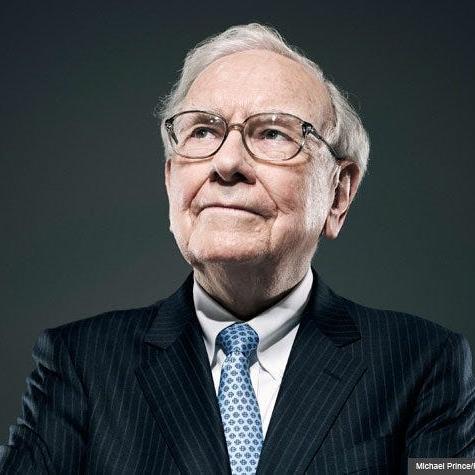

The Warren Buffett Way Book Summary

In 'The Warren Buffett Way', Robert G. Hagstrom unveils the investment strategies and philosophies that have made Warren Buffett one of the most successful investors in history. Through insightful anecdotes and clear analysis, readers discover the principles that guide Buffett's decisions in the stock market. The book delves into the importance of patience, value investing, and understanding businesses beyond their numbers. With a blend of practical advice and timeless wisdom, it challenges conventional investing myths. Prepare to rethink your approach to finance and embrace the mindset of a true investment maestro.

By Robert G. Hagstrom

Published: 2013

"The stock market is filled with individuals who know the price of everything, but the value of nothing."

Book Review of The Warren Buffett Way

Warren Buffett is the most famous investor of all time and one of today’s most admired business leaders. He became a billionaire and investment sage by looking at companies as businesses rather than prices on a stock screen. The first two editions of The Warren Buffett Way gave investors their first in-depth look at the innovative investment and business strategies behind Buffett's spectacular success. The new edition updates readers on the latest investments by Buffett. And, more importantly, it draws on the new field of behavioral finance to explain how investors can overcome the common obstacles that prevent them from investing like Buffett. New material includes: How to think like a long-term investor – just like Buffett Why "loss aversion", the tendency of most investors to overweight the pain of losing money, is one of the biggest obstacles that investors must overcome. Why behaving rationally in the face of the ups and downs of the market has been the key to Buffett's investing success Analysis of Buffett's recent acquisition of H.J. Heinz and his investment in IBM stock The greatest challenge to emulating Buffett is not in the selection of the right stocks, Hagstrom writes, but in having the fortitude to stick with sound investments in the face of economic and market uncertainty. The new edition explains the psychological foundations of Buffett's approach, thus giving readers the best roadmap yet for mastering both the principles and behaviors that have made Buffett the greatest investor of our generation.

Book Overview of The Warren Buffett Way

About the Book Author

Robert G. Hagstrom

Robert G. Hagstrom is an accomplished author and investment strategist, best known for his insights into the world of finance and successful investing. His notable works include 'The Warren Buffett Way,' which delves into the investment philosophy of the legendary investor, and 'Investment Philosophies,' where he explores various strategies utilized by successful investors throughout history. Hagstrom's writing is characterized by its clarity and accessibility, making complex financial concepts understandable to a wide audience. He has also contributed articles to several financial publications and is regarded for his expertise in value investing and the principles that underpin successful market strategies.

Book Details

Key information about the book.

- Authors

- Robert G. Hagstrom

- Published

- September 2013

- Publisher

- John Wiley & Sons

- ISBN

- 1118503252

- Language

- English

- Pages

- 329

- Genres

- InvestingFinanceStock Market Investing

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

The Intelligent Investor Book Summary

In "The Intelligent Investor," Benjamin Graham unveils timeless strategies for navigating the volatile world of investing with wisdom and discipline. He introduces the concept of value investing, teaching readers to distinguish between price and intrinsic value, all while emphasizing the importance of a defensive investment strategy. Graham’s insightful principles empower investors to cultivate emotional resilience, protecting them from the relentless whims of the market. With real-world anecdotes and practical advice, this classic remains a cornerstone for anyone seeking financial success and peace of mind. Dive in to discover how patience, rationality, and a solid plan can transform your investment journey!

The Little Book of Behavioral Investing Book Summary

**The Little Book of Behavioral Investing** uncovers the psychological traps that often lead investors astray. With a blend of insightful anecdotes and cutting-edge research, it reveals how emotions like fear and greed shape our decisions in the financial world. Readers will discover practical strategies to counteract these biases and improve their investment outcomes. By understanding the behavioral factors at play, you can transform your investment approach. Are you ready to challenge your thinking and elevate your financial game?

Black Edge Book Summary

In "Black Edge," investigative journalist Sheelah Kolhatkar delves into the high-stakes world of hedge funds and the enigmatic figure of Steven A. Cohen. As she unravels the saga of insider trading, greed, and Wall Street's murky ethics, the book pulls readers into a gripping tale of ambition that spans decades. With intellectual prowess and audacious risk-taking, Cohen's rise to power raises questions about the moral compass of finance. Kolhatkar's penetrating analysis unveils the dark side of wealth and the relentless pursuit of success, leaving readers questioning the true cost of ambition. Will you dare to uncover the secrets of a financial titan and the shadowy underworld they inhabit?

The Outsiders Book Summary

In 'The Outsiders,' William Thorndike reveals the captivating stories of unconventional leaders who defy the norms of Wall Street and common business wisdom. These mavericks, often overlooked or underestimated, demonstrate that true success comes from deep analytical thinking and a long-term vision. Through engaging case studies, Thorndike uncovers the secret principles that set these extraordinary outsiders apart from their peers. Readers are invited into a world where decision-making is grounded in value creation and discipline rather than mere trends. This thought-provoking exploration challenges conventional beliefs and beckons aspiring leaders to reassess their own paths to success.

The Little Book of Common Sense Investing Book Summary

In 'The Little Book of Common Sense Investing,' John C. Bogle lays out a compelling case for a simple, yet effective, investment strategy that anyone can apply. He champions the power of low-cost indexing, which allows average investors to outperform the majority of actively managed funds over time. Bogle stresses the importance of patience and discipline in the face of market volatility, urging readers to ignore the noise of financial markets. With clear insights and straightforward advice, this book is a treasure trove for both novice and seasoned investors alike. Discover how to make your money work harder for you with strategies rooted in common sense!

The Essays of Warren Buffett Book Summary

In "The Essays of Warren Buffett," the legendary investor distills decades of wisdom into a compelling collection of insights on investing, business, and life. Through a series of thought-provoking essays, Buffett shares his unique perspective on risk, value, and the importance of patience in the tumultuous world of finance. His distinctive voice combines humor with profound lessons, making complex concepts accessible to both novice investors and seasoned pros. As you delve into his reflections, you'll uncover the principles that have guided his success and how they can be applied to your own financial journey. Prepare to be inspired and challenged to rethink your approach to investing and wealth-building!

Made in America Book Summary

In "Made in America," Sam Walton, the visionary founder of Walmart, shares his incredible journey from modest beginnings to building one of the world’s largest retail empires. Through candid anecdotes and insights, Walton reveals the secrets behind his revolutionary approach to customer service and efficiency. This compelling narrative not only chronicles the rise of a retail giant but also offers timeless lessons on entrepreneurship and innovation. As Walton reflects on the values that shaped his success, he challenges readers to rethink their own business strategies. Discover how grit, determination, and a touch of Southern charm transformed the American shopping experience forever!

A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing (Ninth Edition) Book Summary

In "A Random Walk Down Wall Street," Burton Malkiel challenges the myth of market predictability and unveils the chaos underlying financial markets. Through engaging anecdotes and sharp insights, he demystifies complex investment strategies while advocating for the simplicity of index funds. Readers are taken on a journey through the history of financial theory and practical investing advice, revealing how randomness shapes market movements. Malkiel's compelling arguments will make you question conventional wisdom and reconsider your approach to investing. Are you ready to explore the unpredictable world of finance and learn how to navigate it wisely?

Showing 8 of 28 similar books

Similar Book Recommendations →

Bill Ackman's Book Recommendations

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

Alex Lieberman's Book Recommendations

Alex Lieberman is the co-founder and executive chairman of Morning Brew, a media company that delivers engaging business news. Under his leadership, Morning Brew has grown to reach millions of subscribers, becoming a significant player in modern business journalism. Lieberman is also known for his insightful commentary on entrepreneurship and media trends. His work has significantly influenced the way business news is consumed by younger audiences. Beyond Morning Brew, Lieberman frequently writes and speaks about the intersection of media and technology, further cementing his role as a thought leader in the industry.

Charlie Munger's Book Recommendations

Charlie Munger is an American investor, businessman, and philanthropist, best known as the vice chairman of Berkshire Hathaway, where he partners with Warren Buffett. Renowned for his insights on investment strategies and mental models, Munger has significantly influenced the world of finance. His notable literary contributions include "Poor Charlie's Almanack," a compilation of his speeches and writings that distill his wisdom on decision-making and business principles. Munger's work emphasizes the importance of multidisciplinary thinking and continuous learning. Beyond his financial acumen, he is celebrated for his charitable efforts, particularly in education and healthcare.

Andrew Lokenauth's Book Recommendations

Andrew Lokenauth is a distinguished author and financial expert known for his insightful contributions to personal finance and investment literature. With a career spanning over a decade, he has written extensively on topics such as wealth management, financial planning, and market analysis. Lokenauth's works are celebrated for their clarity and practical advice, making complex financial concepts accessible to a broad audience. He has been featured in numerous financial publications and has established himself as a trusted voice in the industry. Beyond his writing, Lokenauth is also a sought-after speaker, sharing his expertise at various seminars and workshops.

Howard Marks's Book Recommendations

Howard Marks was a renowned Welsh author and drug smuggler, best known for his bestselling autobiography, "Mr Nice," published in 1996. The book chronicles his complex life, from Oxford University graduate to one of the world's most infamous cannabis traffickers. Marks' candid storytelling and unique perspective earned him a cult following and critical acclaim, transforming him into a counterculture icon. He further contributed to literature with several other works, including "Señor Nice" and "Sympathy for the Devil." Marks' legacy continues to influence discussions on drug policy and the criminal justice system.

Brendan Moynihan's Book Recommendations

Brendan Moynihan is a distinguished author and financial expert known for his influential works in the field of finance and trading. He co-authored the critically acclaimed book "What I Learned Losing a Million Dollars," which offers profound insights into risk management and the psychology of trading. Moynihan has contributed extensively to financial literature, blending practical experience with academic rigor. He is also recognized for his role as a senior adviser at Marketfield Asset Management and his tenure as an adjunct professor at Vanderbilt University's Owen Graduate School of Management. Through his writing and teaching, Moynihan continues to impact the financial community by fostering a deeper understanding of market dynamics and trader behavior.

Niki Scevak's Book Recommendations

Niki Scevak is a distinguished entrepreneur and venture capitalist, widely recognized for his contributions to the startup ecosystem rather than traditional literature. As a co-founder and partner at Blackbird Ventures, he has played a pivotal role in funding and mentoring successful Australian tech startups. Scevak also co-founded Startmate, an influential accelerator program that has shaped numerous early-stage companies. His work has significantly impacted the Australian tech landscape, fostering innovation and entrepreneurial growth. Though not an author of traditional books, his insights and thought leadership are frequently shared through industry publications and speaking engagements.

Warren Buffett's Book Recommendations

Warren Buffett, known as the “Oracle of Omaha,” is one of the most successful investors of all time and the chairman of Berkshire Hathaway. His investment philosophy, centered on value investing and long-term wealth creation, has made him one of the wealthiest people in the world. Buffett is also known for his philanthropic efforts, having pledged to donate a significant portion of his wealth to charitable causes. His annual letters to shareholders are highly anticipated for their financial wisdom. Buffett remains a revered figure in business and investing circles.

Showing 8 of 10 related collections

“The stock market is filled with individuals who know the price of everything, but the value of nothing.”

The Warren Buffett Way

By Robert G. Hagstrom

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy