The Total Money Makeover Book Summary

In 'The Total Money Makeover', Dave Ramsey unveils a transformative plan to break free from financial struggles and achieve lasting wealth. Through practical steps and inspiring success stories, readers are encouraged to take control of their finances and embrace a debt-free lifestyle. The book challenges conventional money wisdom, revealing the mindset shifts necessary for financial success. With straightforward budgeting techniques and actionable strategies, Ramsey empowers readers to build a solid financial foundation. Are you ready to embark on a journey that could redefine your relationship with money?

By Dave Ramsey

Published: 2013

""Change your life, change your money! The journey to financial peace begins with the first step of taking control of your finances and believing in the power of commitment.""

Book Review of The Total Money Makeover

A strategy for changing attitudes about personal finances covers such topics as getting out of debt, the dangers of cash advances and keeping spending within income limits.

Book Overview of The Total Money Makeover

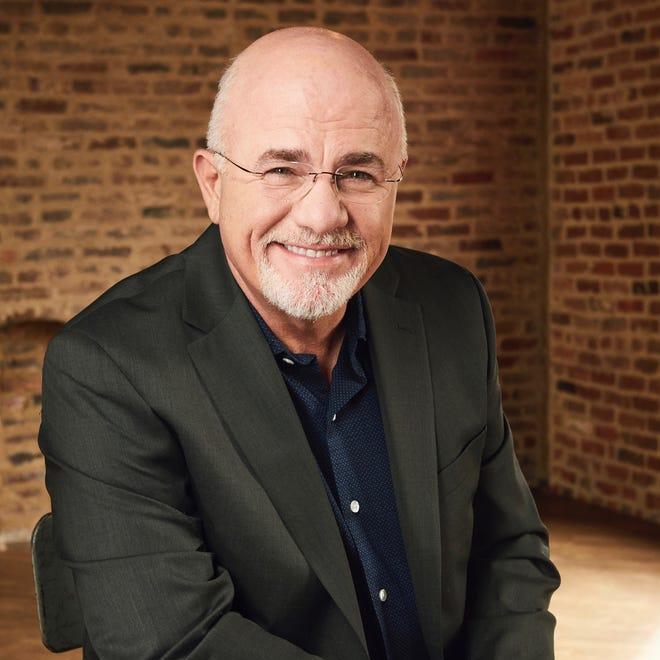

About the Book Author

Dave Ramsey

Dave Ramsey is a well-known financial expert, author, and radio personality, famous for his straightforward approach to personal finance. He is best recognized for his bestselling books, including "The Total Money Makeover," which emphasizes debt elimination and financial independence. Through his popular radio show, "The Dave Ramsey Show," he offers advice to listeners on budgeting, saving, and investing. Ramsey also founded Financial Peace University, a program designed to help individuals and families take control of their financial futures. With millions of followers, his teachings promote a debt-free lifestyle and the importance of financial literacy.

Book Details

Key information about the book.

- Authors

- Dave Ramsey

- Published

- January 2013

- Publisher

- Thomas Nelson

- ISBN

- 1595555277

- Language

- English

- Pages

- 237

- Genres

- FinanceFinancial IndependenceBudgetingPersonal Finance

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

The Priory of the Orange Tree Book Summary

In "The Priory of the Orange Tree," a richly woven tapestry of fantasy unfolds, where a matriarchal society faces an age-old threat from a dragon that once ravaged their lands. Amidst court intrigue and budding alliances, a fierce dragon rider and a reluctant noblewoman must confront their destinies while grappling with their emerging identities. As ancient magical forces stir, secrets long buried begin to surface, challenging their beliefs and allegiances. With a captivating blend of romance, adventure, and empowerment, this epic tale dares to reimagine classic tropes and ignite the flames of courage. Will they unite to save their world, or will the shadows of the past consume them all?

Rich Dad Poor Dad - What the Rich Teach Their Kids About Money Book Summary

No summary available

Rich Dad's Cashflow Quadrant Book Summary

In "Cashflow Quadrant," Robert Kiyosaki introduces a revolutionary framework for understanding how wealth is generated and sustained. He delineates four distinct categories—Employee, Self-Employed, Business Owner, and Investor—that illustrate the pathways individuals can take toward financial freedom. With insights drawn from his own journey, Kiyosaki challenges conventional beliefs about work and money, encouraging readers to shift their mindsets and explore new possibilities. This engaging guide empowers you to evaluate your current position and make strategic transitions to enhance your financial future. Are you ready to discover which quadrant you're in and unlock your potential for wealth?

The Millionaire Next Door Book Summary

In "The Millionaire Next Door," Thomas J. Stanley and William D. Danko reveal surprising truths about the habits and lifestyles of America's wealthy. Rather than flashy spending, these millionaires embody frugality, discipline, and the pursuit of financial independence. Uncover the principles that distinguish the affluent from those who merely appear wealthy, and learn how everyday choices shape true wealth. Through eye-opening statistics and relatable anecdotes, this book dismantles common misconceptions about wealth. Are you ready to discover the secrets of those living quietly among us who have amassed true fortunes?

The Wealthy Gardener Book Summary

In "The Wealthy Gardener," author John Soforic reveals the transformative journey of a father teaching his son the intricate balance between wealth and wisdom. Through a series of poignant parables, readers explore the seeds of financial success that sprout from patience, dedication, and the right mindset. The book intertwines personal anecdotes with practical advice, challenging conventional notions of prosperity and fulfillment. As the characters navigate the gardens of their lives, they uncover profound truths about happiness, legacy, and the true meaning of wealth. Prepare to dig deep into a narrative that cultivates both inspiration and actionable insights for your own growth.

The Culture Code Book Summary

In "The Culture Code," Daniel Coyle unveils the secrets behind the most successful teams, revealing that a strong culture isn't just a byproduct but a deliberate construct. Through fascinating stories from diverse organizations, he identifies three essential skills that foster trust and cooperation. Coyle's insights challenge conventional wisdom, suggesting that vulnerability, belonging, and purpose are the keystones of high-performing groups. With practical tips and compelling examples, he guides readers in transforming their own teams into thriving, connected units. Dive into this engaging exploration and discover how to unlock the hidden potential within your own culture!

MONEY Master the Game Book Summary

In "Money: Master the Game," Tony Robbins unlocks the secrets to financial freedom through insights from legendary investors and his own transformative experiences. He presents a comprehensive blueprint that demystifies the world of finance, empowering readers to take control of their financial destinies. Packed with actionable strategies, Robbins reveals the psychological barriers that hold us back from wealth and how to overcome them. The book challenges conventional wisdom, urging readers to think differently about money and investing. Get ready to embark on an enlightening journey that could reshape your financial future forever!

The Money Book for the Young, Fabulous & Broke Book Summary

The Money Book for the Young, Fabulous & Broke is your ultimate financial guide, tailored for those navigating the complexities of modern money management. With vibrant insights and relatable anecdotes, author Suze Orman empowers readers to take control of their finances while embracing their youthful exuberance. Discover essential tools for budgeting, saving, and investing, all designed to transform your financial future from daunting to dazzling. Orman’s candid advice challenges you to rethink your relationship with wealth and offers a blueprint for living fabulously, even on a budget. Are you ready to unlock the secrets to financial freedom and become fabulously secure?

Showing 8 of 26 similar books

Similar Book Recommendations →

Shane Parrish's Book Recommendations

Shane Parrish is a renowned author and the founder of Farnam Street, a popular blog dedicated to personal development and decision-making. His insightful writings delve into mental models, critical thinking, and learning strategies, earning him a significant following among intellectuals and professionals alike. Parrish's work emphasizes the importance of continuous learning and thinking differently to achieve success. He is also the host of "The Knowledge Project" podcast, where he interviews leading thinkers to uncover their wisdom. His contributions have made a substantial impact on how readers approach problem-solving and personal growth.

Chris Guillebeau's Book Recommendations

Chris Guillebeau is a prolific author and entrepreneur best known for his New York Times bestselling book, "The $100 Startup," which has inspired countless individuals to pursue financial independence and entrepreneurial endeavors. He has traveled to every country in the world, a feat that underscores his commitment to unconventional living and exploration. Guillebeau's work often centers on the themes of personal freedom, creative self-employment, and adventure, as seen in his other notable books like "The Art of Non-Conformity" and "Born for This." He also founded the annual World Domination Summit, a gathering that encourages people to live remarkable lives. Through his writing and projects, Guillebeau has become a leading voice in the movement towards non-traditional career paths and lifestyle design.

Jan Losert's Book Recommendations

Jan Losert is a visionary author and digital design expert, renowned for his contributions to the intersection of technology and creativity. His most significant work includes co-authoring "Design Systems Handbook," which has become a seminal guide for creating cohesive and efficient design frameworks. Losert's expertise extends to his role as a speaker and educator, where he passionately shares his insights on user experience and interface design. In addition to his literary achievements, he co-founded several successful startups, leveraging his deep understanding of design to drive innovation. His work continues to influence and inspire both emerging and established designers worldwide.

Ana Fabrega's Book Recommendations

Ana Lorena Fabrega is an innovative educator and author passionate about reimagining education. Known as “Ms. Fab,” she is the Chief Evangelist at Synthesis, an education startup inspired by the problem-solving and collaboration model used at SpaceX. She advocates for alternative learning methods, encouraging curiosity and creativity in students. Ana's work emphasizes the importance of engaging young learners in real-world challenges and critical thinking. She also shares insights on education reform through her popular newsletter, Fab Fridays.

Alex Honnold's Book Recommendations

Alex Honnold is an American professional rock climber, best known for his free solo ascent of El Capitan in Yosemite National Park, a feat that was documented in the Oscar-winning film Free Solo. Honnold is renowned for his mental toughness, technical skill, and ability to climb without ropes or safety equipment. His accomplishments have made him a legend in the climbing world, and he continues to push the boundaries of the sport. Outside of climbing, Honnold is a philanthropist, founding the Honnold Foundation, which supports environmental sustainability projects, particularly in solar energy.

Ramsey Dave's Book Recommendations

Dave Ramsey is a personal finance expert, radio host, and bestselling author known for his book The Total Money Makeover. He advocates for debt-free living and offers practical advice on budgeting, saving, and investing. Ramsey’s popular radio show, The Dave Ramsey Show, has reached millions of listeners, where he provides real-world financial advice and helps individuals achieve financial peace. His Baby Steps method for eliminating debt and building wealth has become a cornerstone of his teachings. Ramsey’s work has made him one of the most well-known financial educators in the U.S.

David Bach's Book Recommendations

David Bach is a financial expert and bestselling author known for his Finish Rich book series, including The Automatic Millionaire. He has made a career out of teaching people how to build wealth through small, manageable financial habits like “paying yourself first” and automating savings. His approach to personal finance is accessible and focuses on helping everyday individuals achieve long-term financial security. David has appeared on numerous media platforms, advocating for financial literacy and encouraging people to take control of their financial futures.

Anu Hariharan's Book Recommendations

Anu Hariharan is a distinguished partner at Y Combinator's Continuity Fund, where she has been instrumental in scaling numerous startups into successful enterprises. With a strong background in economics and technology, she has become a respected voice in the venture capital community. Hariharan has also made significant contributions through her writing on startup growth and investment strategies, offering insightful analyses and practical advice to entrepreneurs. Her work is frequently featured in leading business publications, showcasing her expertise in the tech industry. Beyond her professional accomplishments, Hariharan is committed to fostering diversity and inclusion within the startup ecosystem.

Showing 8 of 24 related collections

“"Change your life, change your money! The journey to financial peace begins with the first step of taking control of your finances and believing in the power of commitment."”

The Total Money Makeover

By Dave Ramsey

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy