Why Stock Markets Crash Book Summary

In 'Why Stock Markets Crash', Didier Sornette explores the intricate dynamics behind financial crashes, revealing that they are not merely random events but predictable phenomena rooted in human behavior and complex systems. He delves into the psychology of market participants, highlighting how greed and fear can lead to irrational decision-making. Sornette introduces groundbreaking theories and models that attempt to forecast these market failures with surprising accuracy. The book is both a cautionary tale and a guide for investors seeking to navigate the turbulent waters of the stock market. With a blend of science and storytelling, it challenges readers to rethink their understanding of economic stability and risk.

By Didier Sornette

Published: 2017

"Markets are not just about numbers; they are the living pulse of human behavior, where fear and greed dance in an endless cycle, ultimately leading to crashes that reveal our deepest vulnerabilities."

Book Review of Why Stock Markets Crash

The scientific study of complex systems has transformed a wide range of disciplines in recent years, enabling researchers in both the natural and social sciences to model and predict phenomena as diverse as earthquakes, global warming, demographic patterns, financial crises, and the failure of materials. In this book, Didier Sornette boldly applies his varied experience in these areas to propose a simple, powerful, and general theory of how, why, and when stock markets crash. Most attempts to explain market failures seek to pinpoint triggering mechanisms that occur hours, days, or weeks before the collapse. Sornette proposes a radically different view: the underlying cause can be sought months and even years before the abrupt, catastrophic event in the build-up of cooperative speculation, which often translates into an accelerating rise of the market price, otherwise known as a "bubble." Anchoring his sophisticated, step-by-step analysis in leading-edge physical and statistical modeling techniques, he unearths remarkable insights and some predictions--among them, that the "end of the growth era" will occur around 2050. Sornette probes major historical precedents, from the decades-long "tulip mania" in the Netherlands that wilted suddenly in 1637 to the South Sea Bubble that ended with the first huge market crash in England in 1720, to the Great Crash of October 1929 and Black Monday in 1987, to cite just a few. He concludes that most explanations other than cooperative self-organization fail to account for the subtle bubbles by which the markets lay the groundwork for catastrophe. Any investor or investment professional who seeks a genuine understanding of looming financial disasters should read this book. Physicists, geologists, biologists, economists, and others will welcome Why Stock Markets Crash as a highly original "scientific tale," as Sornette aptly puts it, of the exciting and sometimes fearsome--but no longer quite so unfathomable--world of stock markets.

Book Overview of Why Stock Markets Crash

About the Book Author

Didier Sornette

Didier Sornette is a prominent physicist and author known for his groundbreaking work in the fields of complex systems, financial markets, and natural disasters. He is a professor at the University of California, Los Angeles (UCLA) and has authored several influential books and papers on the dynamics of crises and predicting extreme events. His notable works include 'Why Stock Markets Crash: Crashes and Market Volatility' and 'Dragon-Kings: The Science of Eruptions and the New Science of Disruptions.' Sornette's writing style is characterized by its clarity and accessibility, allowing complex scientific ideas to reach a wider audience while retaining rigorous analytical depth.

Book Details

Key information about the book.

- Authors

- Didier Sornette

- Published

- March 2017

- Publisher

- Princeton University Press

- ISBN

- 0691175950

- Language

- English

- Pages

- 448

- Genres

- FinanceBehavioral Finance

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

The Psychology of Money Book Summary

In "The Psychology of Money," Morgan Housel unravels the complex relationship between our emotions and financial decisions. Through captivating anecdotes and profound insights, he reveals that wealth isn't just about numbers, but about behavior and mindset. The book challenges conventional wisdom, urging readers to understand the subtle psychological forces that influence our spending and saving habits. Housel's reflections highlight the power of patience, humility, and a long-term perspective in building true financial success. Prepare to rethink everything you thought you knew about money and its role in your life!

The Black Swan: Second Edition Book Summary

In "The Black Swan," Nassim Nicholas Taleb explores the profound impact of rare and unpredictable events—those seemingly impossible occurrences that shape our world in transformative ways. He challenges conventional thinking, revealing how humans consistently underestimate uncertainty and overvalue what we can predict. Through compelling anecdotes and thought-provoking insights, Taleb illustrates how we can prepare for the unexpected rather than just cling to past experiences. The book urges readers to embrace randomness and rethink the frameworks we use to navigate life’s complexities. Will you recognize your own blind spots before the next Black Swan strikes?

You Are a Badass® Book Summary

In "You Are a Badass," author Jen Sincero delivers a bold and empowering guide to unleashing your inner greatness. With humor and candor, she challenges readers to confront their self-doubt and embrace the power of positive thinking. Through relatable anecdotes and actionable advice, Sincero ignites a fire for self-improvement, urging you to take charge of your life. This book is not just a self-help manual; it's a call to action for anyone ready to break free from mediocrity. Are you ready to step into your badass self and transform your reality?

Black Edge Book Summary

In "Black Edge," investigative journalist Sheelah Kolhatkar delves into the high-stakes world of hedge funds and the enigmatic figure of Steven A. Cohen. As she unravels the saga of insider trading, greed, and Wall Street's murky ethics, the book pulls readers into a gripping tale of ambition that spans decades. With intellectual prowess and audacious risk-taking, Cohen's rise to power raises questions about the moral compass of finance. Kolhatkar's penetrating analysis unveils the dark side of wealth and the relentless pursuit of success, leaving readers questioning the true cost of ambition. Will you dare to uncover the secrets of a financial titan and the shadowy underworld they inhabit?

When Genius Failed Book Summary

When Genius Failed chronicles the dramatic rise and fall of Long-Term Capital Management, a hedge fund that boasted an elite team of financial wizards. As it navigates the complexities of high-stakes finance and groundbreaking quantitative models, the book unveils how overconfidence in genius can lead to catastrophic consequences. When the Asian financial crisis strikes, the fund’s intricate strategies unravel, threatening the global economy. Authors Roger Lowenstein masterfully intertwine personal narratives with economic theory, revealing the fragile balance between risk and reward. This gripping tale serves as a cautionary reminder that brilliance can blind us to the dangers lurking beneath the surface.

The Essays of Warren Buffett Book Summary

In "The Essays of Warren Buffett," the legendary investor distills decades of wisdom into a compelling collection of insights on investing, business, and life. Through a series of thought-provoking essays, Buffett shares his unique perspective on risk, value, and the importance of patience in the tumultuous world of finance. His distinctive voice combines humor with profound lessons, making complex concepts accessible to both novice investors and seasoned pros. As you delve into his reflections, you'll uncover the principles that have guided his success and how they can be applied to your own financial journey. Prepare to be inspired and challenged to rethink your approach to investing and wealth-building!

Shut Up and Run Book Summary

In "Shut Up and Run," the author embarks on a transformative journey that combines the grit of endurance sports with profound life lessons. This energizing read challenges conventional beliefs about running, revealing it as a powerful metaphor for the struggles we face every day. With humor and raw honesty, the narrative invites readers to confront their fears, push beyond limits, and embrace the wild, freeing spirit of movement. Each chapter serves as a catalyst for personal growth, urging you to silence self-doubt and unleash your potential. Ready to lace up your shoes and discover what lies beyond the finish line?

A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing (Ninth Edition) Book Summary

In "A Random Walk Down Wall Street," Burton Malkiel challenges the myth of market predictability and unveils the chaos underlying financial markets. Through engaging anecdotes and sharp insights, he demystifies complex investment strategies while advocating for the simplicity of index funds. Readers are taken on a journey through the history of financial theory and practical investing advice, revealing how randomness shapes market movements. Malkiel's compelling arguments will make you question conventional wisdom and reconsider your approach to investing. Are you ready to explore the unpredictable world of finance and learn how to navigate it wisely?

Showing 8 of 29 similar books

Similar Book Recommendations →

Andrew Lokenauth's Book Recommendations

Andrew Lokenauth is a distinguished author and financial expert known for his insightful contributions to personal finance and investment literature. With a career spanning over a decade, he has written extensively on topics such as wealth management, financial planning, and market analysis. Lokenauth's works are celebrated for their clarity and practical advice, making complex financial concepts accessible to a broad audience. He has been featured in numerous financial publications and has established himself as a trusted voice in the industry. Beyond his writing, Lokenauth is also a sought-after speaker, sharing his expertise at various seminars and workshops.

Ana Fabrega's Book Recommendations

Ana Lorena Fabrega is an innovative educator and author passionate about reimagining education. Known as “Ms. Fab,” she is the Chief Evangelist at Synthesis, an education startup inspired by the problem-solving and collaboration model used at SpaceX. She advocates for alternative learning methods, encouraging curiosity and creativity in students. Ana's work emphasizes the importance of engaging young learners in real-world challenges and critical thinking. She also shares insights on education reform through her popular newsletter, Fab Fridays.

Alex Honnold's Book Recommendations

Alex Honnold is an American professional rock climber, best known for his free solo ascent of El Capitan in Yosemite National Park, a feat that was documented in the Oscar-winning film Free Solo. Honnold is renowned for his mental toughness, technical skill, and ability to climb without ropes or safety equipment. His accomplishments have made him a legend in the climbing world, and he continues to push the boundaries of the sport. Outside of climbing, Honnold is a philanthropist, founding the Honnold Foundation, which supports environmental sustainability projects, particularly in solar energy.

Anu Hariharan's Book Recommendations

Anu Hariharan is a distinguished partner at Y Combinator's Continuity Fund, where she has been instrumental in scaling numerous startups into successful enterprises. With a strong background in economics and technology, she has become a respected voice in the venture capital community. Hariharan has also made significant contributions through her writing on startup growth and investment strategies, offering insightful analyses and practical advice to entrepreneurs. Her work is frequently featured in leading business publications, showcasing her expertise in the tech industry. Beyond her professional accomplishments, Hariharan is committed to fostering diversity and inclusion within the startup ecosystem.

Kevin Rose's Book Recommendations

Kevin Rose is a notable entrepreneur and technology investor, best known for founding Digg, a pioneering social news website that significantly influenced online content sharing. Although not primarily recognized for literary contributions, Rose has impacted digital media and online culture, which are recurring themes in contemporary literature on technology. His insights and experiences have been featured in various tech journals and books, enriching discussions on innovation and digital entrepreneurship. Rose also co-hosted the popular podcast "The Random Show" with Tim Ferriss, where he shares his thoughts on technology, health, and productivity. Through his ventures and public speaking, Rose continues to inspire narratives around the digital revolution and startup culture.

Blake Mycoskie's Book Recommendations

Blake Mycoskie is an American entrepreneur, author, and philanthropist best known for founding TOMS Shoes, a company that pioneered the "One for One" business model, donating a pair of shoes for every pair sold. His significant literary contribution includes the bestselling book "Start Something That Matters," which offers insights into social entrepreneurship and encourages readers to pursue meaningful ventures. Mycoskie's innovative approach to business has inspired a global movement toward corporate social responsibility. He has received numerous accolades for his work, including the Secretary of State's Award for Corporate Excellence. Mycoskie continues to influence the business world with his emphasis on purpose-driven enterprises.

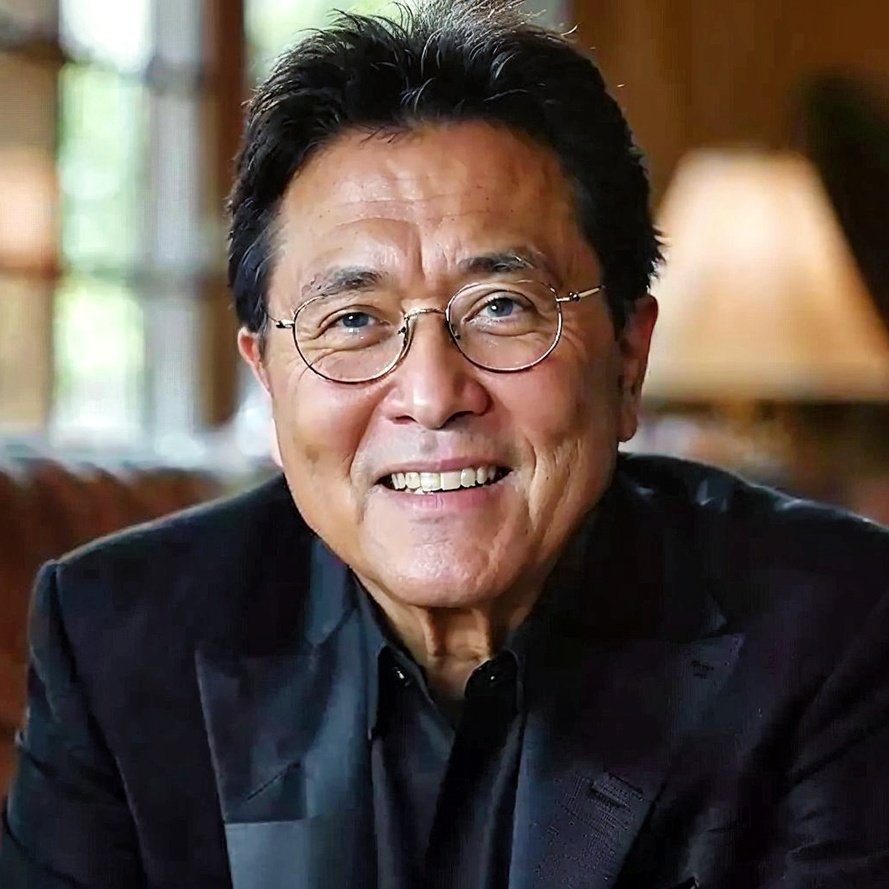

Robert Kiyosaki's Book Recommendations

Robert Kiyosaki is the author of the bestselling personal finance book Rich Dad Poor Dad, which challenges conventional wisdom on wealth building and financial literacy. He is a self-made entrepreneur and investor who emphasizes the importance of financial education and investing in assets that generate passive income. His Rich Dad brand has expanded to include books, seminars, and a board game that teaches financial principles. Kiyosaki advocates for self-reliance and encourages individuals to break free from the traditional “employee mindset.” He continues to teach people how to achieve financial independence.

Malcolm Gladwell's Book Recommendations

Malcolm Gladwell is a Canadian journalist, author, and public speaker, best known for his best-selling books The Tipping Point, Outliers, and Blink. Gladwell’s work often explores the hidden patterns behind success, decision-making, and social phenomena, using storytelling to make complex ideas accessible to a wide audience. He has written extensively for The New Yorker and hosts the popular podcast Revisionist History, where he reexamines overlooked or misunderstood events in history. Gladwell is known for his ability to challenge conventional wisdom and provoke new ways of thinking about human behavior and societal trends.

Showing 8 of 9 related collections

“Markets are not just about numbers; they are the living pulse of human behavior, where fear and greed dance in an endless cycle, ultimately leading to crashes that reveal our deepest vulnerabilities.”

Why Stock Markets Crash

By Didier Sornette

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy