Poor Charlie's Almanack Book Summary

Dive into 'Poor Charlie's Almanack,' where Charles T. Munger, the brilliant mind behind Berkshire Hathaway, shares his wealth of knowledge and unconventional wisdom. This compelling guide offers a treasure trove of insights on decision-making, investing, and life philosophy that challenges conventional thinking. Through a blend of humor and candor, Munger's reflections reveal the power of multidisciplinary thinking and mental models. With engaging anecdotes and practical advice, readers are encouraged to expand their intellectual horizons and apply these lessons in their own lives. Unlock the secrets to success and learn how to navigate the complexities of life with Munger's unique perspective!

By Charles T. Munger

Published: 2008

"It's not whether you're right or wrong that's important, but how much you can learn when you're wrong."

Book Overview of Poor Charlie's Almanack

About the Book Author

Charles T. Munger

Charles T. Munger is an esteemed American investor, businessman, and philanthropist, best known as the vice chairman of Berkshire Hathaway, the conglomerate led by Warren Buffett. Born on January 1, 1924, in Omaha, Nebraska, Munger developed a keen intellect and astute understanding of economics, law, and complex financial systems. He co-founded the investment firm Wesco Financial Corporation and has played a pivotal role in various successful ventures, advocating for value investing and rational decision-making. Munger is also recognized for his philanthropic efforts, particularly in promoting education and scientific research, through significant contributions to institutions like the University of California, Santa Barbara. A lifelong learner, Munger’s insights and wisdom have made him a respected figure in the world of finance and beyond.

Book Details

Key information about the book.

- Authors

- Charles T. Munger

- Published

- January 2008

- Publisher

- N/A

- ISBN

- 1578645018

- Language

- English

- Pages

- 532

- Genres

- InvestingSelf-HelpBusiness and EconomicsBehavioral FinancePersonal GrowthSuccess Stories

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

The Intelligent Investor Book Summary

In "The Intelligent Investor," Benjamin Graham unveils timeless strategies for navigating the volatile world of investing with wisdom and discipline. He introduces the concept of value investing, teaching readers to distinguish between price and intrinsic value, all while emphasizing the importance of a defensive investment strategy. Graham’s insightful principles empower investors to cultivate emotional resilience, protecting them from the relentless whims of the market. With real-world anecdotes and practical advice, this classic remains a cornerstone for anyone seeking financial success and peace of mind. Dive in to discover how patience, rationality, and a solid plan can transform your investment journey!

Start Late, Finish Rich Book Summary

In "Start Late, Finish Rich," financial expert David Bach unveils a transformative roadmap for those who feel it's too late to secure their financial future. Through captivating anecdotes and practical strategies, he encourages readers to seize the power of financial awareness and smart investing, regardless of age. Bach’s message is clear: it’s never too late to turn dreams into reality and build lasting wealth. With his unique blend of motivation and actionable advice, he empowers you to rethink your financial journey. Are you ready to embark on a path that could redefine your retirement?

The Little Book of Behavioral Investing Book Summary

**The Little Book of Behavioral Investing** uncovers the psychological traps that often lead investors astray. With a blend of insightful anecdotes and cutting-edge research, it reveals how emotions like fear and greed shape our decisions in the financial world. Readers will discover practical strategies to counteract these biases and improve their investment outcomes. By understanding the behavioral factors at play, you can transform your investment approach. Are you ready to challenge your thinking and elevate your financial game?

The Essays of Warren Buffett Book Summary

In "The Essays of Warren Buffett," the legendary investor distills decades of wisdom into a compelling collection of insights on investing, business, and life. Through a series of thought-provoking essays, Buffett shares his unique perspective on risk, value, and the importance of patience in the tumultuous world of finance. His distinctive voice combines humor with profound lessons, making complex concepts accessible to both novice investors and seasoned pros. As you delve into his reflections, you'll uncover the principles that have guided his success and how they can be applied to your own financial journey. Prepare to be inspired and challenged to rethink your approach to investing and wealth-building!

Built to Last Book Summary

In 'Built to Last,' Jim Collins and Jerry I. Porras unveil the secrets behind the enduring success of visionary companies. Through thorough research and compelling anecdotes, they identify key characteristics that distinguish these organizations from their competitors. The authors challenge traditional business thinking and reveal how a solid foundation of core values can drive long-term profitability and resilience. Readers are invited to explore how these principles can be applied to both businesses and personal endeavors. Prepare to rethink everything you know about entrepreneurial longevity!

Rich Dad Poor Dad Book Summary

In 'Rich Dad Poor Dad', Robert T. Kiyosaki contrasts the financial philosophies of his two father figures: his biological father (Poor Dad), who values traditional education and job security, and his best friend's father (Rich Dad), who advocates for financial literacy and investing. This compelling narrative reveals how mindset and education shape wealth acquisition and financial independence. Kiyosaki challenges conventional beliefs about money, urging readers to think beyond a paycheck and embrace entrepreneurship. Through personal anecdotes and practical advice, he ignites a rethinking of what it means to be rich. Are you ready to transform your financial future?

Mistakes Were Made (but Not by Me) Book Summary

In 'Mistakes Were Made (but Not by Me)', Carol Tavris and Elliot Aronson explore the psychological mechanisms of self-justification and the often-unconscious ways we avoid admitting our wrongs. With compelling examples from history, psychology, and personal anecdotes, the authors reveal why people, from individuals to large organizations, refuse to accept accountability. This thought-provoking book challenges readers to confront their own biases and the cognitive dissonance that influences decision-making. Will you choose to embrace the discomfort of acknowledging your mistakes? Dive into this enlightening read and discover the profound impact of accountability on personal growth and relationships.

Finding Your Way to Change Book Summary

In 'Finding Your Way to Change,' authors Allan Zuckoff and Bonnie Gorscak unveil the transformative journey of self-discovery and personal growth. They provide practical strategies to confront challenges and embrace change, encouraging readers to harness their unique strengths. Through compelling anecdotes and actionable advice, the book reveals how to turn obstacles into opportunities and create a fulfilling life. As the narrative unfolds, you will be inspired to embark on your own path to change. Are you ready to unlock the potential within you?

Showing 8 of 22 similar books

Similar Book Recommendations →

David Heinemeier Hansson's Book Recommendations

David Heinemeier Hansson, also known as DHH, is a Danish programmer, entrepreneur, and author, best known as the creator of Ruby on Rails, a popular web application framework. Heinemeier Hansson is also a partner at Basecamp, a project management and collaboration software company he co-founded. His contributions to software development have earned him widespread recognition, with Ruby on Rails being used by thousands of developers and companies worldwide. Heinemeier Hansson is also a vocal advocate for remote work, simplicity in business, and sustainable work practices, ideas he explores in his bestselling books Rework and It Doesn’t Have to Be Crazy at Work. In addition to his work in tech, he is an accomplished race car driver, having competed in the 24 Hours of Le Mans. Heinemeier Hansson’s approach to work-life balance and entrepreneurship has made him a thought leader in the tech community, where he continues to challenge traditional business practices and advocate for more human-centered approaches to work

Drew Houston's Book Recommendations

Drew Houston is an accomplished American entrepreneur best known for co-founding Dropbox, a widely-used cloud storage service, in 2007. As the CEO, he has led the company to serve millions of users worldwide and become a key player in the tech industry. Although not primarily known for literature, Houston has shared his entrepreneurial insights and experiences through various interviews and public speaking engagements, offering valuable lessons to aspiring business leaders. His work has significantly influenced the way people and organizations manage and share digital content. Houston's innovative vision continues to shape the future of cloud computing and digital collaboration.

Eric Jorgenson's Book Recommendations

Eric Jorgenson is an author, investor, and product strategist best known for his book The Almanack of Naval Ravikant, which distills the wisdom of the entrepreneur and angel investor Naval Ravikant. Jorgenson's work focuses on personal development, wealth creation, and life philosophy. His ability to synthesize complex ideas into actionable insights has made his writing widely popular among entrepreneurs and tech enthusiasts. Beyond writing, Jorgenson has worked in product strategy at Zaarly, a marketplace for home services, and is involved in early-stage startup investing. He frequently speaks on the intersection of business, technology, and philosophy, and his blog covers topics ranging from mental models to entrepreneurship. Jorgenson's approach emphasizes learning from others' experiences and applying timeless principles to modern challenges. He continues to inspire a generation of readers with his clear, thoughtful reflections on how to live a more successful and fulfilling life.

Daniel Ek's Book Recommendations

Daniel Ek is a Swedish entrepreneur and co-founder of Spotify, the world’s leading music streaming platform. Ek revolutionized the music industry by offering a legal, user-friendly alternative to piracy, and Spotify has since become the dominant player in the streaming market. Under his leadership, Spotify has expanded globally, offering access to millions of songs and podcasts while reshaping how artists distribute their work. Ek is known for his forward-thinking approach to technology and his commitment to evolving Spotify’s platform for both users and creators. He continues to lead Spotify as it explores new innovations in audio entertainment.

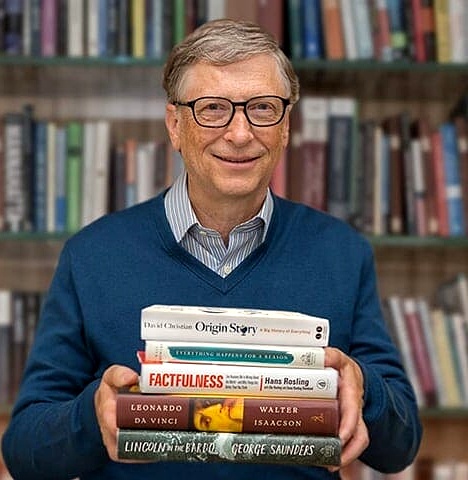

Bill Gates's Book Recommendations

Bill Gates, co-founder of Microsoft Corporation, is a pioneering figure in the tech industry, having played a key role in the personal computer revolution. His work at Microsoft, particularly the development of Windows, transformed software and computing globally. Beyond his technology contributions, Gates is also a prolific author, with notable works such as "The Road Ahead" and "Business @ the Speed of Thought," which offer insights into the future of technology and business. Additionally, his philanthropic efforts through the Bill & Melinda Gates Foundation have had a profound impact on global health, education, and poverty. Gates continues to influence both technology and literature with his forward-thinking perspectives and innovative ideas.

The Barefoot Investor's Book Recommendations

Scott Pape, known as The Barefoot Investor, is an Australian financial advisor and author, best known for his best-selling book The Barefoot Investor: The Only Money Guide You’ll Ever Need. Pape’s simple, no-nonsense approach to personal finance has helped millions of Australians get out of debt, build savings, and invest for the future. His advice is based on practical, straightforward strategies that focus on budgeting, long-term investments, and financial independence. Pape’s work as a financial educator has made him one of the most trusted voices in personal finance, and his book has become one of the most successful financial guides in Australia.

“It's not whether you're right or wrong that's important, but how much you can learn when you're wrong.”

Poor Charlie's Almanack

By Charles T. Munger

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy