The New Financial Order Book Summary

In 'The New Financial Order,' Robert J. Shiller explores the transformative ideas behind reinventing our financial systems. He delves into behavioral economics and the role of markets in managing risk and volatility in our increasingly complex world. Shiller proposes innovative financial instruments that could help achieve a more equitable society, addressing global challenges such as climate change and inequality. With a thought-provoking blend of theory and practicality, this book invites readers to rethink the future of finance. Will you join the conversation to reshape our financial destiny?

By Robert J. Shiller

Published: 2003

"In a world shaped by uncertainty, it is not just economic stability we seek, but a deeper understanding of the financial futures we create together."

Book Review of The New Financial Order

Examines the impact of a rapidly evolving global economy on the twenty-first century financial world and presents six fundamental principles for using information technology and advanced financial theory to hedge risk.

Book Overview of The New Financial Order

About the Book Author

Robert J. Shiller

Robert J. Shiller is a prominent American economist, best known for his analysis of financial markets and behavioral economics. He is a Sterling Professor of Economics at Yale University and a co-founder of the Case-Shiller index, which tracks U.S. home prices. Shiller gained international acclaim with his books, including 'Irrational Exuberance', which critiques the volatility of stock and real estate markets, and 'Animal Spirits', co-authored with George Akerlof, which explores the psychological factors affecting economic decision-making. His writing is characterized by its accessibility, blending rigorous economic theory with practical insights, engaging a broad audience and influencing both academic discourse and public policy.

Book Details

Key information about the book.

- Authors

- Robert J. Shiller

- Published

- January 2003

- Publisher

- N/A

- ISBN

- 0691091722

- Language

- English

- Pages

- 366

- Genres

- Social Justice MovementsFinanceFinancial IndependenceBusiness and EconomicsBehavioral Finance

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

The Latte Factor Book Summary

In "The Latte Factor," personal finance expert David Bach unveils a transformative story that intertwines the journey of a young woman discovering the power of financial freedom. Through the lens of a seemingly simple daily ritual—her coffee habit—she learns profound lessons about saving and investing. With relatable characters and an engaging narrative, Bach challenges readers to rethink their spending habits and recognize the true cost of indulgences. Could a small shift in perspective lead to monumental changes in your financial future? Dive into this inspiring tale and unlock the secrets to achieving your dreams, one latte at a time!

Automatic Wealth Book Summary

In "The Automatic Wealth," author Michael Masterson unveils the secrets to achieving financial independence through smart, strategic investments and income generation. With actionable advice and a no-nonsense approach, he demystifies the path to wealth, emphasizing the importance of mindset and disciplined financial habits. Masterson challenges readers to rethink their approach to money, transforming it from a source of stress into a tool for freedom. Packed with real-life examples and practical steps, this book equips you with the knowledge to build and sustain wealth effortlessly. Are you ready to unlock the doors to your financial future?

Financial Peace Revisited Book Summary

In "Financial Peace Revisited," renowned financial guru Dave Ramsey lays out a transformative blueprint for achieving financial independence and peace of mind. Through compelling personal anecdotes and straightforward principles, he demystifies budgeting and debt management, empowering readers to take control of their finances. Ramsey's seven-step plan not only promises to eliminate debt but also encourages a mindset shift towards saving and giving. With a blend of practical advice and motivational insights, he confronts common financial fears and inspires readers to envision a life free from money stress. Dive into this engaging guide and discover the keys to unlocking your financial freedom!

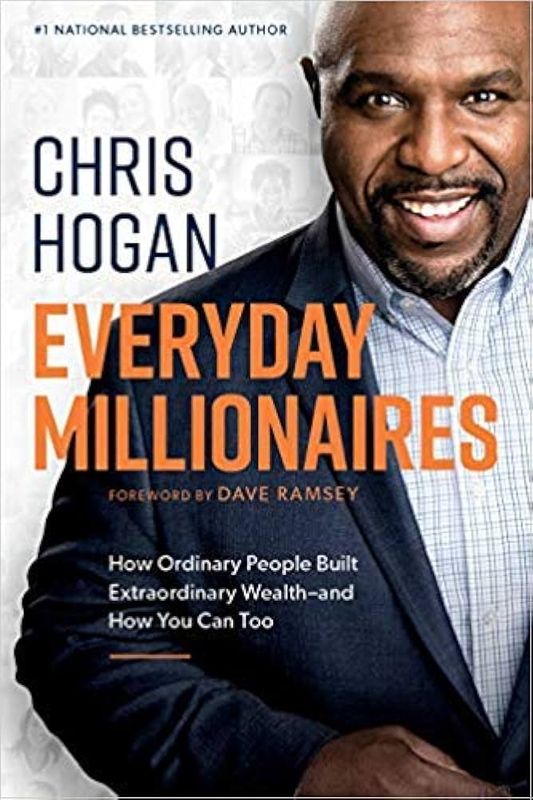

Everyday Millionaires Book Summary

In "Everyday Millionaires," authors Chris Hogan unravel the surprising truths behind the wealth of ordinary people who have achieved extraordinary financial success. Through compelling stories and real-life data, they challenge the myths of wealth, revealing that most millionaires live modestly and prioritize saving and investing over luxury. Hogan shares actionable insights on mindsets, financial habits, and the importance of perseverance, encouraging readers to rethink their own paths to wealth. The book empowers individuals to believe that anyone can attain financial independence with dedication and sensible strategies. Are you ready to unlock the secrets of everyday millionaires and transform your financial future?

Nudge Book Summary

In "Nudge," behavioral economists Richard Thaler and Cass Sunstein unveil the subtle art of influencing choices and shaping outcomes without restricting freedom. They explore how small, seemingly insignificant changes in the way options are presented can lead to drastically improved decisions in health, finance, and overall happiness. With compelling real-world examples and engaging insights, the authors demonstrate how understanding human psychology can empower individuals and policymakers alike. Dive into a world where choice architecture transforms lives and reshapes society's approach to welfare. Discover the hidden nudges that could change everything about the way we choose!

I Will Teach You to Be Rich, Second Edition Book Summary

In 'I Will Teach You to Be Rich, Second Edition,' Ramit Sethi provides a no-nonsense guide to mastering personal finance with a blend of humor and practicality. He challenges conventional money advice and introduces readers to a unique banking system for maximizing their savings. Through straightforward strategies, Sethi reveals how to automate finances and invest wisely for the long term. Each chapter brims with actionable tips that encourage readers to take control of their financial futures. With insights that delve deep into psychology and behavior, this book is a game-changer for anyone seeking to build real wealth.

Financial Freedom Book Summary

In "Financial Freedom," Grant Sabatier unveils the transformative journey from scarcity to abundance, sharing his compelling story of achieving a million-dollar net worth in just five years. The book combines actionable strategies with powerful insights, challenging conventional beliefs about work, money, and happiness. Sabatier emphasizes the importance of redefining your relationship with wealth and creating multiple income streams to escape the rat race. With practical tips on budgeting, investing, and mindset shifts, readers are equipped to take bold steps toward their financial goals. Dive into this guide and discover the blueprint that could lead you to a life of true financial independence!

Your Money or Your Life Book Summary

In 'Your Money or Your Life', Vicki Robin and Joe Dominguez challenge you to redefine your relationship with money and reshape your life. They introduce a transformative program that combines financial independence with personal fulfillment, urging readers to evaluate what truly brings them happiness. With practical tools and real-life examples, the authors guide you through a holistic approach to budgeting and spending. The book encourages you to assess the true cost of your lifestyle choices and empowers you to reclaim your time and energy. Are you ready to discover the secret to living abundantly without being a slave to your income?

Showing 8 of 30 similar books

Similar Book Recommendations →

David Bach's Book Recommendations

David Bach is a financial expert and bestselling author known for his Finish Rich book series, including The Automatic Millionaire. He has made a career out of teaching people how to build wealth through small, manageable financial habits like “paying yourself first” and automating savings. His approach to personal finance is accessible and focuses on helping everyday individuals achieve long-term financial security. David has appeared on numerous media platforms, advocating for financial literacy and encouraging people to take control of their financial futures.

James Clear's Book Recommendations

James Clear is the author of the bestselling book Atomic Habits, which focuses on the power of small habits and incremental improvements to achieve significant personal and professional growth. Clear’s writing blends insights from psychology, neuroscience, and productivity to provide practical strategies for building better habits. His work has helped millions of people create positive changes in their lives by focusing on the process rather than the outcome. James’s clear, actionable advice has made him a sought-after speaker and thought leader in the field of personal development.

Bernie Sanders's Book Recommendations

Bernie Sanders is an American politician and U.S. Senator from Vermont, known for his progressive policies and his advocacy for economic equality. Sanders ran for the Democratic presidential nomination in 2016 and 2020, inspiring a movement with his calls for Medicare for All, free college tuition, and a $15 minimum wage. He identifies as a democratic socialist and has been a long-standing advocate for labor rights, environmental justice, and social welfare programs. Sanders’ candidacy energized a new generation of activists and has had a lasting influence on the direction of the Democratic Party. His focus on income inequality and social justice continues to shape political discourse in the U.S.

Jamie Dimon's Book Recommendations

Jamie Dimon is an American business executive, best known as the Chairman and CEO of JPMorgan Chase, one of the largest and most influential financial institutions in the world. Dimon has led JPMorgan through multiple economic crises, including the 2008 financial crash, and has consistently been recognized for his leadership in the banking industry. Under his tenure, JPMorgan has grown into a global financial powerhouse, focusing on innovation and sustainability. Dimon is also an advocate for corporate responsibility and frequently speaks on economic and regulatory issues. His leadership style and strategic insights have earned him widespread respect in the business world.

David Cancel's Book Recommendations

David Cancel is a prominent entrepreneur and author best known for his influential work in the tech and startup communities. As the CEO and co-founder of Drift, a leading conversational marketing platform, he has revolutionized how businesses engage with their customers online. Cancel has also authored insightful books such as "Hypergrowth," which offers valuable strategies for scaling startups rapidly. His contributions extend beyond literature as he frequently shares his expertise through speaking engagements and his popular podcast, "Seeking Wisdom." David Cancel's innovative ideas and practical advice continue to inspire and guide entrepreneurs worldwide.

Arianna Huffington's Book Recommendations

Arianna Huffington is the founder of The Huffington Post and Thrive Global, a company focused on wellness and productivity. She is a bestselling author and prominent speaker on the importance of sleep and managing stress. Arianna’s work emphasizes the importance of balance between professional success and personal well-being. Her book The Sleep Revolution has inspired a global movement to prioritize rest. She is considered one of the most influential women in media and business.

Graham Stephan's Book Recommendations

Graham Stephan is a prominent real estate investor, YouTuber, and personal finance guru known for his insightful content on financial independence and investment strategies. He began his career in real estate at the age of 18 and quickly rose to prominence, amassing a multi-million-dollar portfolio. Stephan's YouTube channel, which boasts millions of subscribers, offers accessible and practical advice on budgeting, saving, and investing, earning him widespread acclaim and a dedicated following. In addition to his online presence, he has been featured in numerous high-profile publications and media outlets, solidifying his status as an influential figure in personal finance education. Through his work, Stephan has empowered countless individuals to take control of their finances and pursue financial freedom.

Andrew Wilkinson's Book Recommendations

Andrew Wilkinson is a distinguished author and entrepreneur, best known for his insightful business writings and contributions to the tech industry. He co-founded MetaLab, a prominent design agency that has shaped the user experience of major platforms like Slack and Coinbase. Wilkinson's entrepreneurial journey and his publications provide valuable perspectives on startup culture, innovation, and leadership. His writing, often featured in leading business magazines and his personal blog, has garnered a wide readership for its practical advice and engaging storytelling. Andrew continues to influence both literature and the business world with his unique blend of creativity and strategic thinking.

Showing 8 of 20 related collections

“In a world shaped by uncertainty, it is not just economic stability we seek, but a deeper understanding of the financial futures we create together.”

The New Financial Order

By Robert J. Shiller

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy