masterfully blends real-life drama with insights into the financial markets, leaving readers on the edge of their seats. Dive into the labyrinth of moral ambiguity and see how far the quest for success can lead one astray!

Black Edge Book Summary

In "Black Edge," investigative journalist Sheelah Kolhatkar delves into the high-stakes world of hedge funds and the enigmatic figure of Steven A. Cohen. As she unravels the saga of insider trading, greed, and Wall Street's murky ethics, the book pulls readers into a gripping tale of ambition that spans decades. With intellectual prowess and audacious risk-taking, Cohen's rise to power raises questions about the moral compass of finance. Kolhatkar's penetrating analysis unveils the dark side of wealth and the relentless pursuit of success, leaving readers questioning the true cost of ambition. Will you dare to uncover the secrets of a financial titan and the shadowy underworld they inhabit?

Poor Charlie’s Almanack Book Summary

Poor Charlie’s Almanack is an enlightening compilation of wisdom from Charlie Munger, the renowned vice chairman of Berkshire Hathaway and lifelong partner of Warren Buffett. This thought-provoking collection delves into Munger's unique principles of investing, decision-making, and life philosophy, rich with wit and insight. Through anecdotes, illustrations, and a treasure trove of mental models, readers are inspired to think critically and embrace diverse perspectives. Munger’s emphasis on lifelong learning and rational thought challenges conventional thinking and encourages harnessing multidisciplinary knowledge for personal and professional success. Unlock the secrets of Munger’s remarkable intellect and discover how they can transform your approach to wealth and wisdom.

The Essays of Warren Buffett Book Summary

In "The Essays of Warren Buffett," the legendary investor distills decades of wisdom into a compelling collection of insights on investing, business, and life. Through a series of thought-provoking essays, Buffett shares his unique perspective on risk, value, and the importance of patience in the tumultuous world of finance. His distinctive voice combines humor with profound lessons, making complex concepts accessible to both novice investors and seasoned pros. As you delve into his reflections, you'll uncover the principles that have guided his success and how they can be applied to your own financial journey. Prepare to be inspired and challenged to rethink your approach to investing and wealth-building!

Showing 8 of 26 similar books

Similar Book Recommendations →

Kevin Rose's Book Recommendations

Kevin Rose is a notable entrepreneur and technology investor, best known for founding Digg, a pioneering social news website that significantly influenced online content sharing. Although not primarily recognized for literary contributions, Rose has impacted digital media and online culture, which are recurring themes in contemporary literature on technology. His insights and experiences have been featured in various tech journals and books, enriching discussions on innovation and digital entrepreneurship. Rose also co-hosted the popular podcast "The Random Show" with Tim Ferriss, where he shares his thoughts on technology, health, and productivity. Through his ventures and public speaking, Rose continues to inspire narratives around the digital revolution and startup culture.

James Clear's Book Recommendations

James Clear is the author of the bestselling book Atomic Habits, which focuses on the power of small habits and incremental improvements to achieve significant personal and professional growth. Clear’s writing blends insights from psychology, neuroscience, and productivity to provide practical strategies for building better habits. His work has helped millions of people create positive changes in their lives by focusing on the process rather than the outcome. James’s clear, actionable advice has made him a sought-after speaker and thought leader in the field of personal development.

Jamie Dimon's Book Recommendations

Jamie Dimon is an American business executive, best known as the Chairman and CEO of JPMorgan Chase, one of the largest and most influential financial institutions in the world. Dimon has led JPMorgan through multiple economic crises, including the 2008 financial crash, and has consistently been recognized for his leadership in the banking industry. Under his tenure, JPMorgan has grown into a global financial powerhouse, focusing on innovation and sustainability. Dimon is also an advocate for corporate responsibility and frequently speaks on economic and regulatory issues. His leadership style and strategic insights have earned him widespread respect in the business world.

Bill Ackman's Book Recommendations

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

Martin Shkreli's Book Recommendations

Martin Shkreli is an American businessman and former hedge fund manager best known for his role in the pharmaceutical industry. He gained notoriety as the CEO of Turing Pharmaceuticals, where he infamously raised the price of the life-saving drug Daraprim by over 5,000%. Despite his controversial business practices, Shkreli has contributed thought-provoking writings on the ethics of pharmaceutical pricing and the healthcare industry. His articles and essays have sparked widespread debate and discussion in both academic and public spheres. Shkreli's complex legacy continues to influence conversations about drug pricing and corporate responsibility.

Andrew Wilkinson's Book Recommendations

Andrew Wilkinson is a distinguished author and entrepreneur, best known for his insightful business writings and contributions to the tech industry. He co-founded MetaLab, a prominent design agency that has shaped the user experience of major platforms like Slack and Coinbase. Wilkinson's entrepreneurial journey and his publications provide valuable perspectives on startup culture, innovation, and leadership. His writing, often featured in leading business magazines and his personal blog, has garnered a wide readership for its practical advice and engaging storytelling. Andrew continues to influence both literature and the business world with his unique blend of creativity and strategic thinking.

Charlie Munger's Book Recommendations

Charlie Munger is an American investor, businessman, and philanthropist, best known as the vice chairman of Berkshire Hathaway, where he partners with Warren Buffett. Renowned for his insights on investment strategies and mental models, Munger has significantly influenced the world of finance. His notable literary contributions include "Poor Charlie's Almanack," a compilation of his speeches and writings that distill his wisdom on decision-making and business principles. Munger's work emphasizes the importance of multidisciplinary thinking and continuous learning. Beyond his financial acumen, he is celebrated for his charitable efforts, particularly in education and healthcare.

Nassim Nicholas Taleb's Book Recommendations

Nassim Nicholas Taleb is a Lebanese-American author, scholar, and risk analyst, best known for his work on uncertainty, probability, and risk. His books, including The Black Swan and Antifragile, explore how rare and unpredictable events shape the world and how individuals and systems can become more resilient to shocks. Taleb’s insights on risk management have influenced fields ranging from finance to medicine, and he is known for his outspoken criticism of conventional wisdom. His ideas about randomness, decision-making, and the limitations of human knowledge have made him a leading thinker in modern economics and philosophy.

Showing 8 of 18 related collections

“In a world where the pursuit of profit often overshadows the pursuit of purpose, we must remember that true value lies not just in wealth, but in the wisdom of our choices and the impact we have on the lives of others.”

The Clash of the Cultures

By John C. Bogle

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy